Ferrero’s $3.1bn Acquisition of WK Kellog

Written by: Giorgio Barbacci Schettino (Chapter President), Theodara Brafa, Kexin Yan, Karthik Sivaswamy & Adith Anish

Deal Overview

Transaction Summary

Deal Structure: All-cash acquisition

Purchase Price: $23.00 per share

Enterprise Value: $3.1 billion

Premium: 40% to 30-day VWAP / 31% to pre-announcement close

Announcement Date: July 10, 2025

Expected Close: H2 2025

Post-Transaction: WK Kellogg will delist from the NYSE and become a wholly owned Ferrero subsidiary

Shareholder & Board Approval:

Unanimous approval by the WK Kellogg Board of Directors

W.K. Kellogg Foundation Trust and Gund Family (21.7% combined) committed to vote in favour

Pending: Shareholder vote, regulatory approvals, customary closing conditions

Deal Advisors:

Ferrero: Lazard (lead financial), BofA Securities (co-advisor), Davis Polk & Wardwell LLP (legal)

WK Kellogg: Goldman Sachs & Morgan Stanley (financial), Kirkland & Ellis LLP (legal)

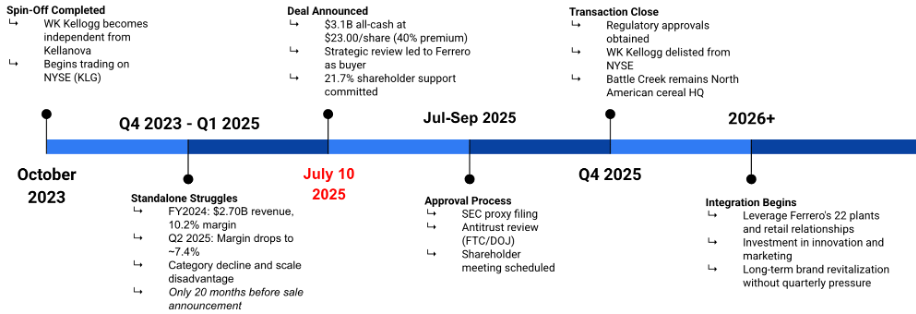

Acquisition Timeline

Source: Original

The transaction timeline illuminates both WK Kellogg's strategic failure and the deal's underlying logic. The company's independence lasted merely 20 months, from the October 2023 spin-off to the July 2025 sale, signalling that the standalone thesis collapsed rapidly. Financial deterioration was decisive: margins compressed from 10.2% (FY2024) to ~7.4% (Q2 2025), likely triggering the board's strategic review. This decline, combined with structural challenges of operating as a $2.7 billion pure-play in a declining category, made continued independence untenable.

The deal demonstrates strong momentum with 21.7% pre-committed shareholder support, unanimous board approval, and expected H2 2025 close. For Ferrero, this $3.1 billion acquisition completes its day-part portfolio and applies its proven brand revitalisation playbook, acquires underinvested heritage brands, removes quarterly pressure, and invests patiently. For WK Kellogg, it provides escape from margin pressure and insufficient scale, offering iconic brands the resources and patient capital they desperately needed but couldn't access as a struggling public company.

Acquirer Overview: Ferrero Group

Founded: 1946, Alba, Italy

Structure: Family-owned private company

Executive Chairman: Giovanni Ferrero

CEO: Lapo Civiletti

Global Employees: 61,000+

FY2024 Revenue: €18.4 billion

Geographic Reach: 35+ brands in 170+ countries

History & Strategic Evolution

Ferrero's journey from a small-town Italian confectioner to a global food powerhouse demonstrates the advantages of family ownership in M&A-driven expansion. Founded in 1946 in Alba, Piedmont, the company's private structure enables genuinely long-term brand investments without quarterly earnings pressures that constrain public competitors, a crucial advantage when acquiring struggling heritage brands (Ferrero Group, 2024).

The company entered the US market in 1969 with Nutella and Ferrero Rocher, but the fundamental transformation began with the 2018 acquisition of Nestlé's US confectionery business for $2.8 billion (Reuters, 2018). This deal brought Butterfinger, Baby Ruth, and CRUNCH into Ferrero's portfolio. It established a consistent M&A playbook: acquire beloved but underinvested American brands, remove quarterly pressure by taking them private, then invest heavily in revitalisation. The WK Kellogg acquisition at $3.1 billion follows this template while representing Ferrero's first significant entry into breakfast cereals, a fundamentally different category from confectionery in terms of consumption occasions and purchase drivers.

Target Overview: Wk Kellogg Co

Founded: 1894 by W.K. Kellogg

CEO: Gary Pilnick (Chairman & CEO)

Market Cap: ~$2.4B (pre-announcement)

LTM Revenue: $2.70 billion (FY2024)

LTM EBITDA: $275 million (FY2024)

EBITDA Margin: ~10.2% (FY2024)

Ticker (NYSE): KLG

Deal Advisor: Goldman Sachs, Morgan Stanley (financial); Kirkland & Ellis (legal)

A Heritage Brand's Failed Independence

WK Kellogg's journey from American breakfast icon to acquisition target in just 20 months reveals the harsh realities of spin-offs in declining categories. Founded in 1894 by Will Keith Kellogg, the company invented breakfast cereal. It maintained cultural relevance for over 120 years through iconic brands like Frosted Flakes (Tony the Tiger) and Froot Loops (Toucan Sam) (WK Kellogg Co, 2024). When the original Kellogg Company split into Kellanova (global snacking and international cereal) and WK Kellogg Co (North American cereal only) in October 2023, the logic seemed sound: pure-play businesses could pursue focused strategies without conglomerate constraints.

The extraordinarily short timeline to sell, just 20 months, tells us this thesis failed. Management likely believed that a focused cereal business could achieve operational excellence and offset category headwinds. Instead, WK Kellogg discovered it was too small to compete, lacking scale advantages in procurement and manufacturing and insufficient resources for meaningful brand investment. The unanimous board approval and immediate commitment from major shareholders (W.K. Kellogg Foundation Trust and Gund Family holding 21.7%) to vote for the transaction signal that everyone recognised the standalone path wasn't working (WK Kellogg Co, 2025).

Structural Pressures & Competitive Disadvantage

WK Kellogg faces a perfect storm of structural challenges in the breakfast cereal market. While maintaining leadership with brands in the majority of North American households, this reflects past success rather than future potential (Euromonitor, 2024). Consumer behaviour has shifted dramatically: younger consumers eat breakfast on the go, health-conscious consumers view traditional cereals as too sugary, and protein-focused alternatives like Greek yoghurt and protein bars have steadily gained market share.

The 2022-2024 inflation crisis compounded these issues. Cereal manufacturers raised prices significantly as input costs surged, but this drove volume declines as price-sensitive consumers traded down or reduced purchases (Nielsen, 2024). Emerging regulatory pressure from the "Make America Healthy Again" initiative targeting synthetic dyes particularly threatens brands like Froot Loops, whose bright colours are integral to their appeal.

Brand Equity vs. Category Reality

Despite operational challenges, WK Kellogg's brand portfolio remains extraordinarily valuable. Frosted Flakes with Tony the Tiger are one of America's most recognisable breakfast brands. "They're Grrreat!" has been a part of the cultural lexicon since 1952 (Brand Finance, 2024). Froot Loops, Rice Krispies, and Special K similarly carry tremendous equity. However, brand equity alone isn't sufficient in a structurally declining category. These brands need significant investment in innovation (protein-enhanced versions, new formats, cleaner ingredients) and sustained marketing to rebuild relevance with younger consumers. As a small public company facing quarterly pressure and margin compression, WK Kellogg simply couldn't make these investments at the required scale. Ferrero's private capital and patient approach may be exactly what these brands need, though success is far from guaranteed, given structural forces working against the category.

Market Overview

The North American breakfast cereal market is experiencing a structural decline amid shifting consumer preferences and competitive dynamics that have fundamentally reshaped the category. Total US cereal sales have declined approximately 15% over the past decade as younger consumers increasingly favor on-the-go breakfast options like protein bars and Greek yogurt over traditional sit-down cereal consumption (Euromonitor, 2024). The category faces a triple squeeze: health-conscious consumers perceive many traditional cereals as overly processed and sugary, inflation-driven price increases during 2022-2024 triggered volume declines as cost-sensitive households traded down to private label or reduced purchases altogether, and emerging regulatory scrutiny around synthetic dyes and artificial ingredients threatens reformulation costs for colorful legacy brands.

Despite these headwinds, the cereal category still represents approximately $10 billion in annual US retail sales, with the top brands commanding significant shelf space and household penetration, creating potential value for well-capitalized acquirers willing to invest in innovation, reformulation, and marketing to reverse long-term trends. This dynamic has made cereal assets increasingly attractive to private buyers like Ferrero, who can pursue multi-year brand revitalization strategies without public market quarterly pressure, as evidenced by Mars's $36 billion acquisition of Kellanova in 2024 and now Ferrero's WK Kellogg purchase.

Motivation

Ferrero’s acquisition of WK Kellogg Co in 2025 was a carefully targeted move to strengthen its position in the global packaged food market. A $3.1 billion public-to-private all-cash take was used to diversify beyond confectionery and secure a scaled platform in North American breakfast cereals.

The deal immediately bolsters Ferrero’s scale in the critical US market and adds a new product category to its portfolio. The deal immediately bolsters Ferrero’s scale in the critical US market, adding a new product category in its portfolio and catapulting it from the 13th-largest to roughly the 10th-largest player in the U.S. centre-aisle packaged food market, as it finally moves beyond its core confectionery and snack products into the breakfast aisle. While cereal has seen lacklustre growth in recent years amid health and wellness trends, it remains a multi-billion-dollar sector valued at around $30 billion (Statista, 2025) in North America.

Reuniting WK Kellogg’s business with the Keebler and other cookie assets, Ferrero previously acquired from Kellogg, unlocks potential synergies. Combined distribution networks, procurement, and manufacturing scale, for example, coordinating cereal and snack deliveries to retailers or optimising production across the acquired plants. Indeed, Ferrero has a playbook of improving margins in acquired brands through supply chain and cost streamlining.

WK Kellogg was likely viewed as an undervalued asset with turnaround potential. On the date of the acquisition, WK Kellogg was trading at roughly 10.57x EBITDA (normalised), a steep discount to the peer group mean of 12.21x (PitchBook, 2025). By acquiring at this multiple, Ferrero can capture significant upside if it succeeds in lifting sales or margins. Adding cereals diversifies Ferrero’s revenue base from a risk perspective. Cereal inputs (grains like corn, wheat) have different supply dynamics than cocoa and sugar; the acquisition offsets some of Ferrero’s exposure to cocoa price volatility and confectionery-specific consumer trends. Ferrero, still family-owned, has been actively reinvesting its ample cash flows into acquisitions to expand globally: this transaction pays tribute to that strategy.

For WK Kellogg Co, the deal offered an attractive exit and growth path. The North American cereal market had been struggling and WK Kellogg faced weakening demand as consumers baulked at higher prices amid inflation and shifted toward healthier or private-label alternatives. As a newly independent company (spun off in late 2023), WK Kellogg lacked scale and was posting declining sales and earnings. Ferrero’s all-cash offer of $23 per share delivered a 31% premium over the pre-announcement trading price. WK Kellogg’s board and major shareholders quickly backed the deal. WK Kellogg’s management believed Ferrero would be a “good home” for the business: a privately held, brand-focused owner with deep resources to invest in the cereal portfolio. CEO Gary Pilnick noted that joining Ferrero gives the company “greater resources and more flexibility to grow our iconic brands” and even explore opportunities beyond cereal.

Deal Navigation

After Kellogg Company’s 2023 decision to split off its U.S. cereal division, WK Kellogg Co quickly became a takeover target. Rumors of Ferrero’s interest surfaced in early 2025, and on July 10, 2025 a definitive agreement was announced to acquire WK Kellogg Co for $3.1 billion in cash. At $23.00 per share, the offer represented roughly a 31% premium to the prior day’s price and around 40% over the 30-day average (WK Kellogg Co, 2025). The bid was unanimously approved by WK Kellogg’s board of directors, following a competitive process in which a consortium led by Cerberus Capital Management and consumer-brands investor Dean Metropoulos both submitted serious rival bids before ultimately losing out to Ferrero. Ferrero had to outmaneuver at least one rival, a consortium of private equity firm Cerberus Capital Management and investor Dean Metropoulos, which put forward a serious competing bid for WK Kellogg.

Regulatory & Shareholder Approvals: Given Ferrero had no existing cereal operations, antitrust hurdles were minimal. Analysts anticipated no significant overlap concerns, as WK Kellogg derived 90% of sales from cereals while Ferrero had 0% in that category. Thus, regulators raised little objection, and the focus was on securing shareholder consent. Major stakeholders, including the W.K. Kellogg Foundation Trust and the Gund family (together holding around 21.7% of WK Kellogg shares), agreed early to support the deal. Their commitment, alongside the board’s recommendation, paved the way for a smooth shareholder vote. By mid-September 2025, WK Kellogg’s shareholders had overwhelmingly approved the acquisition. In just under three months from announcement, all closing conditions were met, and Ferrero officially completed the acquisition on September 26, 2025. The speed of closing reflected the straightforward nature of the deal, a testament to clear strategic alignment and the absence of protracted regulatory or financing delays.

Financing Structure: As aforementioned, the $3.1 billion purchase was financed entirely in cash, consistent with its prior U.S. acquisitions. As a privately held and highly profitable company, Ferrero was able to leverage internal resources and debt capacity to fund the deal, rather than resorting to equity. This approach made the offer particularly attractive to WK Kellogg’s shareholders. Ferrero engaged Lazard and Bank of America as financial advisors. For WK Kellogg’s part, advisors Goldman Sachs and Morgan Stanley helped evaluate offers, but no financing on the target side was needed. Generally, Kellogg Company’s breakup strategy facilitated such transactions, Mars Inc. had agreed to buy Kellogg’s other spin-off (the snacks business, Kellanova) in late 2024 for $36 billion. Ferrero’s purchase of WK Kellogg Co represented the second half of that portfolio transformation, with two family-owned confectionery giants (Mars and Ferrero) acquiring the separated businesses.

Integration

Ferrero has signalled that it values WK Kellogg’s expertise and intends to maintain operational continuity. Upon closing, WK Kellogg Co became a wholly owned subsidiary of Ferrero, with its headquarters in Battle Creek, Michigan remaining the core base for the cereal business. Ferrero has retained key WK Kellogg leadership and staff to run day-to-day operations, reflecting a “steady hand” approach aimed at avoiding disruption to customers, suppliers, and manufacturing teams. Gary Pilnick, WK Kellogg’s CEO, welcomed the acquisition and the “shared winning culture,” indicating alignment in values. This leadership alignment mirrors Ferrero’s past integrations.

Rather than a slash-and-burn approach, Ferrero’s integration philosophy can be characterised as “invest and grow.” The group plans to deploy capital to reinvigorate WK Kellogg’s portfolio through increased marketing, product innovation, and selective capacity upgrades, consistent with its strategy of acquiring and developing established food brands. Ferrero and WK Kellogg both pride themselves on heritage brands and quality products, easing the integration of teams. Ferrero’s CEO and Executive Chairman have been explicit that they “admire WK Kellogg’s legacy” and intend to be faithful stewards of that heritage.

Now that Ferrero owns both Kellogg’s former cookie business (Keebler, Famous Amos, etc.) and the cereal business, there are opportunities to recombine elements that were separated. Analysts noted that “Keebler and Kellogg cereal operated on a combined business in the past” and anticipate efficiency gains by consolidating logistics and support functions again. For example, Ferrero could integrate WK Kellogg’s distribution network with Ferrero’s existing U.S. warehousing to optimise routes, or use Ferrero’s procurement leverage in ingredients (grains, sugar, packaging materials) to negotiate better terms for the cereal unit. Early commentary suggests Ferrero will streamline its supply chain operations by leveraging WK Kellogg’s well-established manufacturing plants, alongside Ferrero’s 22 North American plants, to improve capacity utilisation and reduce costs.

Ferrero’s track record in prior U.S. acquisitions supports the credibility of this approach, with past integrations delivering sourcing efficiencies and margin improvement. In addition, portfolio breadth creates opportunities for cross-promotion and bundled offerings across Ferrero’s expanded U.S. presence, providing incremental revenue upside. Similar integration initiatives are likely underway for cereals, creating opportunities for cross-promotion and bundling, such as potential joint advertising of Nutella and Eggo waffles (formerly Kellogg’s) or bundled sales of cookies and cereals to drive incremental sales. These are softer synergies but reflect how Ferrero can leverage its expanded product suite in the market.

A centrepiece of Ferrero’s integration approach is rejuvenating the acquired brands through product improvements and marketing, essentially breathing new life into “tired” brands. After acquiring the Keebler and Famous Amos cookie lines in 2019, Ferrero immediately updated recipes, packaging, and marketing. Within a year, Keebler rolled out new formulations and refreshed packaging designs, changes that, coupled with increased advertising (especially on digital platforms), drove a 55% surge in Keebler cookie sales by mid-2020. This leads us to believe that Ferrero will invest in product development to address evolving consumer tastes, with marketing playing a focal point: WK Kellogg’s brands like Special K and Raisin Bran have high household recognition but need renewed engagement with younger consumers. Ferrero is expected to ramp up marketing spend, potentially leveraging modern channels (social media, influencers, experiential campaigns) where WK Kellogg’s presence was minimal. The objective is to recapture consumer excitement and loyalty. Overall, the integration strategy places heavy weight on revitalising the top-line growth of these storied cereal brands, not just cutting costs.

Despite a promising start, Ferrero faces a challenging road in integrating a business that has struggled for growth, particularly in the previous quarters since their separation from Kellanova. The cold cereal category remains highly competitive and is pressured by shifts toward protein-rich and convenience-oriented breakfasts, as well as weight-management drugs that may reduce demand for sugary foods. Integrating a large, capital-intensive cereal manufacturing operation into Ferrero’s organisation will also test management capacity, given its differences from confectionery production. To date, Ferrero has taken a prudent approach, keeping facilities running and expressing confidence in existing teams, with no major integration issues reported so far. The financial impact will become clearer over the coming reporting quarters, with improvement from WK Kellogg’s relatively low 6.98x EBITDA margin serving as a key measure of integration success. Overall, the integration remains in its early stages, but Ferrero has articulated a strategy focused on stability, revenue and cost synergies, and most importantly, brand rejuvenation that support their plans for long-term value creation.

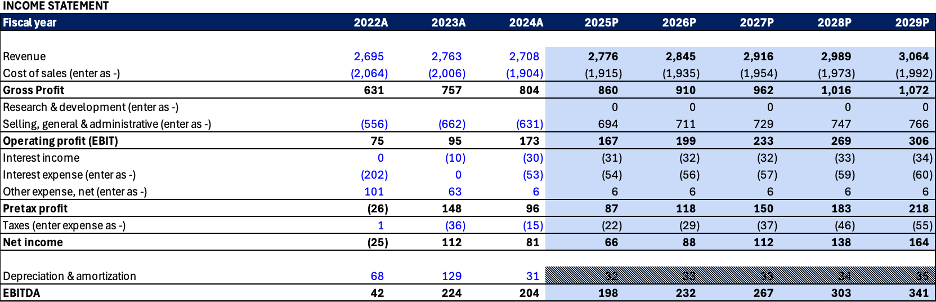

Financials

Statement Analysis

The financial statement for WK Kelloggs has been constructed using its historical financials, with 2.5% constant revenue growth from 2024, predicted over 5 years, a 31% profit margin in 2025, expected to grow by 1% each year in line with previous years, constant SG&A as a percentage of sales at 25%, higher next year due to foreseeable increases in trade barriers and tariffs, which are expected to increase general and administrative costs, and an average tax rate of 25%. We see that WK Kellogg's reports consistently positive net income, which is expected to double over the next 5 years. On the income side, WK Kellogg's shows strong profitability and sustained growth potential.

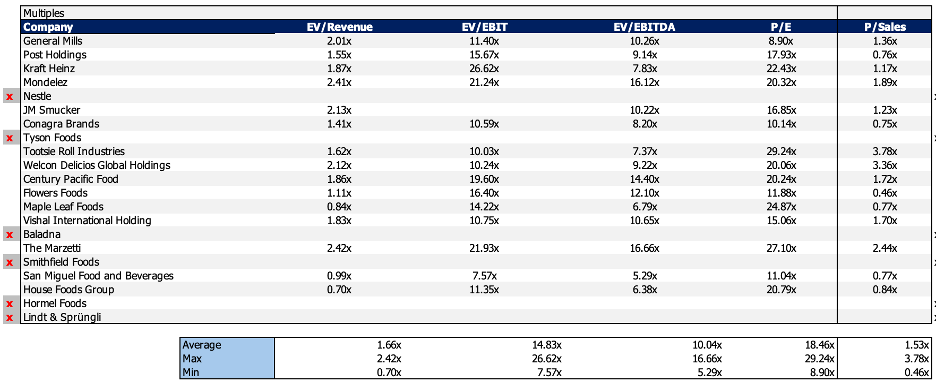

Multiples

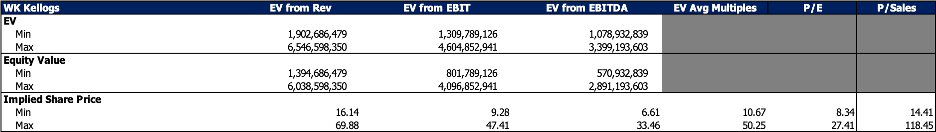

For our multiple analysis, we have selected 21 competitors in the packaged food sector. However, some of these, such as Nestle, Tyson Foods, Baladna, Smithfield Foods, Hormel Foods and Lindt & Sprungll, have been excluded because their multiples were clear outliers and would have unnecessarily inflated our multiples analysis. From our remaining 15, we see an EV/Revenue range from 0.70x to 2.42x, an EV/EBIT range from 7.57x to 26.62x, an EV/EBITDA range from 5.29x to 16.66x, and a P/E range from 8.90x to 29.24x.

These multiples indicate that the food and consumer staples sector is priced as a defensive, mature industry with stable cash flows and limited growth expectations. Average valuations of around 1.7x EV/Revenue, 10x EV/EBITDA, and 18x P/E suggest investors are willing to pay a premium for earnings stability, strong brands, and pricing power, rather than for high growth. Firms trading at higher multiples are perceived as having stronger competitive moats and more predictable margins, while lower multiples generally reflect commodity exposure, thinner margins, or structural growth constraints, rather than clear undervaluation.

Translate these into Implied share prices, by finding Implied Max-Min ranges for our Enterprise Value, subtracting our Net Debt to get to Equity Value and finally dividing by our share price number to reach implied share prices for each multiple method, and an average for our EV valuation based multiples (EV/Revenue, EV/EBIT, EV/EBITDA). This multiple approach yields a wide range of possible share values, which is why we should turn our attention to a discounted cash flow valuation to assess whether, through intrinsic valuation methods, we are able to narrow down our implied share price valuation.

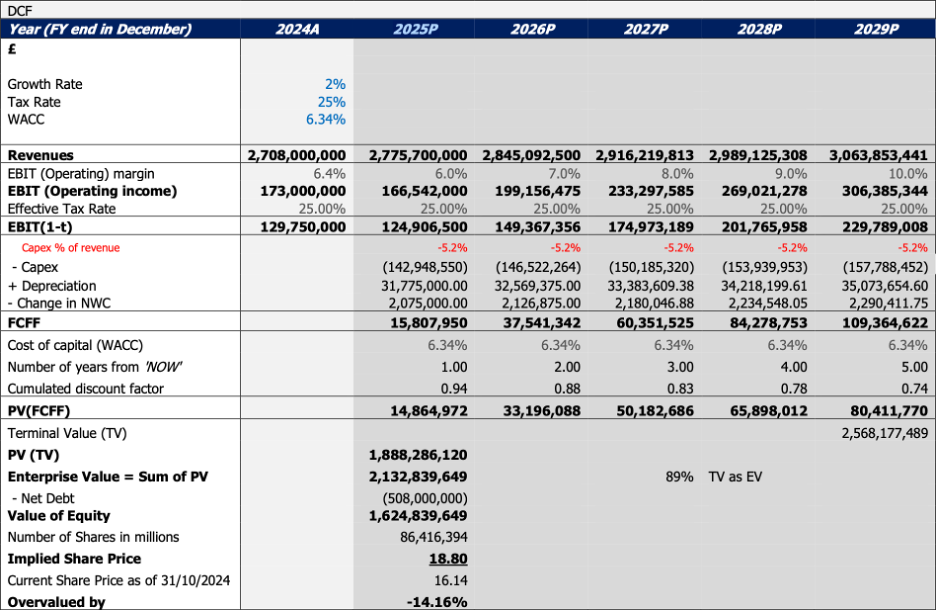

DCF

To complement our relative valuation, we apply a discounted cash flow (DCF) model to estimate WK Kellogg’s intrinsic value based on its ability to generate stable, long-term free cash flows.

Our revenue forecasts assume a constant growth rate of 2 percent per annum from 2025 onward, broadly in line with long-term food industry growth and WK Kellogg’s historical performance. Operating profitability is expected to improve gradually, with EBIT margins increasing from approximately 6 percent in 2025 to 10 percent by 2029, reflecting operating leverage, pricing discipline, and efficiency gains as inflationary pressures ease. These assumptions are conservative and consistent with management’s focus on margin stability rather than aggressive volume expansion.

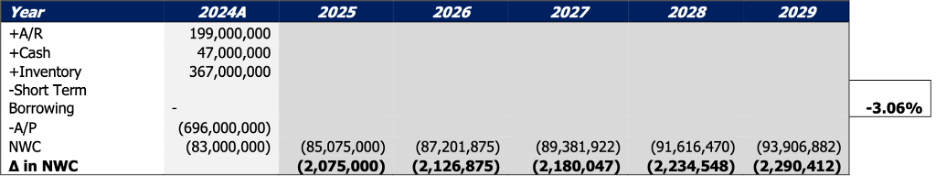

Free cash flows to the firm are derived from after-tax operating income, adjusted for capital expenditures, depreciation, and changes in net working capital. Capital expenditures are assumed at 5.2 percent of revenues, broadly in line with historical reinvestment needs, resulting in steadily improving free cash flow generation over the forecast period.

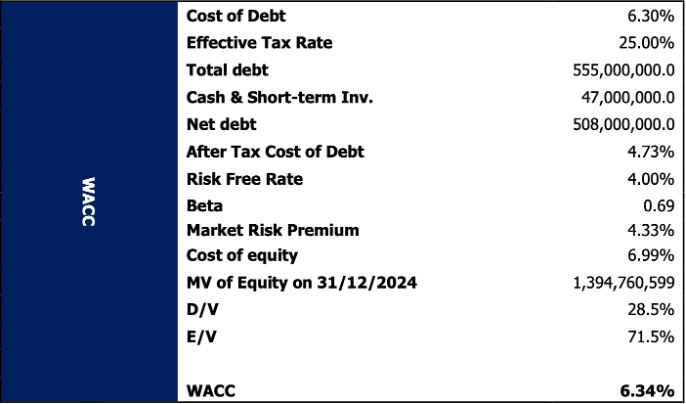

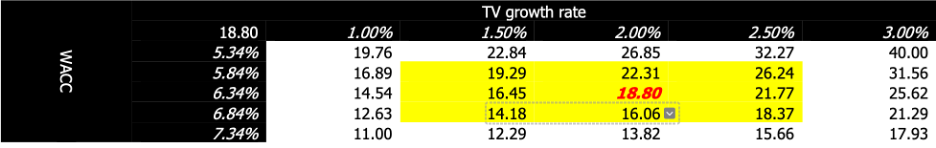

The model applies a weighted average cost of capital (WACC) of 6.34 percent. The cost of equity is derived using a 4 percent US 10-year Treasury rate as the risk-free rate, a beta of 0.69, and a market risk premium of 4.33 percent, resulting in a cost of equity of approximately 7.0 percent. The cost of debt is based on a Fitch BBB credit profile, which is appropriate given WK Kellogg’s leverage, scale, and stable cash flows, producing a pre-tax cost of debt of 6.3 percent and an after-tax cost of 4.7 percent. The resulting WACC reflects the company’s relatively low risk profile within the consumer staples sector.

A terminal growth rate of 2 percent is applied, consistent with long-term inflation and GDP growth expectations for a mature packaged food business. The terminal value accounts for a significant portion of total enterprise value, which is typical for stable, low-growth companies and highlights the importance of disciplined long-term assumptions.

Under these assumptions, the DCF yields an enterprise value of approximately $1.9 billion and an implied equity value of $1.4 billion, corresponding to an intrinsic share price of $18.80. Compared to the pre-announcement share price of $16.14, the stock appears broadly fairly valued, with minimal implied overvaluation. This suggests that, on a standalone basis, WK Kellogg was trading close to intrinsic value prior to the acquisition announcement.

Sensitivity analysis around the WACC and terminal growth rate shows that valuation outcomes are most sensitive to changes in long-term assumptions, particularly the discount rate. Reasonable variations in WACC and terminal growth produce a valuation range that remains broadly centred around the mid-teens to low-twenties per share, reinforcing the robustness of the base-case valuation.

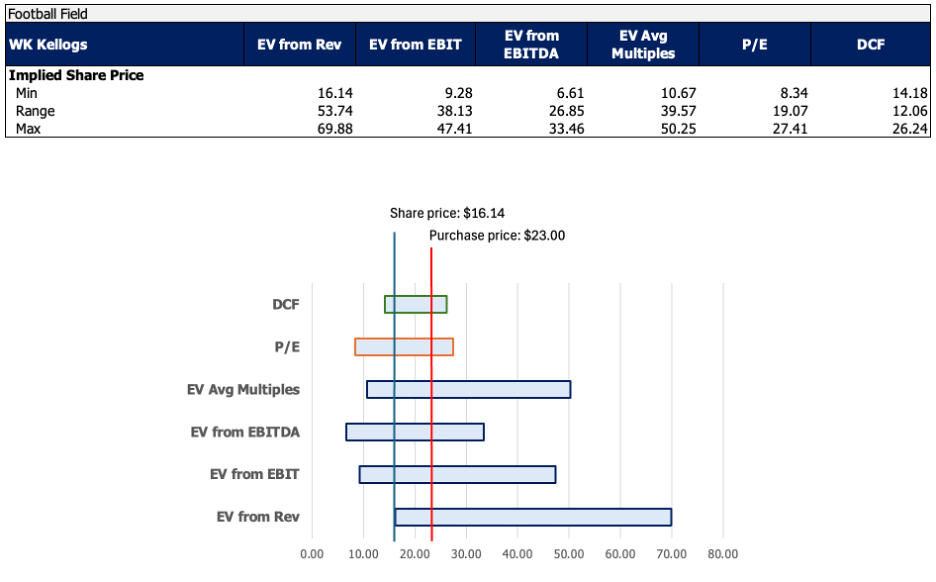

Football Field

To reconcile our intrinsic and relative valuation approaches, we summarise the implied share price ranges from the DCF and multiple analyses using a football-field valuation. Multiples-based methods produce a wide dispersion of outcomes, particularly under EV/Revenue, while EV/EBITDA and P/E yield more concentrated ranges. In contrast, the DCF valuation produces a narrower range centred in the mid-teens, reflecting its focus on long-term cash flow fundamentals.

The pre-announcement share price of $16.14 sits comfortably within both the DCF range and the lower end of the multiples-derived valuations. Ferrero’s all-cash offer of $23.00 per share lies meaningfully above the DCF-implied intrinsic value and towards the upper end of the valuation ranges, reflecting a clear control premium and the strategic value of WK Kellogg’s brand portfolio within the consumer staples sector.

ESG

Environmental

WK Kellogg has made strong progress on packaging sustainability, with 98% of U.S. packaging recyclable or recycle-ready, material reductions in paperboard and plastic, and pilot achievements such as net zero waste to landfill at one facility. Key challenges remain in reducing absolute emissions, managing water-intensive crops like wheat, corn, and rice, and scaling regenerative agriculture and traceability across complex global supply chains.

Social

The company delivers nutrition at scale, with around 58% of portfolio sales meeting its Nourishing Food Criteria, over 5.2 billion servings of fiber provided, and extensive food access programs through WIC, school meals, and donations exceeding 42 million servings. Social risks persist around ongoing public health scrutiny of sugary cereals, the need to further reformulate legacy brands, and balancing affordability with rising input and reformulation costs.

Governance

Governance is underpinned by formal nutrition thresholds, SQF-certified food safety systems, supplier codes of conduct, and responsible sourcing policies aligned with SASB, GRI, and TCFD frameworks. However, as a relatively new standalone company, WK Kellogg faces execution risk in translating policies into consistent supplier-level compliance and in setting measurable long-term climate and environmental targets.

SWOT

Strengths

Portfolio of Iconic and Trusted Brands: The acquisition gives Ferrero ownership of established breakfast cereal brands with strong household penetration and recognition across North America.

Strategic Diversification into a High Value Food Category: The global breakfast market is expected to grow in value over the next decade, driven by urban lifestyles, convenience, and premium fortified products. This diversification lessens Ferrero’s dependence on confectionery, spreading risk across various consumption occasions and enhancing resilience to demand shocks.

Alignment with Convenience and Nutritional Demand: Breakfast cereals are a quick, micronutrient-rich food option, contributing vitamins and minerals, especially for busy households. When responsibly formulated, they fit modern diets and support Ferrero’s focus on everyday eating, not just treats.

Operational and Distribution Scale: Ferrero’s North American operations offer a platform to boost WK Kellogg's efficiency by consolidating procurement, distribution, and commercial relationships. This reduces costs while maintaining product availability and service, increasing financial flexibility for product development and branding.

Weaknesses

Structural Maturity of the Cereal Category: Ready to eat cereals see stagnant or declining sales in mature markets like the U.S., despite rising market value. Changing breakfast habits and competition from alternatives limit volume growth, increasing reliance on pricing, brands, and innovation to maintain revenue.

Nutritional Sensitivity of Core Products: Public health research shows declining grain-based food consumption and increased scrutiny of added sugars in processed products, especially those marketed to children. Several WK Kellogg brands face criticism for sugar content and perceived nutritional quality. Without reformulation and transparency, these issues threaten reputation and invite regulation.

Environmental Impact of Packaging: Cereal packaging typically relies on large cardboard boxes with plastic liners, which increase material use and waste generation and significantly contribute to the environmental footprint of cereal products.

Governance and Integration Complexity: Integrating WK Kellogg into Ferrero’s operating structure requires alignment across supplier standards, nutrition policies, and reporting practices, which can increase administrative complexity and oversight demands.

Opportunities

Revenue Growth through Nutrition-Led Product Development: Market forecasts project global breakfast cereal revenues to grow at over six per cent annually, reaching approximately USD 139 billion by 2033. Growth is rising mainly in fortified, functional, and premium segments. Ferrero's shift to lower-sugar, higher-fibre, and whole-grain products helps capture this value and meet changing dietary preferences.

Packaging Redesign and Environmental Efficiency: Packaging improvements offer measurable scope to reduce environmental impact through recyclable materials, reduced material intensity, and improved life cycle performance.

Expansion into Health-Oriented Cereal Segments: Consumer demand is shifting toward cereals with added protein, natural ingredients, and functional health attributes, creating opportunities to reposition existing brands and develop higher-margin offerings aligned with evolving preferences.

Brand Differentiation through Trust and Transparency: Brands that demonstrate ingredient and formulation clarity can strengthen loyalty and remain relevant in a competitive food market. WK Kellogg’s brand recognition provides a strong base for such differentiation if supported by credible product changes.

Threats

Long-term changes in Breakfast Consumption: Breakfast habits continue to evolve toward portable, fresh, and customizable options such as smoothies, bars, and ready-to-drink products. This shift represents a structural challenge to traditional cereal consumption that marketing alone cannot reverse.

Regulatory and Public Health Pressure: Scrutiny of sugar levels and processing intensity in cereals has increased, particularly for products marketed to children. Regulatory measures such as labelling requirements or marketing restrictions could affect demand and increase compliance costs.

Rising Expectations from Investors and Regulators: Food manufacturers face growing pressure to demonstrate progress on nutrition, environmental impact, and supply chain practices. Firms that lag behind peers’ risk reputational damage and reduced appeal to institutional investors.

Supply Chain Sustainability Constraints: Reducing emissions and resource use across agricultural supply chains requires ongoing investment and coordination with suppliers. Poor execution could raise costs or disrupt input availability, affecting both margins and operational reliability.

House View

Ferrero's all-cash purchase of WK Kellogg for $23.00 per share, with an enterprise value of $3.1 billion, was a clean take-private of well-known but struggling cereal brands. The price was a significant premium that reflects deal certainty and brand equity rather than strong near-term fundamentals. The deal received strong support from the board and early anchor shareholders, which helped it move quickly through the approval process. Shareholders voted in favour on September 19, 2025, and the deal closed on September 26, 2025. After that, WK Kellogg was delisted and became a wholly owned subsidiary of Ferrero.

Ferrero's expansion into North America and its acquisition of WK Kellogg make sense, given its focus on execution, procurement, logistics, SKU and plant efficiency, and marketing, supported by private ownership that keeps antitrust risk low.

Ferrero’s valuation of WK Kellogg considers both relative and intrinsic factors. WK Kellogg showed low single-digit revenue growth, steady net income, and limited margin expansion, typical of a mature consumer staples firm. Comparable companies analysis revealed a defensive sector valued more for earnings stability and brand strength than growth, with a wide range of implied prices. A conservative DCF valuation suggested an intrinsic value in the $18+ per share, indicating the stock was lightly undervalued before the deal, and further highlighted that the $23.00 offer does include a control premium, that reflects strategic value and deal certainty.

Potential growth lies in stabilising volumes, modernising offerings, and improving margins by cutting trade spending and leveraging fixed costs. Risks include category headwinds, operational complexity, and scrutiny of legacy SKUs. Early signs to watch are service levels, promotion intensity, gross margins, and innovation rather than price alone.