Synopsys’s $35 Bn Acquisition of Ansys

Written by: Tom Suttling (Chapter President), Devam Desai & Victor Woods

Deal Overview

Acquirer: Synopsys, Inc.

Target: Ansys, Inc.

Total Transaction Size: ~US$35 billion (enterprise value) in a cash-and-stock deal.

Consideration Mix: Each Ansys share will receive US$197.00 in cash plus 0.3450 shares of Synopsys common stock.

Closing Date: July 17, 2025

Executive Summary

In a landmark move for the engineering‐software and semiconductor sectors, Synopsys announced in January 2024 its acquisition of Ansys for about US$35 billion. This transaction comes at a time when demand for integrated “silicon-to-systems” design workflows is rising sharply driven by growth in AI, automotive electronics, aerospace, industrial systems and the need to simulate entire product ecosystems.

Synopsys’ strategic objectives for the deal include:

Combining its leading electronic design automation (EDA) capabilities with Ansys’ multiphysics simulation and analysis assets, thereby enabling a single workflow from chip design through full-system performance.

Expanding its total addressable market (TAM): post-close Synopsys says it will be positioned to compete in an ~US$31 billion market.

Leveraging simulation and systems design to support emerging domains (AI hardware, automotive electrification, ruggedised electronics) rather than just chip layout.

From a deal‐structure standpoint, the high valuation and cash & stock mix reflect both the strategic urgency and competitive pressure in the sector. Synopsys planned roughly US$19 billion in cash consideration, helped by committed debt financing (~US$16 billion) to fund the deal.

Market reaction was mixed: while the long-term strategic logic is strong, investors flagged the large scale of the deal, integration risks, regulatory scrutiny (especially in the U.S., EU, China) and near-term dilution. Indeed, regulators required divestitures and conditions for approval.

Immediate implications for Synopsys include:

A substantial financial commitment, including large cash outflows and debt issuance (reports of ~US $10 billion bond sale to help finance the transaction).

Potential share dilution for existing Synopsys shareholders given the equity component and issuance of new debt.

A significantly broader product offering, enabling cross-selling across both companies’ enterprise customer bases (EDA + simulation) and accelerating entry into adjacent markets.

Heightened regulatory and integration risk: antitrust approvals required, and success will depend on execution of combining product stacks, go‐to‐market alignment, and cross-platform synergy realisation.

In summary: this is a transformative acquisition that aligns with the broader industry trend of merging chip design and system simulation capabilities into unified platforms. The high price underscores both the strategic value and the risk profile.

Acquirer Overview: Synopsys, Inc.

Founded: 1986

CEO: Sassine Ghazi

Market Cap: US$78.3 Billion (Jan 2024)

LTM Revenue: US$5.843B (FY2023)

LTM EBITDA: US$1.60B (FY2023)

P/E: 57.7x

Ticker (NASDAQ): SNPS

Deal Advisor: Evercore Partners Limited

History & Background

Founded in 1986 by Aart de Geus, David Gregory, Alberto Sangiovanni-Vincentelli, and Bill Krieger in Research Triangle Park, North Carolina, Synopsys, Inc. is a U.S.-based multinational leader in electronic design automation (EDA), currently headquartered in Sunnyvale, California. Synopsys began under the name Optimal Solutions, focusing on commercialising logic synthesis technology initially developed at General Electric’s Advanced Computer-Aided Engineering Group. In 1987, the firm rebranded as Synopsys and relocated to Mountain View, California.

The company specialises in the design and verification of silicon chips, system-level design, and reusable intellectual property (IP) components. Its software and services are used throughout the semiconductor design and manufacturing process, providing tools for digital and analogue circuit implementation, simulation, and debugging, all essential for developing modern chips and electronic systems.

The company went through its Initial Public Offering (IPO) in February 1992, offering 2 million shares (1.55 million from the company and 450,000 from existing stockholders) at an initial price of US$18 per share, and it closed its first day at US$31.50. Since 2017, Synopsys has been a constituent of both the NASDAQ-100 and S&P 500 indices, underscoring its strong and enduring position in the technology sector. As of 2025, Synopsys ranked as the 21st largest software company globally by Market Cap.

Product Lines

Synopsys (2025) offers four main product lines.

EDA tools for digital & custom IC design, verification (e.g., simulation, formal, emulation), sign-off (timing, power), and manufacturing—sold largely via long-term, time-based licenses.

Semiconductor IP (DesignWare) across interfaces, memory, processors, security, and analog/mixed-signal.

Software Integrity (AppSec) tools and services (Coverity, Black Duck, etc.) that scan code and open-source components (again: part of Synopsys as of Jan 2024).

AI-enabled/powered EDA, Optimisation, Analytics. Generative AI for chip design and Agentic Engineering AI.

Strengths

Technological Leadership & Market Recognition: As one of the world’s top three providers of Electronic Design Automation (EDA) software, Synopsys is recognized for its deep expertise in chip design, verification, and semiconductor intellectual property. Its tools are used by virtually all major semiconductor manufacturers, including industry leaders like Intel, Nvidia, and TSMC. Synopsys’ reputation for innovation has been reinforced by decades of leadership under founder Aart de Geus, and the smooth transition to CEO Sassine Ghazi in early 2024 ensured strategic continuity as the company pursued its next growth phase.

Diversified and Scalable Product Portfolio: Synopsys offers an extensive suite of tools spanning EDA, Design IP, and Software Security, enabling end-to-end support across the chip design lifecycle. Its combination of design automation and reusable IP solutions creates cross-selling opportunities and strengthens customer dependence on its ecosystem. Acquisitions such as Magma Design Automation, Black Duck Software, and WhiteHat Security have expanded Synopsys’ reach beyond traditional EDA into software integrity and system-level design. This diversification helps buffer the company against cyclical downturns in the semiconductor industry.

Financial Health

Synopsys entered 2024 in a strong financial position, demonstrating consistent revenue growth and high profitability across its core business segments. In fiscal year 2023, the company reported US$5.84 billion in revenue and US$1.6 billion in EBITDA, driven primarily by long-term customer contracts and a robust recurring revenue model. This strong balance sheet and predictable cash flow gave Synopsys the flexibility to pursue large-scale investments such as the US$35 billion acquisition of Ansys, while continuing to fund innovation and shareholder returns.

Challenges

Dependence on Semiconductor Cycles: Although Synopsys benefits from long-term licensing contracts and a high proportion of recurring revenue, its performance remains closely tied to the broader semiconductor industry cycle. Periods of reduced chip demand such as those caused by inventory corrections or declining PC and smartphone sales can lead customers to delay design activity and software renewals. This cyclicality introduces potential volatility in bookings and cash flow, especially during downturns in global semiconductor spending.

Integration and Execution Risks: The company’s growth has been supported by a steady stream of acquisitions, which brings the challenge of integrating products, technologies, and workforces. The planned Ansys acquisition (the largest in Synopsys’ history) adds considerable complexity. Aligning business models, sales channels, and engineering platforms between two large software firms requires significant coordination to capture anticipated synergies and maintain focus on core operations.

Regulatory and Geopolitical Exposure: As a critical supplier to global semiconductor firms, Synopsys operates under strict export controls and international trade regulations. Ongoing U.S. - China tensions and restrictions on advanced semiconductor technology exports can affect demand in key markets. Additionally, large transactions such as the Ansys deal are subject to antitrust reviews across multiple jurisdictions, introducing uncertainty and potential delays to strategic execution.

Market Positioning - Porter’s Five Forces

Rivalry (High):

Synopsys operates in a mature but fiercely competitive segment of the semiconductor design ecosystem (EDA). It competes head-to-head with Cadence Design Systems, Inc. and Siemens EDA (formerly Mentor Graphics) for enterprise chip-design workflows. Industry commentary identifies these three firms as dominating the global EDA, hence it is an oligopoly. Multiple industry trackers peg Synopsys ~31% global share around 2023–24 (Cadence ~30%, Siemens ~13%), though some datasets (such as CSIMarket) attribute up to ~47.8% in the “Software & Programming” sector for SNPS as of Q2 2025.

This concentrated competitive structure means Synopsys must continuously invest in R&D and customer service to hold its position. While the high entry barriers temper some competitive pressure, the rivalry among incumbents remains intense.

Buyer Power (Medium):

Synopsys serves large chip designers, semiconductor foundries and system-OEMs: customers with significant bargaining power. These buyers have scale, may negotiate contract terms, and can demand integration across multiple tool vendors. However, Synopsys mitigates this by embedding its tools deeply into chipset-design workflows, using long-term licenses and high switching costs. This lock in reduces buyer power somewhat: customers find it costly to shift to alternative toolchains mid-design. As one analyst summary states, “the software is deeply embedded in semiconductor design workflows … making it indispensable to chip manufacturers.” Thus, buyer power is moderate, real, but constrained by Synopsys’ entrenched position.

Supplier Power (Low–Medium):

In the EDA business, “suppliers” are somewhat atypical as key inputs include specialized engineering talent, advanced compute infrastructure, and access to foundry process-design kits (PDKs) and ecosystem relationships. While these resources are valuable, Synopsys has built scale, internal capability and long-standing foundry partnerships which limit supplier power. For example, its dependency on any single supplier of compute or process data is low, given its broad ecosystem. The barrier to switching among compute platforms is moderate. So supplier power is relatively low to medium.

Threat of Substitutes (Low):

Substitutes to Synopsys’ tools would include internal in-house tool development by large chip-design firms, open-source EDA flows, or lower-cost tool entrants. While such alternatives exist, they rarely match the breadth, performance, ecosystem compatibility, foundry-certified flows and time-to-market benefits offered by Synopsys’ commercial tools. As a result, the threat of effective substitutes remains relatively low. Strategic commentary notes that while large OEMs once developed internal EDA, the commercial tool providers (Synopsys, Cadence) dominate because of higher productivity and lower risk.

Threat of New Entrants (Low):

The EDA industry has very high barriers to entry: decades of domain-specific knowledge, long design-tool development cycles, centrality of process-design-kit (PDK) partnerships with foundries, large customer trust and inertia in switching toolchains. While niche players and speciality tool providers may form, the odds of a new entrant quickly displacing an incumbent like Synopsys are small. Industry analysis underscores that the market is effectively dominated by the “big three” vendors.

Summary

Synopsys aimed to extend from “Silicon to Systems” by combining leading EDA & IP with multi-physics/system simulation to meet megatrends (AI, chiplet/system complexity). The US$35B Ansys deal projected a ~US$28B TAM and US$400M run rate cost synergies by Year 3, funded with US$19B cash and US$16B committed debt. This fits well with Synopsys’ solid financial position and consistent profitability, providing the stability and resources necessary to execute the acquisition effectively.

Company Overview: Ansys, Inc

Date Founded: 1970 (founded by John Swanson)

CEO: Ajei S. Gopal (President & CEO)

Market Cap: US$30-33Bn

LTM Revenue (FY24) : US$2,544.8M

LTM EBITDA (GAAP): US$861M (GAAP operating income $717.9M+D&A $142.7M)

Net Income (FY24): $575.7M (GAAP net income)

Cash & Short-Term Investments: US$1,446.7M cash; US$50.8M short-term investments

Total Long-Term Debt: US$755.0M outstanding (long-term debt; maturity in 2027)

Net Cash: US$692m (Cash US$1446.7M; Debt US$755M)

Diluted EPS (FY24): US$6.55 GAAP diluted EPS

P/E: ~50–60X

History & Background

Founded in 1970 as Swanson Analysis Systems, Ansys built its franchise on finite-element analysis and expanded into multi-physics simulation over five decades. It has become the leading specialist in engineering simulation across mechanical, thermal, CFD, electromagnetics and system-level domains.

Global footprint with thousands of employees and customers across aerospace, automotive, semiconductors, energy, healthcare and industrial equipment, revenue diversified by geography and sector (U.S., EMEA, APAC). FY-2024 geographic revenue split shows the U.S. as the largest market (~US$1.252bn of revenue in 2024).

Historically heavy R&D reinvestment (management cites ~18% R&D-to-revenue), supplemented by targeted tuck-ins to broaden physics coverage and electronics/CFD capabilities. The company has used a mix of organic R&D and bolt-on acquisitions to maintain technological leadership.

Product lines

Comprehensive simulation portfolio: structural mechanics (FEA), computational fluid dynamics (CFD), electromagnetics (HFSS, Maxwell), thermal/electronics cooling (Icepak), system-level simulation (Twin Builder, Twin Cloud), materials & additive manufacturing tools, and multiphysics coupling that spans electronics, mechanics & fluids. Ansys also offers cloud-deployed solutions and digital-twin products. These product lines are sold as licenses & maintenance and increasingly subscription/ACV.

Revenue mix: FY-2024 breakdown shows ~$1.264bn software license revenue and US$1.281bn maintenance & services (maintenance/recurring revenue now ~50% of total: a valuable recurring base). This mix drives high gross margins and predictable renewal economics.

Strengths

High margins & recurring revenue: FY-2024 gross profit margin ~89% and strong operating margins (GAAP operating margin ~28.2%). Non-GAAP margins are materially higher after adjustments. High gross margins reflect software economics and a large maintenance base.

Large installed base & sticky renewals: Significant deferred revenue / backlog, US$1.718bn in remaining performance obligations (as of 12/31/2024, a pipeline of contracted, near-term revenue).

Strong cash generation & balance sheet: Operating cash flow in 2024 of ~US$795.7m; cash & equivalents ~US$1.447bn against ~US$755m debt; positive net cash position entering the transaction, giving buyer confidence on liquidity / working capital.

Market leadership & IP moat: Broad multi-physics IP, decades of validated models, certifications with large OEMs (autos, aerospace) and high switching costs.

Challenges

Growth moderation / ACV dynamics: While FY-2024 revenue grew ~12.1% y/y, some quarterly commentary in 2024–25 showed deceleration (Q1-2025 revenue growth ~8% reported, 10% cc), and ACV / big-ticket upsell momentum was noted as modest in some quarters, a potential headwind for a buyer relying on rapid top-line expansion. Management suspended guidance in 2025 due to the pending transaction.

Competition & substitution risk: Competes with Dassault Systèmes (SIMULIA), Siemens Digital Industries Software, Altair and specialised vendors. Cloud-native entrants and open-source toolchains can exert pricing pressure over time. Reuters/coverage notes intense competition in simulation/CAD/PLM adjacent markets.

Rising R&D Competition: Maintaining technological leadership requires sustained R&D (~hundreds of millions annually) and stock-based compensation is a meaningful expense (stock comp ~US$271m in 2024), a margin pressure/expense consideration for a buyer.

Regulatory / geopolitical risk for global customers: Given Ansys’ presence in China, Asia and U.S. defense/aerospace customers, export controls / regulatory approvals (and conditions) are a factor for any buyer, and indeed the Synopsys deal required multi-jurisdictional approvals.

Market positioning

Position: Ansys sits at the high-end of simulation (multi-physics specialist) rather than as a general CAD/PLM vendor. It occupies a premium niche anchored by model fidelity, validated physics and customer trust.

Porter’s Five Forces:

Barriers to entry: High (domain expertise, validated IP, certification by OEMs).

Ansys Buyer power: Moderate (large industrial customers negotiate aggressively, but switching is costly).

SEC Supplier power: Low/Moderate (talent & compute vendors matter, but Ansys owns core IP).

SEC Substitutes: Moderate (alternative simulation stacks, in-house tools, open models, cloud-aaS entrants).

Rivalry: High (established incumbents (Dassault/Siemens/Altair) and strategic consolidators (e.g., Synopsys now) push competition).

Financial health & leverage

FY-2024 snapshot (key items):

Revenue: US$2,544.8m

GAAP operating income: US$717.9m; D&A US$142.7m; implied EBITDA ≈ US$860.6m.

Cash & ST investments: US$1,446.7m + US$50.8m.

Long-term debt (principal): US$755m; Interest expense US$47.8m.

Net cash position: US$692m. This low leverage (net cash) implied Ansys was balance-sheet healthy pre-deal, making it an attractive, lower-execution-risk target from a financial integration perspective.

Strategic fit & how the target justifies the buy

Capability plug-in: Ansys provides system-level simulation and multiphysics capabilities that complement Synopsys’ EDA, verification and semiconductor IP enabling a “silicon-to-systems” value chain and cross-sell into adjacent engineering workflows. The product adjacency (electronics simulation, HFSS, thermal/electronics cooling) was repeatedly flagged in the deal rationale.

Commercial rationale: Large installed base, recurring maintenance revenues & high margins create predictable cash flow that can accelerate Synopsys’ TAM expansion (Synopsys estimated enlarged TAM post-deal). The largely net-cash balance sheet and recurring revenue base reduce immediate financial distress risk for an acquirer.

Summary

Ansys is a mature, high-margin engineering-simulation leader (FY-2024 revenue US$2.545bn; GAAP operating income US$717.9m; cash ~US$1.45bn vs debt ~US$0.75bn) with a deep installed base and broad multiphysics IP. Those attributes explain why Synopsys structured a sizable cash+stock bid (~US$35bn enterprise value: US$197 cash + 0.3450 SNPS shares per ANSS share), the buyer is purchasing durable, recurring software economics plus strategic product adjacencies (electronics & system simulation) to create a “silicon-to-systems” platform. Major risks for acquirer integration are sustaining growth/ACV momentum, defending margins vs. cloud commoditization, and navigating regulatory approvals.

Motivations

The Synopsys–Ansys transaction was driven by strong strategic and financial motives centred on building a unified “silicon-to-systems” design ecosystem. Synopsys pursued Ansys to combine its leading electronic design automation (EDA) and semiconductor IP portfolio with Ansys’ world-class multiphysics simulation and system-level modelling tools, enabling earlier and deeper design integration across electronics, mechanical physics, thermal, structural, and electromagnetic domains. This combination directly supports Synopsys’ long-term strategy of moving beyond traditional EDA toward full-stack system engineering capabilities, particularly as industries adopt chiplets, 3D-ICs, and increasingly complex AI-enabled architectures.

From a financial standpoint, Synopsys viewed the acquisition as a way to materially expand its total addressable market and accelerate revenue synergies through cross-selling into Ansys’ diversified industrial customer base spanning aerospace, automotive, energy, and industrial engineering. The deal also represents an efficient deployment of capital during a period of strong balance-sheet capacity, supported by Synopsys’ concurrent US$10 billion debt offering, signalling confidence from capital markets in the company’s cash-flow profile and integration capability.

Operationally, the acquisition enhances customer value by reducing time-to-market through earlier detection of thermal, structural, and electromagnetic issues, improving design quality and reducing costly late-stage rework. The deal brings meaningful opportunities for scale benefits, including enhanced R&D leverage, strengthened customer lock-in, and the ability to offer end-to-end toolchains in markets where design complexity is accelerating.

Diversification was another key motive: Ansys’ broad sector reach offers Synopsys resilience against semiconductor cyclicality and provides entry into high-growth modelling segments such as digital twins, electrification, autonomous systems, and aerospace simulation. Cultural and strategic alignment also eased execution concerns, given the companies’ long-standing partnership prior to the merger.

However, the acquisition’s approval came with regulatory conditions, particularly from the U.S. Federal Trade Commission, which required that Synopsys and Ansys divest specific overlapping assets in areas such as photonics and power analysis to mitigate competitive concerns. These divestitures slightly dilute potential synergies and illustrate execution risk in consolidating two market-leading software franchises. Nonetheless, clearing these regulatory hurdles affirms that the overall competitive structure was deemed sustainable.

In evaluating opportunity cost, Synopsys could have pursued organic expansion or a series of smaller, targeted acquisitions. But the scale, brand strength, and deep technical moat of Ansys made it a uniquely attractive target unlikely to be replicated. Given industry trends toward multi-domain integration, system-level verification, and end-to-end digital engineering workflows, the acquisition represents a strategically coherent long-term investment rather than a short-term financial play.

Overall, the deal aligns tightly with Synopsys’ strategic roadmap, provides substantial revenue and capability synergies, materially elevates its competitive positioning, and addresses customer demand for integrated silicon-to-systems engineering. While regulatory and integration risks remain non-trivial, the acquisition constitutes a strong and forward-looking use of resources within the constraints and opportunities of Synopsys’ broader strategy.

Integration

Following the announcement of its proposed acquisition of Ansys in January 2024, Synopsys began shaping an integration plan that was designed to combine the two organisations with complementary strengths in semiconductor design and multiphysics simulation. Early signals from leadership indicate that integration is being approached in a measured, strategically aligned manner consistent with the company’s long-term “Silicon-to-Systems” vision.

At the governance level, Synopsys has emphasised continuity and coordination. The transition in leadership to CEO Sassine Ghazi shortly before the deal announcement ensured a focused integration agenda with clear executive ownership. Synopsys’ founder and Executive Chair, Aart de Geus, has remained actively involved, offering stability and oversight during the transition period. Both companies’ management teams have communicated their intention to maintain operational independence until regulatory approvals were secured, which then allowed integration workstreams to progress behind the scenes without disrupting their day-to-day performance.

Cultural alignment has also been an important consideration. While both Synopsys and Ansys are built on engineering-focused and innovation-oriented cultures, their histories reflect different technical perspectives. Ansys comes from a background in mechanical and systems simulation, whereas Synopsys is rooted in semiconductor design. These differences mean the combined organisation must actively work to harmonise various facets such as their communication styles, decision processes or ways of engaging with customers. Synopsys’ leadership has consistently highlighted transparent communication and cross-functional collaboration as priorities to ensure a cohesive culture and retain key technical talent.

Operationally, integration efforts are expected to focus especially on aligning R&D roadmaps and licensing structures, but also sales models. The two companies operate with similar high-margin, subscription-based revenue models, which should simplify systems compatibility and financial integration. Early statements from Synopsys (2024) suggest a disciplined approach to realising the projected $400 million in annual cost synergies within three years, with emphasis on unifying technology platforms and accelerating combined product development.

Retention of specialised engineers and customer-facing experts is another key priority as Synopsys has historically maintained strong post-acquisition retention through incentive-based compensation and career development programs. This suggests that it has both the experience and resources to preserve Ansys’ critical human capital.

While detailed post-merger milestones remain limited due to ongoing regulatory reviews, available disclosures point to an integration plan that balances ambition with caution. Synopsys appears to be prioritising cultural and operational stability while laying the groundwork for long-term synergy capture. However, some market commentary points to the near-term revenue guidance undershooting analyst expectations. That gap underscores the importance of the early integration phase, not only to align operations and culture but also to demonstrate to the market that the enlarged entity can sustain performance while absorbing the acquisition. Overall, early integration activity aligns well with the strategic intent outlined at the announcement, which will inevitably expand Synopsys’ capabilities from chip design into broader system-level engineering and simulation.

Performance & Valuation

Market reaction to Synopsys’ acquisition of Ansys has been cautious. Following the announcement and into the early post-close period, Synopsys’ share price did not exhibit a sustained positive re-rating and lagged parts of the broader software and semiconductor tools sector. Analyst commentary generally characterised the transaction as strategically coherent but financially demanding, with particular focus on the high acquisition multiple and integration risk. Overall, early investor response suggests acceptance of the strategic logic but uncertainty regarding near-term value creation.

Operationally, the strategic fit between Synopsys’ electronic design automation tools and Ansys’ multiphysics simulation software is clear. Management communications indicate steady progress on integration planning and alignment of product roadmaps. Cost synergies have been reaffirmed, and early cross-selling initiatives have been referenced. However, there is limited external evidence so far that revenue synergies are being realised at scale. Integration appears controlled, but the benefits remain largely prospective rather than observable in reported performance.

The acquisition has materially increased Synopsys’ leverage, reflecting the significant debt component used to finance the transaction. While the combined group continues to demonstrate solid revenue growth and strong operating margins, the higher debt load reduces financial flexibility and raises the importance of consistent cash flow generation. Profitability remains healthy, but the post-deal financial profile is more sensitive to execution risk than prior to the acquisition.

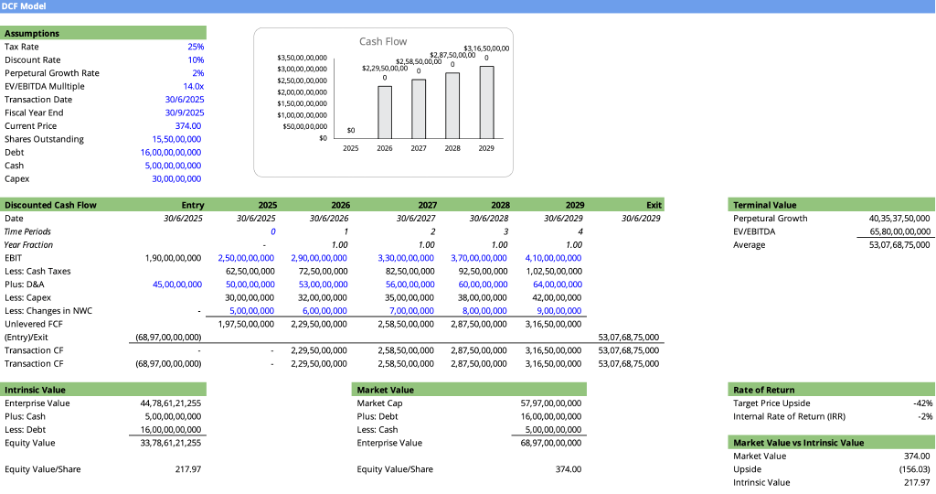

The discounted cash flow analysis indicates that the price paid embeds optimistic assumptions. Under conservative inputs, including a 10% discount rate, 2% perpetual growth, and a 14× terminal EV/EBITDA multiple, the model produces an intrinsic equity value of approximately 217.97 per share, compared with a market price of 374.00. This gap suggests that current valuation reflects expectations of faster or larger synergy realisation than assumed in the base case. Relative to peers and precedent transactions in the engineering and design software sector, the implied acquisition multiple appears elevated, increasing downside risk if integration benefits are delayed or fall short.

Combining market signals, operational progress, financial impact, and valuation evidence, the acquisition does not yet demonstrate clear value creation. Strategic positioning has improved, and integration execution appears disciplined, but early financial outcomes do not materially support the premium implied by the transaction price. The DCF results reinforce this view by indicating that intrinsic value under reasonable assumptions remains below the current market valuation.

Market reaction and investor sentiment

The announcement of Synopsys’ acquisition of Ansys was met with a mixed market response, reflecting the scale and strategic ambition of the transaction. Synopsys’ share price experienced initial volatility following the announcement, as investors weighed the long-term strategic benefits against the near-term execution risks and financing implications of a large and transformational acquisition. Analyst commentary broadly acknowledged the strategic logic of combining EDA with simulation and analysis software, particularly in the context of increasingly complex semiconductor and system-level design. However, the majority of concerns were raised around deal complexity and integration risk, especially given the premium implied by the transaction relative to Ansys’ historical trading multiples.

Early market signals suggest cautious optimism: investors appear to recognise the industrial logic of the transaction, but remain sensitive to evidence of successful execution and synergy realisation before fully re-rating the combined group.

Operational traction and early integration signals

Early disclosures and management communication point toward a high degree of strategic alignment between Synopsys and Ansys. Both firms serve engineering-led customers and occupy critical positions in customers’ product development workflows, which reduces commercial disruption risk and supports cross-selling opportunities over time. Management has emphasised a phased integration approach and has prioritised customer continuity and retention of technical talent, rather than aggressive near-term cost extraction.

The acquisition is being framed as a long-term platform investment rather than a short-term margin enhancement exercise. This positioning aligns with prior large-scale software transactions, where value creation is driven by ecosystem expansion and product convergence rather than immediate cost cutting.

Financial health and balance sheet impact

From a financial standpoint, Synopsys entered the transaction with a strong balance sheet and net cash position that provided flexibility to absorb the acquisition without materially constraining operational investment. The post-announcement guidance indicates a temporary increase in leverage, but not to levels that would threaten credit quality or strategic optionality. Importantly, Synopsys’ high-margin, recurring-revenue business model provides resilience during the integration phase, which also helps reduce downside risk should synergy realisation take longer than anticipated.

The group’s overall profitability profile is enhanced by Ansys’ stable cash generation and high operating margins. Even though the short-term earnings dilution risk exists, particularly from financing costs and integration expenses, the transaction does not appear to materially weaken the acquirer’s financial position.

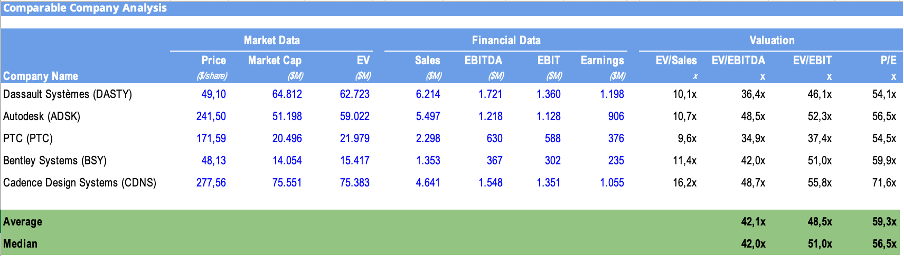

Comparable Companies Analysis

The Comparable Company Analysis (CCA) below examines Ansys’ sector peers’ transaction multiples to provide insight into valuation comparison. It is a useful benchmark for assessing whether the price paid for Ansys reflects a justified premium.

Relative to listed peers in EDA and engineering software (including Cadence, Dassault Systèmes, Autodesk, PTC, and Bentley Systems), Synopsys trades at the upper end of sector valuation ranges, reflecting its market leadership and IPR intensity. Ansys’ standalone trading multiples prior to the announcement were already elevated due to its strong margins and mission-critical positioning.

At the time of the announcement of the acquisition, Ansys was trading at elevated but defensible valuation levels relative to its peer group. Based on FY2024 results, Ansys generated approximately US$2.5bn of revenue and US$861m of EBITDA, implying an EV/Sales multiple of around 11.6x and an EV/EBITDA multiple of roughly 34x. Although these multiples exceed broader software averages, they are broadly consistent with high-quality engineering software peers characterised by sticky maintenance revenues, high margins, and strong cash generation. The implied P/E multiple of just over 50x further reflects investor willingness to capitalise long-term growth and strategic scarcity, rather than near-term earnings alone. Against this backdrop, the valuation embedded in the transaction appears demanding, but not disconnected from prevailing sector norms for best-in-class simulation assets.

The implied transaction valuation represents a premium to peer median EV/EBITDA and EV/Sales multiples, suggesting Synopsys is paying not only for Ansys’ current earnings power, but also for its strategic role in enabling multi-physics, system-level design. This premium appears consistent with precedent large-cap software transactions where scarce, high-quality assets are acquired to secure long-term technological leadership.

From a valuation perspective, the deal cannot be justified on near-term multiple arbitrage alone. Instead, the price relies on strategic optionality, including deeper penetration of automotive, aerospace, and AI-driven system design markets, as well as tighter integration across silicon-to-system workflows. As such, the valuation appears demanding but defensible, provided execution risks are managed effectively.

Overall assessment of value creation

Taken together, early performance indicators suggest the acquisition reflects a strategic premium rather than clear overvaluation. Market caution appears driven less by doubts over strategic fit and more by the inherent risks of integrating two complex, high-value software platforms. While the absence of immediate financial synergies limits short-term valuation upside, the transaction is consistent with Synopsys’ long-term strategy of expanding its role across the full semiconductor and systems design stack.

At this stage, evidence supports a view that the acquisition is potentially value-accretive over the medium to long term, though confirmation will depend on execution discipline and the pace of ecosystem integration.

Risks

Strategically, the central risk is that the intended end to end silicon to systems platform does not translate into clear productivity gains for customers, limiting cross selling and incremental revenue capture. Both businesses also retain exposure to a relatively concentrated set of large semiconductor, automotive, and aerospace customers, which heightens sensitivity to cyclical R&D spending and delays in capital allocation. If customer adoption of integrated workflows is slower than anticipated, the strategic rationale weakens despite strong underlying market positions.

Also, the two firms operate with different organisational cultures, development cadences, and go to market models, raising the risk of leadership misalignment, cultural friction, and disruption to core product roadmaps. Operational challenges may emerge from incompatible systems, licensing structures, and data architectures, while any loss of key technical talent would directly impair innovation velocity. Financially, the transaction embeds a premium valuation that assumes sustained growth and meaningful long term synergies. Sensitivity analysis using the aforementioned DCF model suggests that modest under delivery on revenue synergies or margin expansion would have a disproportionate impact on returns, particularly given the increase in leverage and reduced balance sheet flexibility.

Lastly, antitrust scrutiny in the US and EU could result in behavioural remedies or constraints that dilute strategic benefits, while the enlarged software footprint increases exposure to intellectual property disputes, cybersecurity threats, and data privacy issues. Taken together, the overall risk profile appears manageable but heightened, with successful value creation dependent on disciplined integration, regulatory clearance without material concessions, and early evidence that the combined platform delivers measurable customer value.

House View

Viewpoint

The Synopsys–Ansys acquisition appears strategically coherent and directionally sound, with early signals indicating that value creation is plausible but not yet proven. The deal reflects a deliberate shift toward platform-scale dominance rather than incremental growth.

Positive signals

The strongest positives lie in the strategic complementarity of the two businesses, the acquirer’s financial resilience, and management’s measured approach to integration. The transaction positions Synopsys at the centre of increasingly complex, cross-domain engineering workflows, reinforcing its relevance in AI, automotive, and advanced manufacturing markets.

Emerging risks

Key risks remain around integration complexity, regulatory delays, and the realisation of revenue synergies, particularly given the premium valuation implied by the deal. Investor patience may be tested if integration milestones are delayed or if near-term earnings dilution persists longer than expected.

Forward insight

For future dealmakers, this transaction highlights the importance of strategic clarity when paying premium valuations. Where financial synergies are limited in the short run, successful outcomes depend on disciplined integration, credible long-term vision, and transparent communication with investors. At present, the Synopsys–Ansys deal appears on track but execution-sensitive, with ultimate value creation contingent on management’s ability to convert strategic logic into operational reality.

References

Ansys (2024). Synopsys to Acquire Ansys, Creating a Leader in Silicon to Systems Design Solutions. [online] www.ansys.com. Available at: https://www.ansys.com/news-center/press-releases/1-16-24-synopsys-acquires-ansys.

Autodesk (2025) Investor Relations Annual Report FY2024 Autodesk, Autodesk. Available at: https://investors.autodesk.com/static-files/c8b18520-59fa-478b-b665-2fb51c45062f (Accessed: 18 December 2025).

Bentley Systems (2025) Investor relations Bentley Systems 2024 Annual Report, Bentley Systems. Available at: https://investors.bentley.com/ (Accessed: 20 December 2025).

Broersma, M. (2025) Synopsys, Cadence Shares Surge after EDA controls lifted, Silicon Technology Powering Business UK. Available at: https://www.silicon.co.uk/e-regulation/china-chip-design-620616 (Accessed: 22 November 2025).

Cadence Design Systems, Inc. (2024) Cadence Annual Report 2024. Available at: https://s206.q4cdn.com/597110084/files/doc_financials/2024/ar/Cadence-Annual-Report-2024.pdf (Accessed: 20 December 2025).

Companies Market Cap (2025) Largest software companies by market cap. Available at: https://companiesmarketcap.com/software/largest-software-companies-by-market-cap/ (Accessed: 11 November 2025).

Dassault Systèmes (2025) Investor Relations - UNIVERSAL REGISTRATION DOCUMENT 2024 Including the Annual financial report, Dassault Systèmes. Available at: https://investor.3ds.com/static-files/eef15140-12ab-42c1-8dcb-88f3fdbf8714 (Accessed: 18 December 2025).

Gottlieb, C. (2025). Synopsys in $10 Billion Inaugural Offering. [online] Clearygottlieb.com. Available at: https://www.clearygottlieb.com/news-and-insights/news-listing/synopsys-in-10-billion-inaugural-offering [Accessed 10 Nov. 2025].

Dan, K. (2025) Synopsys: High-Growth Play in Chip Design and Verification. Long-term Pick Available at: https://longtermpick.com/p/synopsys-analysis (Accessed: 15 November 2025).

McColl, B. (2025). Synopsys Clears Final Regulatory Hurdle for $35B Ansys Deal. [online] Investopedia. Available at: https://www.investopedia.com/synopsys-clears-final-regulatory-hurdle-for-usd35b-ansys-deal-11771448 [Accessed 11 Nov. 2025].

Milana Vinn, Sen, A. and Nellis, S. (2024). Synopsys to buy engineering software firm Ansys in $35 billion deal. Reuters. [online] 16 Jan. Available at: https://www.reuters.com/markets/deals/synopsys-finalizes-35-bln-deal-buy-engineering-software-vendor-ansys-source-2024-01-16/.

Nellis, S. and Singh, J. (2024) Synopsys lifts annual forecast on AI Boom driving demand for chip design software | Reuters, Reuters. Available at: https://www.reuters.com/technology/synopsys-lifts-annual-forecast-ai-boom-driving-demand-chip-design-software-2024-05-22/ (Accessed: 14 November 2025).

PTC (2025) 2024 annual report, PTC. Available at: https://s27.q4cdn.com/610238322/files/doc_financials/2024/ar/PTC-2024-Annual-Report.pdf (Accessed: 27 December 2025).

Reuters Staff (2025). US FTC will require Synopsys, Ansys to divest certain assets to resolve merger concerns. Reuters. [online] 28 May. Available at: https://www.reuters.com/sustainability/boards-policy-regulation/us-ftc-will-require-synopsys-ansys-divest-certain-assets-resolve-merger-concerns-2025-05-28/.

Sec.gov. (2024). anss-20241231. [online] Available at: https://www.sec.gov/Archives/edgar/data/1013462/000101346225000009/anss-20241231.htm [Accessed 11 Nov. 2025].

Sec.gov (2003) Restated certificate of incorporation of Synopsys, Inc., SEC.gov. Available at: https://www.sec.gov/Archives/edgar/data/883241/000116606303000018/fifth_exh.htm (Accessed: 15 November 2025).

StockAnalysis. (2025). ANSYS. [online] Available at: https://stockanalysis.com/stocks/anss/market-cap/ [Accessed 11 Nov. 2025].

Synopsys (2024) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended October 31, 2024, Synopsys. Available at: https://s201.q4cdn.com/778493406/files/doc_financials/2024/q4/SNPS-10K-Q4-2024.pdf (Accessed: 13 November 2025).

Synopsys (2025) Generative AI for chip design, Synopsys. Available at: https://www.synopsys.com/ai/generative-ai.html (Accessed: 15 November 2025).

Synopsys (2024) Creating a leader in silicon to systems design solutions. Synopsys. Available at: https://synopsysansys.transactionfacts.com/wp-content/uploads/2024/01/Synopsys-Ansys-Investor-Presentation.pdf (Accessed: 29 November 2025).

Synopsys News Releases. (2024). Synopsys to Acquire Ansys, Creating a Leader in Silicon to Systems Design Solutions. [online] Available at: https://news.synopsys.com/2024-01-16-Synopsys-to-Acquire-Ansys%2C-Creating-a-Leader-in-Silicon-to-Systems-Design-Solutions [Accessed 10 Nov. 2025].

Synopsys.com. (2022). Synopsys Completes Acquisition of Ansys. [online] Available at: https://investor.synopsys.com/news/news-details/2025/Synopsys-Completes-Acquisition-of-Ansys/default.aspx? [Accessed 10 Nov. 2025].

Synopsys (2025). Synopsys responds to U.K. competition and Markets Authority’s phase 1 announcement regarding Ansys Acquisition, Synopsys. Available at: https://investor.synopsys.com/news/news-details/2025/Synopsys-Responds-to-U.K.-Competition-and-Markets-Authoritys-Phase-1-Announcement-Regarding-Ansys-Acquisition/default.aspx (Accessed: 25 November 2025).

Zeoli, C. (2022) How synopsys and cadence are fueling the semiconductor industry’s growth engine, Wing Venture Capital. Available at: https://www.wing.vc/content/how-synopsys-and-cadence-are-fueling-the-semiconductor-industrys-growth-engine (Accessed: 20th November 2025).