DoorDash’s $3.9 Bn Acquisition of Deliveroo

Written by: Tom Suttling (Chapter President), Aurelien Bommelaer & Vedansh Rawat

Deal Overview

Acquirer: DoorDash

Target: Deliveroo

Total Transaction Size: $3.9 billion

Announcement date: May 6, 2025

On May 6 2025, DoorDash finalised its acquisition of Deliveroo in an all-cash transaction valued at US$3.9 billion. The deal involved DoorDash paying $2.40 for each Deliveroo share, a 29% premium over the closing price on 24 April, a day before the offer was made public.

The deal marks an end to the company’s tumultuous time in the UK’s public market, coming amid a consolidating global food-delivery sector, where major players such as DoorDash seek scale and geographic diversification to offset slowing growth in mature markets.

DoorDash cited three primary strategic objectives behind the deal. First, to accelerate its international expansion, especially across Europe and the Middle East, leveraging Deliveroo’s local market strength. Second, to capture operating synergies by integrating platforms, rider networks and merchant relationships, aiming to improve efficiency and margins. Lastly, as DoorDash diversifies its services beyond traditional food delivery, exploring areas like restaurant reservations and autonomous delivery in some markets, Deliveroo offers the ideal platform to scale these innovations internationally.

Market reaction was mixed, with analysts noting the high purchase price and potential integration risks, particularly in adapting to different regulatory and labour frameworks. Nonetheless, the acquisition marks DoorDash’s largest international move since acquiring Wolt in 2022 and significantly extends its global footprint in the on-demand delivery space.

Company Overview: DoorDash

Founded: January 2013

CEO: Tony Xu

Market Cap: $108.7 billion

LTM Revenue: $11.9 billion

LTM EBITDA: $834 million

P/E: 144.9x

Ticker (NASDAQ): DASH

Deal Advisor: J.P. Morgan Securities LLC

History & Background

DoorDash was founded by four Stanford students in January 2013 and rapidly grew to become one of the leaders in the US food delivery industry. Originally founded to connect local restaurants to clients on a simple app, the company encountered massive success. Between 2015 and 2020, the company went through extensive growth, supported by various fundraising rounds with investors such as Sequoia Capital or Y Combinator. During the COVID-19 pandemic, the number of orders doubled, in turn allowing DoorDash to consolidate its position as one of the major players in the food delivery industry. This culminated in their December 2020 IPO, with a price per share of $102.

Prior to the Deliveroo acquisition, DoorDash previously entered the European and Middle Eastern markets through an exchange-of-shares merger with Wolt Enterprises in 2021, in a deal totalling $8.1 billion. This provided DoorDash with 23 new operating countries, while also keeping the local expertise of Wolt. The announcement of Deliveroo's acquisition only comes as the continuation of DoorDash’s expansion plans, combining its dominant position in North America with Deliveroo’s in Europe, the UK and Asia. The final objective for DoorDash, which Tony Xue made clear, is to compete globally with UberEats or JustEat.

Product Lines :

DoorDash offers a range of food but also other delivery services, which include :

The original product line of meal deliveries, connecting restaurants, customers and deliverymen (Dashers). Within the US food delivery market, it holds about 65% of the market share. DoorDash also launched DoorDash for work, targeting companies directly.

The company also extends its services to now include delivery of groceries through DoorDash Grocery, but also of other products with DashMart and Convenience. This is done in collaboration with major US firms such as Walmart or Albertsons.

Through this diversification of their product lines, DoorDash was able to increase its Gross Order Value (GOV), which surpassed $70 billion in 2024, leading over its rivals GrubHub or PostMates.

Strengths :

DoorDash shows strong revenue growth in the last few years (about 20-25% YoY), along with robust financial stability, improving its adjusted EBITDA to more than $800 million, with the majority of its revenue coming from DashPass subscriptions (over 18 million subscribers).

The US domestic market is currently dominated by DoorDash, of which it controls about ⅔. This near-hegemonic position was built through operational excellence, superior logistics execution but also more than 500,000 partnerships with restaurants. With this scale, DoorDash generates the cash flow needed for its international objectives.

Since 2021, DoorDash pursued targeted acquisitions to strengthen its international reach, firstly through Wolt in 2021, now followed by Deliveroo. The firm thus enjoys the international penetration (regulatory compliance, customer base and local infrastructure) of these well-established companies without having to build each market from scratch.

Challenges :

Despite its size, DoorDash, like any other food delivery company, faces weak net margins, as the company model relies on high fixed costs but also is in play with fierce competitors. In 2024, the net margin was still under 5%, making the company vulnerable to slowdowns in demand or to a rise in the cost of labour.

DoorDash, now a global player, is facing strong competition as its rivals now include UberEats or JustEat, but also Amazon through the GrubHub app. These companies possess strong financial means, allowing them to pursue aggressive price strategies. The aspects in which DoorDash can make a difference thus appears to be in the quality and speed of service.

DoorDash’s international expansion, like any of the kind, makes the company vulnerable to the regulatory environments of its new markets. Especially in the EU, regulations differ from the US regarding the rights of “Dashers” but also on their minimum pay. Moreover, Deliveroo being also a major actor in UK and Asia, DoorDash will have to adapt to various regulations which may in turn lead to organisational restructuring, a source of additional costs and slowing down possible synergies.

Summary:

DoorDash is a well-established domestic leader in the food delivery industry, a company that enjoys steadily growing revenues but also strong financial stability, all of which are useful for the firm’s international expansion plans, as exemplified by the acquisition of Wolt in 2021.

Deliveroo’s acquisition appears as such as the next step in DoorDash’s plans, which are to broaden its footprint across the European, Asian and Middle Eastern markets, to reinforce its global competitive position by exploiting platform synergies.

The success of the deal will depend on how effectively DoorDash manages to integrate Deliveroo efficiently, for example how the company will manage the various regulatory environments in order to sustain healthy margins in markets that significantly differ from the US.

Target Overview: Deliveroo

Founded: February 2013

CEO: Miki Kuusi

Market Cap: $3.9 million

LTM Revenue: $2.75 million

LTM EBITDA: $135.85 million

P/E: -179.80x

Ticker (LSE) : ROO

Deal Advisor: Goldman Sachs

History & Background

Deliveroo was launched in London in 2013 to bring high-quality restaurants to consumers who previously had limited delivery options. It expanded rapidly into multiple countries across Europe, the Middle East and Asia, partnering with restaurants and logistics networks of couriers. The company raised significant venture capital during its growth phase and went public via IPO on the London Stock Exchange in March 2021. More recently, it diversified into grocery and retail partnerships (e.g., via “dark stores” and grocery delivery) to extend beyond pure restaurant meals.

Product Lines

Deliveroo operates a 3-sided marketplace, connecting local consumers, riders and restaurant, grocery and retail partners

Restaurant Food Delivery: The foundation of Deliveroo’s offerings is its food delivery business. Receiving orders via app/website, fulfilled by independent couriers from partner restaurants.

Grocery and Retail Delivery: Deliveroo has developed rapid-delivery grocery services and partnerships with grocers/retailers to increase delivery density and broaden revenue mix.

Advertising & Value-Added Services: Includes subscription services (e.g., “Plus”), promotional/advertising platform for merchants.

Strengths

Strong Market Position & Profitability Milestone: Deliveroo has established itself as one of the top three players in the UK and major European markets, supported by a loyal customer base and dense delivery network. In 2024, it reported its first annual profit (£2.9m) and positive free cash flow, signalling improving unit economics and operational efficiency.

Diversified Growth Through Grocery & Retail Expansion: Deliveroo’s growing grocery and retail segment now accounts for around 16% of total GTV, helping stabilise order volumes and reduce dependence on restaurants (Deliveroo PLC, 2025). This diversification aligns closely with DoorDash’s global strategy of expanding beyond traditional food delivery.

Regulatory Advantage in Key Markets: In 2023, the UK Court of Appeal reaffirmed that Deliveroo riders are self-employed contractors, providing legal clarity and shielding the company from the rising labour cost pressures facing peers in the EU and other markets. This gives the combined entity flexibility in scaling operations.

Challenges

Highly Competitive Market & Margin Pressure: Deliveroo operates in one of the most saturated delivery markets, facing intense competition from Uber Eats and Just Eat. Aggressive pricing and promotions continue to squeeze margins, making sustained profitability and differentiation difficult.

Regulatory and Labour Uncertainty Across Europe: While the UK ruling favoured Deliveroo, upcoming EU-wide labour reforms could classify riders as employees, increasing costs and operational complexity. Managing compliance across diverse regulatory environments will be a key integration challenge for DoorDash.

Integration and Execution Risk Post-Acquisition: Deliveroo’s localised business model and strong UK-centric culture could complicate integration with DoorDash’s global systems and management approach. Achieving synergies—particularly in technology and logistics—will depend on careful coordination and execution.

Summary

In summary, Deliveroo is a UK-based food-delivery and local-commerce company founded in 2013, now operating across multiple countries, with a business model rooted in restaurant delivery but increasingly diversified into grocery and retail logistics. For DoorDash, acquiring Deliveroo offers geographic expansion, an urban logistics network and platform capability in Europe and other markets—helping DoorDash build a more global, diversified local-commerce business.

Motivation

Accelerated international expansion: Deliveroo’s acquisition provides DoorDash with an immediate expansion of its footprint in Asia and Europe, without having to create new infrastructure. Moreover, the firm will use Deliveroo’s already existing local networks, notoriety but also regulatory compliance to enter densely populated urban areas, which correspond to DoorDash & Deliveroo’s core markets, given that they hold more purchasing power and represent the bulk of orders. This operation represents the next step in DoorDash’s clear push to transform itself into a global platform for local business.

Operational and technological synergies: Both companies already share a common online marketplace model, with partner restaurants, independent deliverymen and on-app clients. This acquisition will in turn lead to a pooling of data, logistics, and route optimisation strategies. This process gives DoorDash an opportunity to improve its profit per order, efficiency and analytical capabilities, thanks to the integration of the systems used by Deliveroo in European cities.

Reinforcement of DoorDash’s global position: As DoorDash faces powerful competition worldwide, especially against UberEats and JustEat, the Deliveroo acquisition consolidates its standing as one of the world’s leading food delivery platforms. With Deliveroo, a renowned brand, established on multiple continents with a loyal customer base, DoorDash is now able to enhance its global reach. This strengthened global presence increases DoorDash’s bargaining power with stakeholders, diversifies its income sources, but also reduces its dependence on the North American markets.

Deal Navigation

The Deliveroo acquisition required multiple clearances from various competition authorities to ensure the deal’s completion. The most important, that of the European Commission’s Directorate of Competition, was given in September 2025. The Directorate concluded that the transaction was to be approved, under the simplified merger procedure, arguing that the acquisition did not raise competition concerns nor created a dominant entity within the European market. Moreover, the UK’s CMA (Competition & Markets Authority) also cleared the acquisition under no conditions, citing UberEats and JustEat’s presence in the UK domestic market as constraining factors for the newly formed merged entity.

Beyond the antitrust challenges, the new entity remains exposed to changing labour-law and platform-work regulations in the UK and the EU, as both companies relied and will continue to rely on independent workers, For example, the EU’s Platform Work directive will force the new entity to review its worker practices, especially with regard to pay schemes and worker protection. DoorDash acknowledged in its SEC filings that this adaptation may increase its compliance, but assured that this would in no way threaten the merger’s legality.

Integration

As the transaction has only recently received final regulatory clearances, public disclosure regarding the post-merger integration of Deliveroo into DoorDash remains limited. DoorDash has not yet published precise integration milestones, nor have they quantified synergy targets in their communications — overall suggesting that the company tends to mostly prioritise continuity in operations for the early phases of the integration.

Nevertheless available signals indicate that DoorDash pursues a decentralised integration model, a process which would be consistent with its approach following the acquisition of Wolt in 2021. In its announcement of the Deliveroo transaction, DoorDash insisted on the importance of preserving local market-specific expertise, implying that Deliveroo will continue to operate with a certain degree of autonomy for the time being. This allowed Doordash to reduce immediate cultural and execution risks.

From an operational point of view, most risks appear manageable. Both firms operate similar marketplace models, thus limiting compatibility issues and facilitating a gradual integration of logistics/infrastructure. Even though adapting operating practices across jurisdictions may increase compliance costs and slow the realisation of synergies, it is not expected to undermine the rationale of the transaction.

Overall, the approach adopted so far is consistent with DoorDash’s strategy of international expansion, while ensuring local operational preservation. The integration’s outcome will ultimately depend on DoorDash’s ability to ensure technology/efficiency synergies over time, making sure not to disrupt Deliveroo’s existing market positions in the process.

Performance & Valuation

Comparable Company Analysis

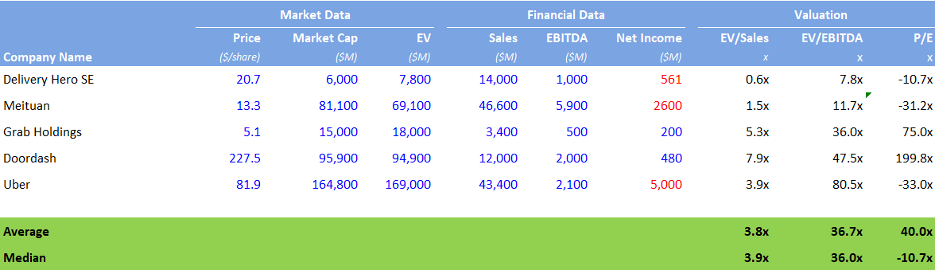

The public comparable company analysis shows that DoorDash acquired Deliveroo at valuation levels significantly below the current trading multiples of the global food-delivery peer group. This suggests an appealing entry point on a relative basis. Based on the estimated transaction enterprise value for Deliveroo, the deal closed at around 1.1x EV/Sales and 14.4x EV/EBITDA. This positions it much closer to the lower end of the sector range and aligns more with struggling European peers like Delivery Hero (0.6xEV/Sales; 7.8x EV/EBITDA) than with premium platforms like DoorDash itself (7.9x EV/Sales; 47.5x EV/EBITDA). This discount reflects Deliveroo’s historically weak profitability, regulatory risks, and competition pressures in Europe. However, there is significant potential for growth if DoorDash can successfully improve the asset's performance.

Market reaction supports this view. Deliveroo’s share price jumped sharply after the announcement, showing a strong takeover premium. Meanwhile, DoorDash’s stock saw only a small and brief drop, indicating that investors generally considered the deal to be beneficial rather than harmful to value. Initial analyst comments focused on the idea that the deal was a “selective European land-grab” at low cycle valuations, with potential gains dependent on realizing synergies instead of financial tricks. On the operational front, early integration signs—including the launch of DoorDash’s advertising technology, aligning courier incentives, and initial cost-cutting—suggest that the idea of platform-level synergy is believable, although it still needs to be proven on a larger scale. From a financial health standpoint, DoorDash managed the acquisition without a significant increase in leverage, maintaining balance-sheet flexibility while Deliveroo’s revenues contribute additional growth.

In conclusion, the $3.9 billion purchase price appears to represent attractive value for DoorDash when assessed against prevailing market multiples and prevailing investor sentiment. However, the ultimate success of the transaction will depend on DoorDash’s ability to execute a disciplined and effective integration of Deliveroo.

Risks

Operational and integration challenges present a significant risk for DoorDash as it brings Deliveroo into its ownership. Successfully integrating Deliveroo’s existing technology, operations and market approach with DoorDash’s systems is complex and mistakes could disrupt customer experience or partner relationships, especially across multiple countries with distinct regulatory and labour environments. Observers note that cultural integration and operational execution are common pitfalls in cross-border mergers, and failure here could weaken brand loyalty or reduce efficiencies that justified the acquisition in the first place.

Regulatory and labor scrutiny remains a crucial uncertainty despite recent approvals. Although the European Commission cleared the transaction and major regulatory hurdles have been passed, ongoing focus from the UK’s Competition and Markets Authority (CMA) and other bodies means that restrictions could still be imposed — particularly as they relate to competition and gig-work practices.

Finally, financial and competitive pressures could challenge DoorDash’s ability to realise the deal’s value. DoorDash is paying a significant premium for Deliveroo in an industry still grappling with profitability issues, including Deliveroo who reported recent net losses. Combined with intensified rivalry from other services such as Uber Eats and Just Eat Takeaway, there is a risk that anticipated revenue may take longer to materialise, potentially weighing on margins and shareholder returns.

House View

Overall, the DoorDash–Deliveroo transaction for now appears strategically coherent however still very much dependent on its future execution. The regulatory clearances in the EU and UK have removed a key source of uncertainty and also validated the deal’s industrial logic, and DoorDash’s prior experience with Wolt suggests a disciplined approach to international expansion.

Early signals are positive. The approval under the simplified merger procedure confirms that competition concerns are limited, and DoorDash enters integration from a position of improving financial performance. In addition, the emphasis on preserving local operations reduces short-term disruption risk.

However, value creation remains exposed to execution risks. Disclosure on integration milestones and synergies is limited, and evolving labour regulations in the EU may constrain margin expansion.

The deal thus looks well-designed, however not yet proven. Its ultimate success remains dependent, less on strategic intent than on DoorDash’s ability to translate scale into sustainable profitability, especially across Europe’s diverse regulatory environments.

References

Deliveroo PLC (2025) FY 2024 preliminary results. 13 March. Available at: https://www.rns-pdf.londonstockexchange.com/rns/4829A_1-2025-3-13.pdf .

DoorDash, Inc. (2025a) DoorDash announces agreement to acquire Deliveroo. IR News, 6 May. Available at: https://ir.doordash.com .

DoorDash, Inc. (2025b) DoorDash completes acquisition of Deliveroo. IR News, 2 October. Available at: https://ir.doordash.com .

DoorDash, Inc. (2025c) Q4 and FY2024 financial results. IR News, 11 February. Available at: https://ir.doordash.com.

Griffith, E. (2020) ‘DoorDash faces its latest challenge: wooing Wall Street’, The New York Times, 2 December. Available at: https://www.nytimes.com (Accessed: 31 December 2025).

Reuters (2025) ‘DoorDash to acquire UK’s Deliveroo for $3.9 billion’, Reuters, 6 May. Available at: https://www.reuters.com.

Ritter, J. (2024) DoorDash’s acquisition of Deliveroo: strategic rationale and value creation. Master’s thesis, Nova School of Business and Economics, Universidade Nova de Lisboa.

U.S. Securities and Exchange Commission (SEC) (2025) Ex-99.1 press release: Q4/FY2024 results (DASH). 11 February. Available at: https://www.sec.gov.