Lufthansa’s €325mn Acquisition of ITA Airways

Written by: Raul Fahradov (Chapter President), Maurice Haegar, Krish Apurva Kothari & Yukeng Zhang

Deal Overview

Acquirer: Lufthansa Group

Target: ITA Airways

Transaction Value: €325 million

Announced: 25th May 2023

On 25 May 2023, Lufthansa announced its minority stake in ITA Airways, potentially reshaping the European airline industry for years to come. The acquisition was financed with 100% cash, totaling €325 million, for a 41% stake in the company alongside its majority owner, the Italian Ministry of Economy. The acquisition was regarded as a strategic move by the group to strengthen its position in the Italian and European aviation markets and to reinforce its position as number one in Europe. It also marks Italy as an additional home market for the group, alongside Germany, Switzerland, Belgium, and Austria.

The airline industry remains fragmented, with numerous small independent airlines, presenting significant cost-cutting and consolidation opportunities. Regardless, critics have questioned the Lufthansa Group's growing power in Europe and the potential for future abuses of monopoly power. However, these concerns may be overstated, as the group’s activities are subject to rigorous European Commission oversight, particularly in competition law and merger control.

Due to high operating costs and ever-increasing industry standards, margins in the airline industry have been consistently challenged. This has pushed airlines to seek ways to retain their margins without cutting corners or damaging their brand image. Hence, organic growth in the airline industry is challenging, and M&A is a way to remain viable and drive sustained growth. Through this acquisition, Lufthansa has strengthened its bargaining power, expanded its network, and increased its fleet size.

Company Overview: Acquirer

Founded: 1953

CEO: Casten Spohr

Headquarters: Cologne, Germany

Market Cap: €9.5 bn (year-end 2023)

LTM Revenue: €35,442 million

LTM EBITDA: €4,910 million

P/E: 6 X

Ticker (ETR): LHA

Advisor: BNP-Paribas

History & Background

Lufthansa was founded in West Germany and commenced flight operations in 1955. Over the years, the company underwent several major restructurings and established independent operating units to support its expanding operations. In 1997, Lufthansa completed its full privatization and became a Group, a strategic transformation aimed at reducing the impact of cyclical fluctuations in the aviation industry by diversifying its portfolio.

As part of this expansion strategy, the Lufthansa Group continued to grow through the strategic integration of other carriers, including Swiss International Air Lines (2007), Eurowings (2008), Austrian Airlines (2009), and Brussels Airlines (2018). In 2020, the Group experienced substantial financial losses due to the COVID-19 pandemic. To stabilize its operations, Lufthansa received a €9 billion government bailout, during which the German government acquired a 20% ownership stake.

Product Lines

Lufthansa Group is a leading European aviation group with four major business segments: Passenger Airlines, Logistics, Maintenance, Repair & Overhaul (MRO), and Additional businesses. The Passenger Airlines segment comprises Lufthansa Airlines, SWISS, Austrian Airlines, and Brussels Airlines, which operate as network carriers under a multi-hub strategy, offering extensive connectivity via hubs in Frankfurt, Munich, Zurich, Vienna, and Brussels to more than 270 destinations. The segment also includes Eurowings, a low-cost carrier providing point-to-point short- and medium-haul services, primarily from German-speaking countries.

Lufthansa Airlines: Lufthansa Airlines is Germany’s largest airline and national flag carrier, with hubs at its home airport Frankfurt and Munich. The platform also includes the regional airlines Lufthansa CityLine, Lufthansa City Airlines, Air Dolomiti, and Discover Airlines.

SWISS: SWISS is Switzerland's national flag carrier. Alongside its sister company, Edelweiss Air, which focuses on leisure travel, it maintains a premium positioning, operating flights from its Zurich and Geneva hubs to over 100 destinations in 50 countries, with a strong emphasis on the Mediterranean region and North America.

Austrian Airlines: Austrian Airlines is Austria's largest airline and national flag carrier, operating primarily from its hub at Vienna International Airport. The airline focuses on connecting Central and Eastern Europe, serving a strong network of short-haul European routes, while also offering a limited long-haul network to North America.

Brussels Airlines: Brussels Airlines is Belgium’s national carrier, operating from Brussels Airport with a network focused on Europe and sub-Saharan Africa.

Eurowings: Eurowings is Germany's largest low-cost carrier, focusing on short- and medium-haul point-to-point flights. It operates non-stop services to over 150 destinations across Europe and beyond, making it one of Europe’s largest holiday airlines. The airline consists of two operations: Eurowings Germany, serving flights from Germany to European destinations, and Eurowings Europe, covering pan-European routes.

| Type | Manufacturer | Lufthansa | SWISS | Austrian | Brussels | Eurowings | Lufthansa Cargo | Group fleet |

|---|---|---|---|---|---|---|---|---|

| Short- to medium- haul |

Airbus A220 | 30 | 30 | |||||

| Airbus A319 | 40 | 15 | 31 | 86 | ||||

| Airbus A320 | 63 | 25 | 29 | 16 | 50 | 183 | ||

| Airbus A320neo | 35 | 8 | 5 | 5 | 8 | 61 | ||

| Airbus A321 | 54 | 6 | 6 | 6 | 4 | 76 | ||

| Airbus A321neo | 17 | 4 | 5 | 26 | ||||

| Bombardier CRJ | 27 | 27 | ||||||

| Embraer | 26 | 17 | 43 | |||||

| Long- haul |

Airbus A330 | 22 | 14 | 10 | 46 | |||

| Airbus A340 | 33 | 9 | 42 | |||||

| Airbus A350 | 30 | 4 | 34 | |||||

| Airbus A380 | 8 | 8 | ||||||

| Boeing 747 | 27 | 27 | ||||||

| Boeing 767 | 3 | 3 | ||||||

| Boeing 777 | 12 | 6 | 18 | |||||

| Boeing 787 | 5 | 2 | 7 | |||||

| Boeing 777F | 18 | 18 | ||||||

| Total aircraft | 387 | 112 | 68 | 46 | 100 | 22 | 735 |

Strengths

Market Positioning: Lufthansa Group operates the largest fleet among Europe’s three major legacy airline groups, totaling 735 aircraft (IAG: 601; Air France–KLM: 574). The Group also maintains the highest number of short- to medium-haul aircraft, reflecting a strategic focus on high-frequency regional routes across Central and Southern Europe, North Africa, and the Middle East.

Decentralised Market Strategy: As an aviation group comprising multiple national airlines, Lufthansa has adopted a multi-hub strategy (Frankfurt, Munich, Zurich, Brussels, Vienna) that allows each carrier to operate with a high degree of autonomy. Supported by distinct market positioning, strong historical heritage, and deep local operational expertise, each airline can tailor its network and service offering to its home market. This autonomy helps preserve individual competitiveness and customer loyalty, while also minimising internal competition and enabling the group to maximise overall network coverage and market penetration.

Challenges

Operational Inefficiency: Lufthansa Group’s EBIT declined sharply by 35% in 2024, largely driven by a significant deterioration in results at Lufthansa Airlines, where EBIT fell to a loss of EUR 94 million from a profit of EUR 864 million in the prior year. Although revenue at Lufthansa Airlines continued to grow steadily, escalating operating costs and the disruptive impact of labor strikes substantially eroded profitability. This inefficiency is further evidenced by the fact that total headcount remains 7% higher than in 2019, despite flight activity not yet having returned to pre-COVID levels.

Strategic Risks: Lufthansa Group faced significant organisational complexity, with more than 300 subsidiaries and affiliated companies. Under the multi-hub strategy, individual airlines operated with a high degree of autonomy, which resulted in substantial duplication of functions and inefficient coordination.

Supply Chain Risks: Ongoing disruptions across the aerospace supply chain are delaying the production and delivery of new aircraft and critical components. The global commercial aircraft backlog reached a record level of more than 17,000 aircraft in 2024, materially exceeding the annual backlog levels of approximately 13,000 aircraft observed between 2010 and 2019. These delays have tangible cost implications for airlines. Extended reliance on older, less fuel-efficient aircraft has driven up excess fuel costs. In parallel, the aging global fleet has led to additional maintenance expenses, reflecting higher inspection frequency, component replacements, and unscheduled repairs.

Company Overview: Target

Founded: 2021

CEO: Fabio Lazzerini

Headquarters: Rome, Italy

Market Cap: Not Public Listed

LTM Revenue: €2,400 million

LTM EBITDA: €70 million

History & Background

ITA Airways, launched in October 2021, emerged as the successor to Alitalia after the Italian government retired the legacy carrier due to persistent financial losses. ITA inherited parts of Alitalia’s domestic and international operations, along with key slots and a modest fleet. Designed as a leaner, more sustainable national airline, ITA focused on modernising its fleet, streamlining operations, and improving connectivity across Europe and beyond. By 2023, it had positioned itself as Italy’s flag carrier with a growing emphasis on network efficiency and partnerships in the broader aviation ecosystem.

Product Lines

ITA Airways operates scheduled passenger services across domestic, European, and intercontinental routes, leveraging both narrowbody and wide-body aircraft. Its offerings include economy and business class, loyalty programs (MilleMiglia), and ancillary services such as cargo, charter flights, and code-share partnerships. The airline has also prioritised fleet modernisation with fuel-efficient aircraft and is increasingly integrating premium services and joint operations with Lufthansa Group airlines to enhance the passenger experience.

Strengths

ITA’s main strengths lie in its strategic hubs in Rome Fiumicino and Milan, which provide strong connectivity across Europe and to long-haul destinations. Its small, agile organisational structure enables rapid decision-making, fleet flexibility, and operational optimisation. The partnership with Lufthansa Group enhances global reach, premium service offerings, and access to advanced systems in revenue management, loyalty programs, and codeshare networks. Additionally, its government backing and support provide financial stability while it scales operations.

Challenges

ITA Airways faces capital intensity and profitability pressures typical of an emerging flag carrier that was created out of a distressed predecessor in the middle of a demand shock. Decades of Alitalia’s structural losses and repeated state bailouts culminated in its shutdown during the Covid period, with the new ITA platform inheriting a challenged brand, network, and labour cost base against a backdrop of sharply depressed long-haul demand and heavy travel restrictions. Even after launch, ITA reported a net loss of about €486 million in 2022 on roughly €1.6 billion of revenue, explicitly attributing the result to lingering pandemic effects, weaker demand in early 2022, and a spike in fuel costs linked to the Russia-Ukraine conflict and euro weakness, forcing tight cash and capacity management.

At the same time, Italy’s market recovery has been driven disproportionately by ultra‑low‑cost carriers such as Ryanair and Wizz Air, with Ryanair alone carrying around one‑third of Italian passengers and holding more than 40% of seat share (Having been investigated for dominant positioning by the AGCM), leaving ITA with roughly 11% of capacity and intense fare pressure on core domestic and short‑haul European routes. These competitive and macro headwinds sit on top of the usual challenges of capital‑intensive fleet renewal: ITA is targeting 80% new‑generation aircraft by 2026, and since ITA Airways entered the market with considerably less cash than its competitors, it is more vulnerable to volatility during these renewals.

Market Positioning

ITA Airways is a national flag carrier with modern ambitions, positioned between a full-service European airline and a domestic network carrier. While smaller and less capital-rich than European super-majors like Lufthansa or Air France-KLM, ITA offers a strategically valuable network in Italy and a growing intercontinental footprint. It positions itself as a short-haul European route budget airline competing with Ryanair and Wizz Air.

Summary

By 2025, ITA Airways will hold valuable Italian aviation assets, a growing international network, and integration potential with Lufthansa Group, yet it remains a high-risk, capital-intensive operation. Strategic investment by Lufthansa unlocks operational synergies, premium network benefits, and financial stability, while mitigating execution and market risks inherent to a smaller, emerging airline.

Motivation

European airline market environment

Unlike the US, the European aviation market remains relatively fragmented. While in the United States the major airlines, American, Delta, United, and Southwest, accounted for over 72 percent of the flight schedule, the four largest European airlines have a combined share of 46 percent (Palladino 2024). To increase their market share and feed their long-haul hubs, the largest airlines in Europe have embarked on a consolidation strategy. For example, British Airways and Iberia merged to form International Airlines Group (IAG), which later acquired the Irish flag carrier Aer Lingus. In contrast, Air France and KLM formed a joint venture in 2004 and took a minority stake in Scandinavian Airlines (SAS). Lufthansa had previously purchased only airlines in Central Europe, such as Swiss and Austrian Airlines.

Geographic advantage of ITA Airways

Acquiring ITA Airways would add Rome-Fiumicino as the southernmost hub airport to Lufthansa Group’s portfolio. Geography is a key determinant of an airline’s success, as it enables shorter connecting times for passengers. Rome’s geographic location is strategically advantageous for flights from Northern and Central Europe to South America and Africa, both of which are markets where Lufthansa is currently weaker than IAG and Air France-KLM. Furthermore, Italy is one of Lufthansa’s largest markets for flights between Europe and North America (The Economist, 2024).

Economies of scale

To understand why Lufthansa would be interested in acquiring ITA Airways, one must consider the strategic thinking of the entire airline group, not just Lufthansa. When purchasing new aircraft from Boeing and Airbus, the airline group's size gives it a strong negotiating position, resulting in lower prices. Essentially, the group makes bulk purchases and distributes the planes among its subsidiaries based on need and revenue potential. ITA Airways could benefit from lower costs in future fleet procurement, while Lufthansa would gain additional negotiating leverage. Furthermore, there are economies of scale from having a sizable subsidiary in one of Europe’s most populous countries. If passengers want to fly to cities not served by ITA, they can be “fed” into one of the other Lufthansa Group hubs, most prominently Frankfurt, Munich, and Zurich. This is especially important given Lufthansa’s strong reliance on connecting passengers, as its hub airport cities do not have the same market size as London (British Airways) or Paris (Air France). Furthermore, Lufthansa intends to integrate ITA into the Star Alliance, a global airline alliance, thereby enhancing its access to connecting passengers (Lufthansa Group 2025).

Protection against competing airline groups

Furthermore, acquiring ITA Airways is also a protective move against its European competitors. If ITA Airways were to be acquired by a rival such as Air France-KLM, Lufthansa would not only face stronger competition in the Italian market but also lose the opportunity to operate a Southern European subsidiary. Before the acquisition of ITA, it was one of the few larger independent airlines in Southern Europe, and multiple large companies were interested in it. The other airline is TAP Air Portugal. If Lufthansa failed to acquire either ITA or TAP, it would be significantly disadvantaged on flights between Europe and Latin America, as its hubs are less well-positioned for connecting passengers than hubs in Madrid, Lisbon, or Rome. At the time of the ITA acquisition, a potential TAP sale was still distant. Had Lufthansa decided against acquiring ITA, it would not have a guarantee for acquiring TAP. Two different airlines, which potentially could have been acquired by Lufthansa, were Scandinavian Airlines (SAS) and Finnair. However, following the Russian invasion of Ukraine and the closure of Russian airspace for European airlines, the Northern hubs in Helsinki and Copenhagen have become rather uncompetitive for passenger flows between Europe and Asia, while already being historically weak for traffic between Europe and South America or Africa.

Fleet efficiency and commonality

Given the internal factors that may make ITA an attractive target for Lufthansa, its fleet should not be overlooked. Following its launch in 2021, the airline received many new aircraft from Airbus, which offer a better passenger experience and consume less fuel. The majority of its fleet already consists of the modern A220, A320neo family, A330-900, and A350-900. Its older A320ceo-family aircraft and A330-200 are likely to be retired in the next few years, making ITA’s fleet one of the youngest and most fuel-efficient in Europe. For Lufthansa, this reduces operating costs and the need to invest in new aircraft for ITA. Lufthansa itself is also currently affected by delivery issues of Airbus and Boeing, postponing the entry into service of new 787s and A350s, forcing the airline to continue operating older aircraft such as the 747-400 and A340. The older aircraft have inferior cabins compared to Lufthansa’s new Allegris product, while ITA’s modern fleet offers brand new cabins with an elevated passenger experience.

Improving management quality and utilising existing experience

Moreover, Lufthansa appears to believe that Alitalia's failure was due to poor management. In January 2025, Lufthansa Group managers Joerg Eberhart and Lorenza Maggio were appointed to ITA’s board of directors (Lufthansa Group 2025). Both have experience in the Italian market and in strategic and organisational management, to bring ITA closer to the other Lufthansa Group airlines and boost profitability. Last but not least, Lufthansa can draw on experience integrating loss-making airlines into its portfolio, as demonstrated by the turnarounds of Swiss and Austrian Airlines.

Deal Navigation

Regulatory approval

To successfully implement the initial 41 percent stake in ITA Airways, Lufthansa required European Commission approval. A key concern of regulators was Lufthansa's potential dominant market position in Europe, particularly on flights between Italy and Central Europe (European Commission 2024). Furthermore, the transatlantic joint venture A++ between Lufthansa Group, United Airlines, and Air Canada, which ITA Airways would join following the acquisition, was under scrutiny by the European Commission due to concerns about reduced competition and higher ticket fares. Additionally, Milan-Linate Airport posed a regulatory obstacle to the acquisition. Linate is one of 3 airports in the Milan metropolitan area and caters primarily to business travellers, given its close proximity to the city centre (Milan-Malpensa airport handles further short-haul and all intercontinental traffic, while Milan-Bergamo serves low-cost airlines). Lufthansa eventually cleared these obstacles by agreeing to transfer take-off and landing slots at Milan-Linate to competing airlines, such as British Airways and KLM, thereby creating competition on short-haul flights and offering one-stop itineraries to North America via their London-Heathrow and Amsterdam-Schiphol hubs (European Commission 2024).

Financing

The deal was executed through an all-cash transfer from Lufthansa to the Italian Ministry of Economy and Finance, valued at €325 million (Reuters, 2025). BNP Paribas acted as the exclusive financial advisor to Lufthansa, supporting the airline’s capital increase of €325 million to finance the transaction (BNP Paribas, 2025). The deal values ITA Airways at around €792.68 million. In 2024, ITA’s revenues were €3.1 billion with an EBITDA of €337 million and EBIT of €3 million (ITA Airways 2025).

Integration

Following the partial acquisition by Lufthansa, ITA Airways left the Sky Team alliance and has since begun codesharing with Lufthansa Group airlines. By 2026, the airline is expected to join Star Alliance, while ITA’s own frequent flyer programme will be replaced by Lufthansa’s Miles & More. During the Lufthansa Group capital markets day, the airline outlined its goal of leveraging ITA’s home base of Rome Fiumicino as a hub for flights to South America and Africa. By the end of 2025, Lufthansa claims to have captured 20-30% of ITA synergies, increasing them to 80% by 2027 (Lufthansa Group 2025).

Performance & Valuation

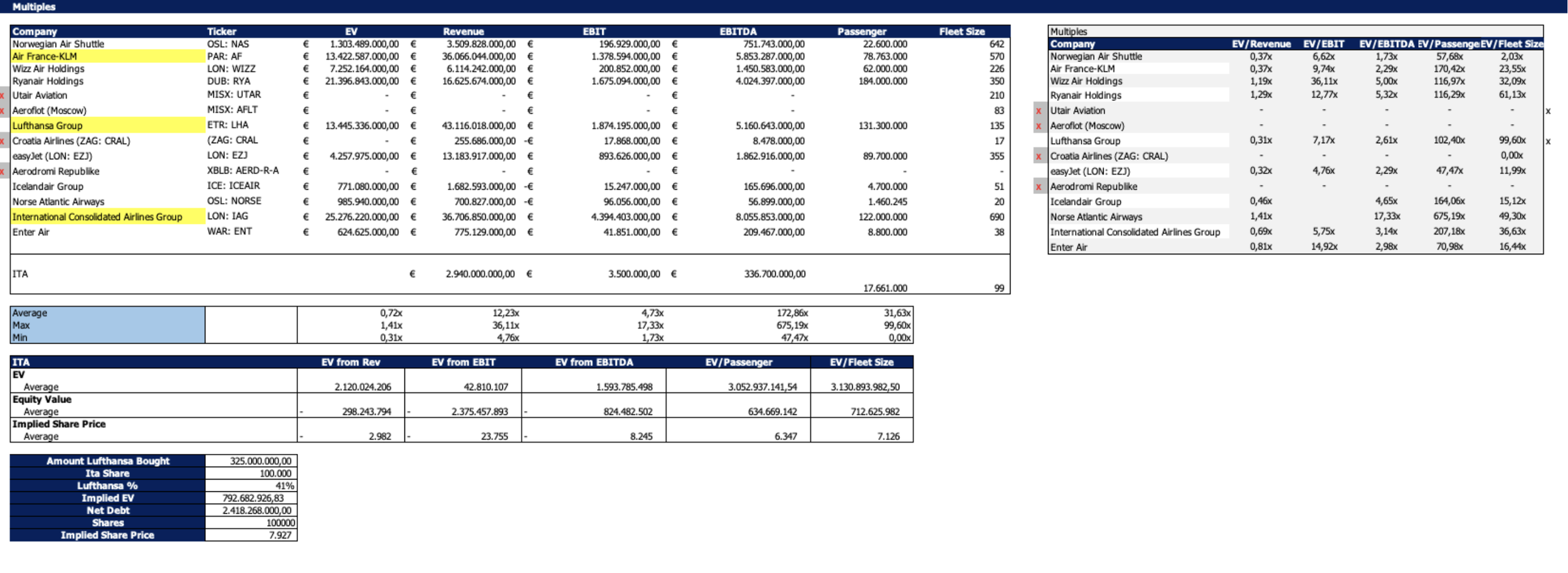

Due to ITA Airways being a newly established, state-owned enterprise, there is a lack of publicly available, consistent financial reporting, which makes the construction of a detailed intrinsic or cash flow-based valuation unfeasible. As a result, acquiring accurate and comparable financial data across periods is challenging, limiting the reliability of traditional valuation approaches that depend on stable historical financials. In this context, a multiples-based analysis provides a practical alternative and offers a directional view on the valuation of the transaction and its key implications.

Based on the valuation figures shown in the screenshot, the implied share price calculated using EV to EBITDA multiples and fleet size-based multiples is broadly consistent with the price paid by Lufthansa, indicating that, on these two airline-specific valuation approaches, the transaction price is supported by the underlying metrics presented. This alignment suggests that, at least from an operating cash flow perspective and an asset capacity perspective, the consideration paid does not appear anomalous when compared to the valuation outputs generated by those methodologies in the model.

However, the remaining valuation metrics shown in the screenshot imply a lower equity value and implied share price than the one derived from the transaction, which causes the Lufthansa price to screen as overvalued within the context of the full valuation set presented. The dispersion between EV to EBITDA and fleet size outcomes versus the other implied valuation outputs highlights that the transaction price sits toward the upper end of the valuation range, and is not uniformly supported across all methodologies displayed. As such, while the Lufthansa price is consistent with certain key airline benchmarks shown, it appears rich relative to the broader group of valuation indicators included in the analysis.

Risks

Risks of integration

Integrating ITA into the Lufthansa Group presents a number of challenges. Historically, ITA’s predecessor, Alitalia, was unsuccessfully privatised and later sold to state-owned UAE airline Etihad Airways, never becoming a profitable company. ITA Airways still has many Alitalia employees and potentially the same corporate culture. This could become a major issue for Lufthansa, as it has to navigate potential employee dissatisfaction and management problems for a successful restructuring. Furthermore, the acquisition diverts money away from the existing Lufthansa Group airlines. Lufthansa German Airlines, especially, is in dire need of renewing its fleet and cabin product to compete with European airlines, but also with Gulf and Chinese airlines on flights to Asia. Diverting resources to Italy could negatively impact the core German subsidiary’s progress. With the ITA acquisition, Lufthansa is also adding two new aircraft types to the fleet, the A321LR and A330-900. Though these aircraft are only modifications of existing Lufthansa Group planes, they add complexity, while the airline group actually wants to simplify its fleet. However, this risk seems manageable, especially considering that these planes could be sold or returned to lessors and replaced with A350s or regular A321neos.

Outcome

Overall Outcome

Following the transaction, ITA Airways has been integrated into the Lufthansa Group as its fifth network carrier, alongside Lufthansa, SWISS, Austrian Airlines, and Brussels Airlines, within a multi-hub, multi-brand model. Integration centres on commercial, network, and loyalty alignment (including Miles & More and Star Alliance) while retaining ITA’s Italian identity and Rome Fiumicino hub.

Early results are positive. ITA expects revenues to exceed €4 billion by 2025E, two years ahead of plan, supported by rising passengers and load factors. Revenue reached €1.2 billion in H1 2024 (+33% YoY) with 8.3 million passengers. ITA reported its first positive EBIT in 2024 (€3 million). In Q1 2025, revenue rose 15% YoY to €600 million, with 3.7 million passengers, an 81% load factor, and top-tier punctuality and regularity.

Lufthansa targets €300 to 400 million of annual synergies by 2027 and expects ITA to add “hundreds of millions of euros” to group profit once fully integrated. Strategically, Lufthansa strengthens its Southern Europe and Italy–North America presence, while Italy secures a stabilised, well-capitalised flag carrier within an investment-grade airline group.

Industry impact

Lufthansa’s 41% acquisition of ITA Airways advances European airline consolidation and shows that major cross-border deals can pass strict EU competition review when paired with targeted slot, route, and partnership remedies. The Commission’s approval: requiring concessions on Italy-Central Europe and Italy–North America routes, including at constrained airports like Milan Linate—signals support for consolidation while managing competition risks.

By placing Italy’s flag carrier within a major airline group rather than relying on repeated state rescues, the deal provides a model for stabilising structurally weak national carriers and strengthens confidence in the European airline system by reducing the risk of a disorderly carrier failure.

Great success / Resounding failure

From Lufthansa’s perspective, the integration of ITA Airways is designed to create value through network and cost synergies: improved Italy–US and intra‑Europe connectivity, joint procurement, coordinated scheduling, and cross‑selling via the group’s loyalty and corporate contracts are expected to drive higher revenue per passenger and better asset utilisation over the medium term. Management guidance and external commentary indicate that Lufthansa expects ITA to start contributing positively from 2025 onward, with the revenue ramp, synergy capture, and discipline on fleet and capacity viewed as key levers for restoring acceptable returns on invested capital. Academic work on crisis‑era and state‑backed restructurings, including Laeven and Valencia’s analysis of distressed mergers, emphasises that long‑term value creation hinges on strong post‑deal governance, adequate capital buffers, and credible integration plans, which aligns with Lufthansa’s structured, phased approach and the Commission’s insistence on robust remedies and monitoring for this transaction.

House View

Viewpoint

While the transaction remains strategically sound, the imposed remedies cap near-term upside and introduce execution risk. Successful integration will depend on Lufthansa’s ability to offset capacity limitations and operational inefficiency through cost synergies, fleet optimization, and disciplined network planning.

Positive Signal

| 2025 | ||||

|---|---|---|---|---|

| Operating / Financial Metrics | Q1 | Q2 | Q3 | |

| Lufthansa Airlines |

Operating Metrics | |||

| Available seat-kilometers (m) | 39,629 | 49,733 | 52,147 | |

| Revenue seat-kilometers (m) | 31,417 | 40,875 | 45,563 | |

| Passenger load-factor (%) | 79.3 | 82.2 | 87.4 | |

| Financing Metrics | ||||

| Total Revenue (€ m) | 3,423 | 4,579 | 4,879 | |

| Operating Expenses (€ m) | -4,151 | -4,539 | -4,554 | |

| EBIT (€ m) | -563 | 240 | 454 | |

| Lufthansa Group |

Net Profit Group (€ m) | -885 | 1,012 | 966 |

Operational Improvement

Lufthansa Airlines exceeded expectations in its Q2 results. Passenger load factor improved, with total revenue growing rapidly. Q3 performance in operating expenses reflects the Group’s continued efforts to enhance the operational efficiency of Lufthansa Airlines.

| ITA | Lufthansa Group | |||

|---|---|---|---|---|

| Type | Manufacturer | Total | Manufacturer | Lufthansa |

| Short- to medium-haul aircraft | Airbus A321neo | 77 | Airbus A220 | 30 |

| A320neo | Airbus A319 | 40 | ||

| Airbus A320 | Airbus A320 | 63 | ||

| Airbus A319 | Airbus A320neo | 35 | ||

| Airbus A220-300 | Airbus A321 | 54 | ||

| Airbus A220-100 | Airbus A321neo | 17 | ||

Capacity Flexibility

ITA’s current fleet comprises 77 short- to medium-haul aircraft, with substantial overlap with Lufthansa Airlines’ existing aircraft types. These narrow body aircraft form the backbone of Lufthansa’s fleet and provide near-term capacity flexibility, particularly as new aircraft deliveries remain constrained by ongoing global supply-chain bottlenecks.

Strategic Motivations

The integration of ITA Airways is expected to generate synergistic benefits for both Air Dolomiti and Lufthansa Airlines. It expands the Group’s Italian and Southern European network, connecting cities such as Verona, Florence, and Venice with Milan Linate and Rome Fiumicino—Europe’s 8th busiest airport by departing seats in 2024—thereby increasing feeder traffic into Lufthansa’s Munich hub. Simultaneously, ITA’s integration and switch to Star Alliance are anticipated to strengthen one-stop connectivity via Germany and onward links with United Airlines, enhancing its competitiveness and market penetration on Italy–US routes.

Emerging Risk

Competition: Italy has experienced a fast post-pandemic capacity recovery, driven primarily by low-cost carriers, notably the ultra-LCCs Ryanair and Wizz Air. The European Union approved the transaction under strict competition conditions. As part of these requirements, ITA was obligated to transfer a substantial portion of its takeoff and landing slots at Rome and Milan to the low-cost carrier easyJet. Additionally, ITA must provide connecting flights on preferential terms for passengers of competing airlines, including IAG and Air France, allowing transfers to those carriers’ hub airports. To enforce these measures, easyJet has launched 27 new routes to multiple European destinations, aimed at limiting Lufthansa Group’s market influence. Meanwhile, Ryanair remains the largest capacity provider in the Italian market, intensifying competitive pressure on Lufthansa and ITA.

Forward Insights

In conclusion, paying a premium for a distressed company may initially seem unreasonable. However, given the strategic importance of the Italian market for Lufthansa’s expansion in Southern Europe, its connectivity to North America, and potential links to the Middle East and Africa, the investment can be justified. However, managing a distressed asset requires strong operational and managerial capabilities, which also represent a significant challenge for Lufthansa, even within its existing core brands. Ultimately, the success of this acquisition will depend on Lufthansa’s ability to enhance operational efficiency while addressing labor and aircraft shortages, supply chain disruptions, and persistently high inflation.

References

BNP Paribas. (2025). BNP Paribas acts as Exclusive Financial Advisor to Lufthansa Group on the acquisition of a 41% stake in ITA Airways. Available at:

https://www.linkedin.com/posts/bnpparibascorporateandinstitutionalbanking_bnpp4clients-mergersandacquisitions-banking-activity-7287442872117727236-9xP6

Burns, H. (2024). Option for Lufthansa to increase its stake in ITA to 90% from 2025. ch-aviation. Available at:

https://www.ch-aviation.com/news/142265-option-for-lufthansa-to-up-stake-in-ita-to-90-from-2025 [Accessed 20 Nov. 2025].

CAPA (2025). Italy aviation: growth driven by ultra-low-cost airlines. CAPA – Centre for Aviation. Available at:

https://centreforaviation.com/analysis/reports/italy-aviation-growth-driven-by-ultra-low-cost-airlines-725648.

Finimize Newsroom (2024). ITA Airways forecasts soaring revenues ahead of schedule. Available at:

https://finimize.com/content/ita-airways-forecasts-soaring-revenues-ahead-of-schedule.

Lufthansa Group. (2023). Lufthansa Group reaches agreement on the acquisition of a 41 per cent stake in ITA Airways. Available at:

https://newsroom.lufthansagroup.com/en/lufthansa-group-reaches-agreement-on-the-acquisition-of-41-per-cent-stake-in-ita-airways/.

Lufthansa Group. (2024). European airlines are on a shopping spree. The Economist. Available at:

https://www.economist.com/business/2024/06/20/european-airlines-are-on-a-shopping-spree.

Lufthansa Group. (2025). Italian Ministry of Economy and Finance (MEF) appoints ITA Airways Board of Directors. Available at:

https://newsroom.lufthansagroup.com/en/italian-ministry-of-economy-and-finance-mef-appoints--ita-airways-board-of-directors/.

Lufthansa Group. (2025). Lufthansa Group finalizes 41 percent stake in ITA Airways. Available at:

https://newsroom.lufthansagroup.com/en/lufthansa-group-finalizes-41-percent-stake-in-ita-airways/.

Palladino, C. (2024). Europe’ s airlines need Lufthansa–ITA to beget more deals. Financial Times. Available at:

https://www.ft.com/content/61edf4cf-1de1-4312-956c-b865e7c3fbfa.

PubAffairs Bruxelles. (2021). State aid: Commission approves €12.835 million Italian aid measure to compensate Alitalia for further damages suffered due to the coronavirus outbreak. Available at:

https://www.pubaffairsbruxelles.eu/eu-institution-news/state-aid-commission-approves-e12-835-million-italian-aid-measure-to-compensate-alitalia-for-further-damages-suffered-due-to-coronavirus-outbreak/.

Reuters (2023). ITA Airways posts 486 mln euro net loss in 2022. Available at:

https://www.reuters.com/business/aerospace-defense/ita-airways-posts-486-mln-euro-net-loss-2022-2023-03-28/.

Reuters (2024). ITA Airways expects revenues to exceed $4 billion in 2025, the chairman says. Yahoo Finance. Available at: https://uk.finance.yahoo.com/news/ita-airways-expects-revenues-exceed-084335879.html.

Rytis Beresnevicius (2023). Italy must recover €400 million plus interest from Alitalia. AeroTime. Available at:

https://www.aerotime.aero/articles/alitalia-state-aid-probe-italy-must-recover-e400m-plus-interest-ec-says.

Rytis Beresnevicius (2023). Ryanair is being investigated for dominance in Italy. AeroTime. Available at:

https://www.aerotime.aero/articles/ryanair-being-investigated-for-its-dominant-position-in-the-italian-market.

Villamizar, H. (2025). CEO interview: ITA Airways’ disciplined strategy. Airways Magazine. Available at:

https://www.airwaysmag.com/new-post/ceo-interview-eberhart-ita-airways#google_vignette [Accessed 10 Jan. 2026].