Nintendo's Acquisition of CRI Middleware

Written by: Vishisht Bais (Chapter President Technicals), Russel Choy (co-Chapter President Report), Ethan Khoo, Eric Mai, Jessica Williams, Xuan Jia Liu, Rupert Greenwood, Kriszta Jozsa

This report was written as part of M&A Watch’s partnership with the Cambridge Student Investment Fund

Deal Overview

Proposed Transaction Value: ¥9,565 million

Premium: 25.6%

Consideration: 100% cash

Ownership: 100% acquisition

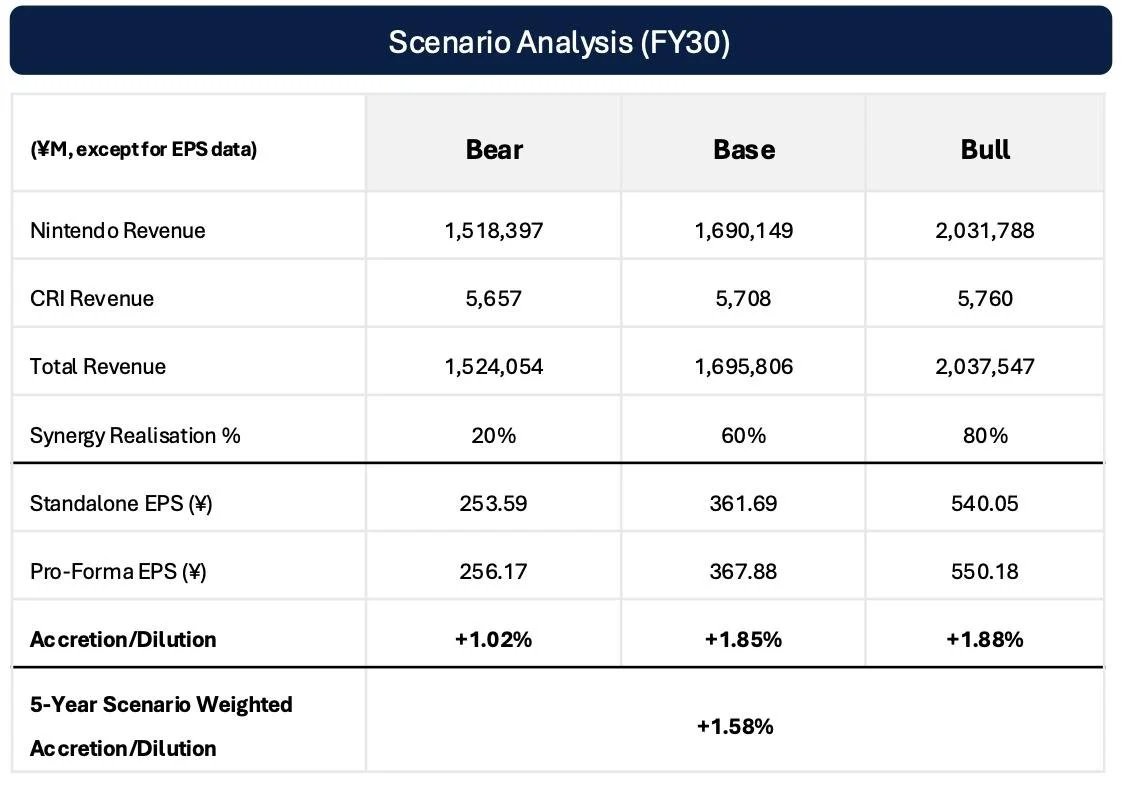

EPS Impact (Base Case): +1.85%

Nintendo Co., Ltd. is evaluating the 100% acquisition of CRI Middleware Co., Ltd. for a proposed value of ¥9,565 million in an all-cash transaction. Although financially small relative to Nintendo’s ¥17.46 trillion market capitalisation, the deal carries disproportionately high strategic importance. The timing aligns with the development and pre-launch window of Nintendo’s next major hardware cycle—popularly referred to as “Switch 2”—which is expected to increase demands on audiovisual quality, file sizes and runtime performance.

The wider gaming industry is undergoing rapid consolidation, especially across middleware and toolchain providers. Sony acquired Audiokinetic (Wwise), Epic Games owns RAD Game Tools, and Savvy Gaming Group has signalled a US$38 billion budget for global gaming acquisitions. In such an environment, independent middleware companies have become scarce, making CRI one of the last significant standalone players in the sector. Nintendo’s extensive existing reliance on CRI technologies—already integrated into more than 800 of its titles—elevates the strategic relevance of securing CRI before a competitor does.

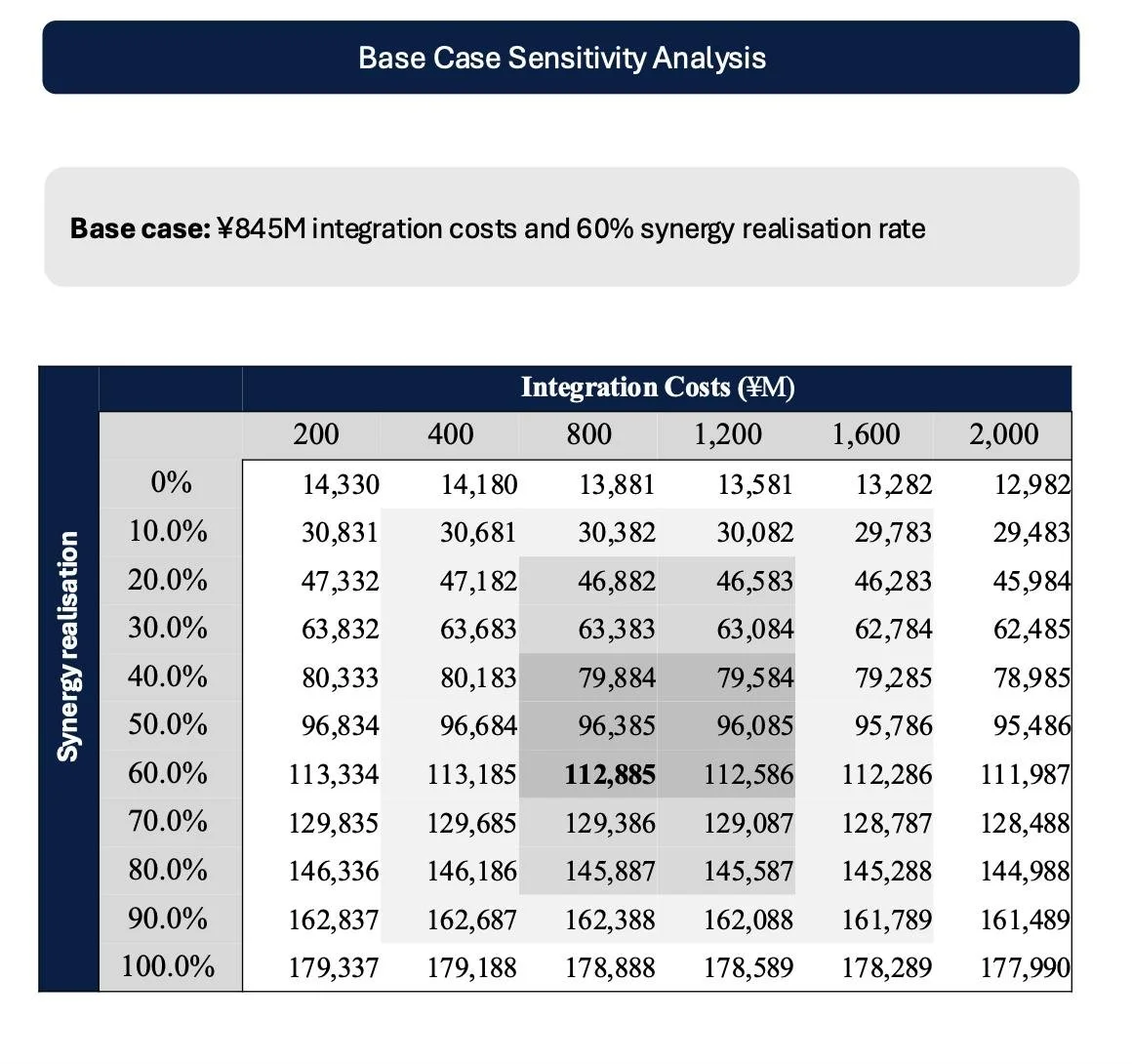

The proposed acquisition would eliminate Nintendo’s recurring licensing expense of between ¥5 million and ¥30 million annually, simplify its technology stack and enable tighter integration of compression, audio and video pipelines into future hardware. Early modelling indicates the transaction would be accretive to earnings by roughly 1.85% in the base case, and regulatory risk appears limited given CRI’s modest market share.

The acquisition of CRI is in-line with Nintendo’s recent acquisition activity, which demonstrates a deliberate strategic shift toward strengthening its internal development pipeline, enhancingplatform capabilities, and securing long-term technical partners. Its most recent transactions are: SRD Co. (2022), a 40-year embedded software engineering partner; Dynamo Pictures (2022), a CG animation studio now rebranded as Nintendo Pictures; and Shiver Entertainment (2024), a specialist in high-quality game porting and cross-platform optimization. These collectively highlight Nintendo’s intention to deepen control over core development functions and expand its capacity to support modern, multi-platform content demands.

Each of these acquisitions shares common characteristics: the targets were (1) long-standing collaborators, (2) possessed highly specialised technical expertise, and (3) filled structurally important roles within Nintendo’s broader development ecosystem. As reflected in Nintendo’s FY2025 Annual Report, these deals were pursued to “secure high-level resources for porting and developing software titles” and to reinforce the company’s ability to deliver consistent quality across evolving hardware generations.

This pattern suggests a strategic orientation toward vertically integrated development capabilities, enabling Nintendo to reduce dependence on external vendors, streamline production workflows, and maintain creative autonomy. Within this context, acquiring CRI Middleware represents a natural continuation of Nintendo’s established M&A philosophy: targeting mission-critical technical partners whose integration would support long-term platform competitiveness and development efficiency.

Together, these elements present a compelling combination of low financial cost, strategic alignment and manageable execution risk.

Acquirer Overview: Nintendo

Market Capitalisation: ¥17.46 trillion

LTM Revenue: ¥1.164 trillion

LTM EBITDA: ¥282,533 million

P/E Ratio: 42.22

Console Market Share: ~27%

Nintendo is one of the most influential companies in the global gaming industry, distinguished by a unique blend of hardware–software integration and a world-class IP portfolio. Founded in 1889 and headquartered in Kyoto, Nintendo has built an ecosystem centered around first-party content, tightly optimised hardware and distinctive gameplay experiences rather than raw processing competition.

The company’s financial foundation is extremely strong. With a market capitalisation of ¥17.46 trillion, revenue of ¥1.164 trillion and EBITDA of ¥282,533 million, Nintendo enjoys a robust balance sheet and a high-margin software business. Its P/E ratio of 42.22 reflects sustained investor confidence, largely driven by the successful performance of the Switch platform and enduring IPs such as Pokémon, Mario, Animal Crossing, Zelda and Splatoon. Nintendo’s global console market share of roughly 27% cements its position as one of the dominant players in the industry.

However, Nintendo’s hardware strategy, focusing on accessibility and long lifecycle products creates technical constraints when handling the increasingly large and complex audiovisual assets associated with modern AAA titles. Third-party developers often note that porting high-fidelity games to Nintendo platforms involves significant optimisation effort, much of it centred around compression, memory management and audiovisual playback limitations. Middleware plays a critical role in solving these constraints.

Given that more than 800 Nintendo titles already rely on CRI’s codecs, compression tools and playback systems, the acquisition strengthens Nintendo’s internal toolchain and expands its capacity to support more technically demanding titles on future hardware. Integrating CRI into Nintendo’s technology stack would allow for more efficient pipelines, faster iteration cycles and improved performance consistency for both first-party and third-party studios.

Target Overview: CRI Middleware

Market Capitalisation: ¥5.64 billion

FY25 Revenue: ¥3.45 billion

EBITDA: ¥682 million

Net Profit: ¥420 million

P/E Ratio: 13.32

Revenue Split: Gaming 53%, Enterprise 47%

- 8,753+ game titles using CRIWARE

- 20+ supported platforms

- 9.62 million+ automotive units using CRI tech

CRI Middleware, founded in 2001 in Tokyo, is a leading Japanese provider of audiovisual and compression technologies for game development and embedded systems. Its flagship suite, CRIWARE, includes CRI ADX (audio), CRI Sofdec (video) and FileMagic (compression and file-handling). These technologies have become deeply embedded in Japanese development culture thanks to their stability, low memory footprint and excellent runtime performance. CRI’s technology powers more than 8,753 game titles across over 20 platforms, demonstrating exceptional adoption and trust among developers. The company also maintains a fast-growing enterprise division serving the automotive sector, with CRI’s tools implemented in more than 9.62 million vehicles worldwide.

Financially, CRI is stable and well-positioned. It recorded FY25 revenue of ¥3.45 billion, EBITDA of ¥682 million and net profit of ¥420 million, with a market capitalisation of ¥5.64 billion. Its P/E ratio of 13.32 indicates a modest valuation relative to its technology footprint. While CRI’s scale is small compared to larger global middleware competitors, it benefits from high switching costs, strong customer relationships and extensive integration into existing development pipelines.

These strengths make CRI attractive not only for Nintendo but also for other major industry players—reinforcing the defensive rationale behind the acquisition. Yet its limited global scale, concentration in Japan and vulnerability to acquisition also explain why Nintendo’s interest is well-timed.

Motivation

Annual Licensing Cost Savings: ¥5–30 million

Number of Nintendo Titles Already Using CRIWARE: 800+

Competitor Consolidation: Sony (Audiokinetic), Epic (RAD Tools), Savvy Gaming ($38bn budget)

Nintendo’s motivation for acquiring CRI is multi-layered, combining strategic, operational and defensive considerations.

First, the acquisition would enable deeper technological integration. Nintendo’s hardware approach relies on optimising performance under constraints, and CRI’s codecs, compression engines and playback systems directly address key bottlenecks such as load times, file sizes and memory usage. With asset complexity rising sharply, especially for titles that blend high-quality cinematics with complex gameplay, CRI’s tools are becoming increasingly essential to delivering competitive user experiences.

Second, the acquisition enhances Nintendo’s platform competitiveness. Third-party developers frequently highlight that optimising games for Nintendo hardware involves substantial effort due to compression and performance challenges. Incorporating CRIWARE natively into the Switch 2 SDK would streamline development workflows, lower porting costs and make Nintendo’s platform more attractive to external studios.

Third, the deal provides financial benefits. Nintendo currently incurs ¥5–30 million annually in CRI licensing fees, which would be eliminated. Additionally, consolidation of overlapping R&D and SG&A functions could be completed within approximately 12 months, creating direct cost efficiencies.

Fourth, the acquisition supports developer enablement. CRI’s technologies, already used widely within Nintendo’s ecosystem, provide developers with stable, feature-rich pipelines that accelerate iteration and improve production efficiency.

Finally, the acquisition is a defensive move. With competitors aggressively acquiring middleware providers, Nintendo risks losing access to vital technologies if CRI were acquired by a rival. In such a scenario, cross-platform neutrality could erode, pricing could increase or certain tools could become exclusives. Securing CRI prevents such strategic exposure.

Deal Navigation

Primary Regulator: Japan Fair Trade Commission (JFTC)

Expected Integration Period for Synergies: 12 months

Regulatory approval would fall under the Japan Fair Trade Commission. While middleware is strategically significant, the fragmented nature of this market and CRI’s modest market share reduce the risk of major antitrust concerns. The most likely regulatory requirement would relate to maintaining CRIWARE’s availability across platforms, especially for independent developers who rely on its tools. Such a neutrality clause may slow synergy capture but would not impair the core rationale for acquisition.

Nintendo plans to fund the acquisition entirely with cash, reflecting its preference for maintaining a debt-free balance sheet. With its strong liquidity position, this approach involves no dilution, no refinancing risk and minimal impact on financial ratios. Shareholders benefit from a transaction that is immediately accretive in earnings terms and strategically transformative from a technical standpoint.

Integration

- 800+ existing Nintendo titles using CRIWARE

- R&D + SG&A consolidation expected within 12 months

Successful integration hinges on retaining CRI’s core engineering talent, as the company’s value is deeply tied to its technical expertise. CRI’s engineers possess specialised knowledge in codec design, compression algorithms and real-time playback systems—areas where expertise develops through long-term refinement. Ensuring continuity in these teams will be crucial.

Although Nintendo’s corporate culture is more structured and conservative than CRI’s engineering-driven approach, the company has historically succeeded in maintaining autonomy for acquired studios. A similar model—independent operation with shared strategic oversight—would preserve CRI’s strengths while aligning its roadmap with Nintendo’s long-term objectives.

Technically, integrating CRIWARE into the Switch 2 SDK would deliver immediate benefits. Given that over 800 Nintendo titles already use CRI technologies, the compatibility foundation is strong. Standardising build pipelines, testing frameworks and version control around CRIWARE would reduce friction across development teams and shorten production cycles.

Synergies related to R&D and SG&A consolidation are expected within roughly 12 months, generating tangible cost efficiencies without disrupting development timelines.

Performance and Valuation

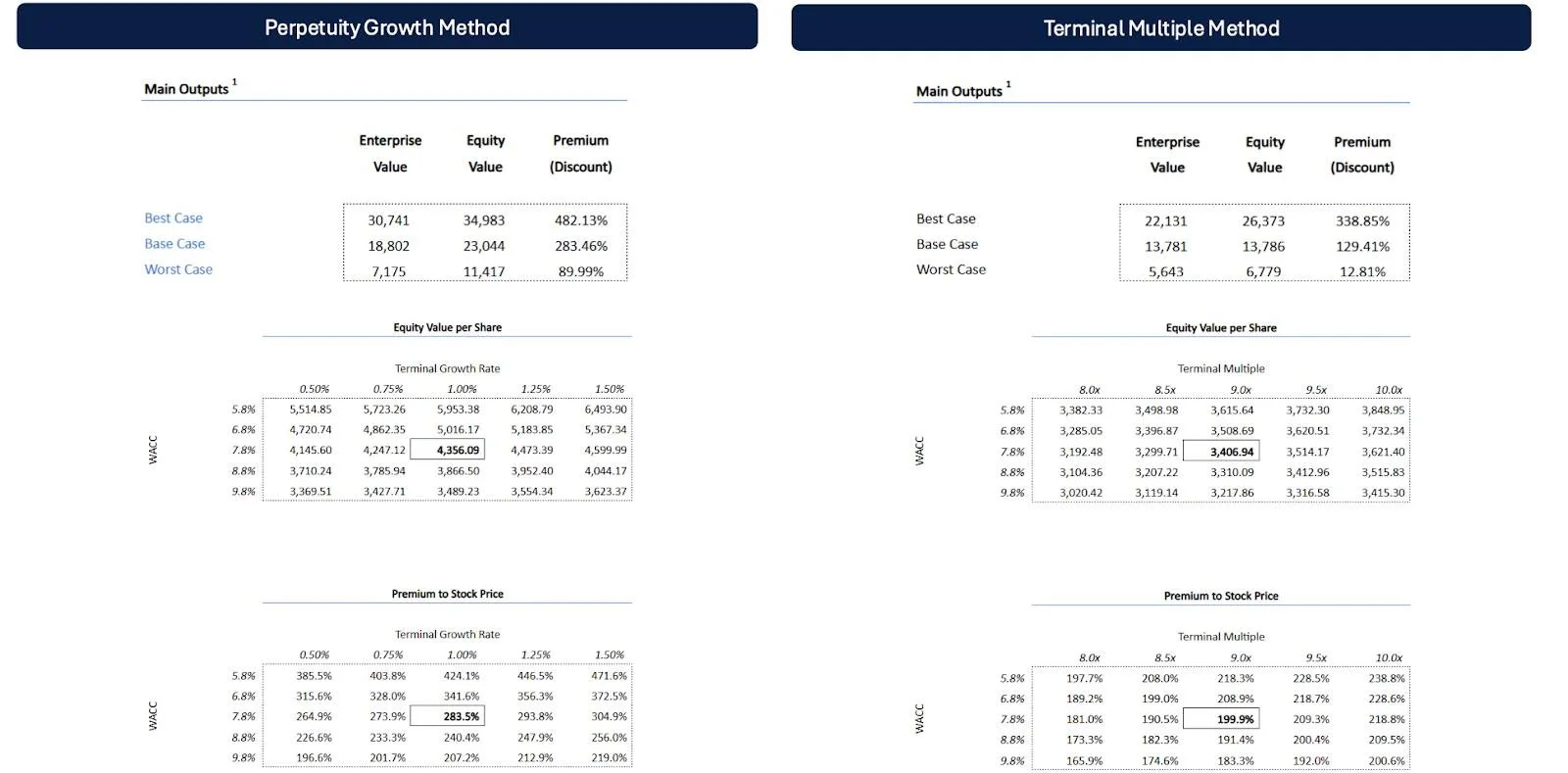

DCF Valuation Range: ¥2,158 (bear) – ¥6,613 (bull)

DCF Base Case: ¥4,356

Weighted Value: ¥4,371 (+385%)

Precedent Transactions Range: ¥362–1,075

Median EV/EBITDA: 12.5×

EPS Accretion: +1.85%

CRI’s valuation underscores the attractiveness of the proposed transaction. The DCF analysis yields a bear-case valuation of ¥2,158 per share, a base-case valuation of ¥4,356 and a bull-case valuation of ¥6,613, with a weighted average of ¥4,371 per share. This weighted valuation represents approximately 385% upside versus CRI’s standalone levels, reflecting both intrinsic value and strategic scarcity.

The 25.6% premium contemplated in the deal is well supported by precedent transactions in the middleware and interactive technology space, where valuations range from ¥362 to ¥1,075 per share and the median EV/EBITDA multiple is 12.5×. Middleware assets often trade at premium valuations due to their centrality in development pipelines and the difficulty of replicating mature codebases.

Operationally, Nintendo stands to benefit from immediate licensing cost eliminations and longer-term improvements in development throughput. Improved compression, more efficient build processes and optimised audiovisual playback would enhance performance for both internal and external developers. Over time, this would likely translate into broader third-party support and more technically ambitious first-party titles.

Given Nintendo’s scale and the relatively small financial commitment required, the acquisition offers substantial strategic value at limited financial risk.

Risks

Despite its merits, the proposed acquisition carries several risks. Chief among them is talent retention: CRI’s core value resides in its engineering team, whose departure could slow innovation and compromise the quality of CRIWARE. Maintaining CRI’s engineering culture while aligning it with Nintendo’s processes will require careful balance.

Regulatory scrutiny, while unlikely to block the deal, may impose platform-neutrality obligations that constrain Nintendo’s ability to capture certain synergies quickly. Such obligations could mandate continued support for rival platforms for a set period, delaying the full consolidation of technologies into the Switch ecosystem.

Technological risks also merit consideration. The rapid evolution of AI-driven asset generation, compression and rendering could outpace CRI’s current capabilities unless Nintendo invests significantly in ongoing R&D. CRI’s enterprise segment, which contributes 47% of revenue through automotive deployments, may underperform if automotive production slows.

Finally, integrating middleware deeply into hardware involves long-term architectural decisions. If Nintendo’s future hardware shifts direction, the tight coupling with CRIWARE could create technical debt.

House View

Overall, the proposed acquisition is strategically compelling, financially modest and well-aligned with Nintendo’s long-term needs. It would secure a critical technological layer, reduce dependency on external providers, enhance developer experience and defend Nintendo’s ecosystem against competitor acquisitions. The valuation is reasonable, synergies are tangible and integration risks—while real—are manageable with thoughtful execution.

As the gaming industry continues to consolidate around proprietary toolchains and vertically integrated ecosystems, owning foundational middleware becomes a competitive necessity. CRI provides Nintendo with a mature, widely adopted and technically strong suite of tools that can significantly improve the competitiveness of its next hardware generation.

From both a financial and strategic standpoint, the timing and logic of the proposed acquisition are compelling. The deal would strengthen Nintendo’s internal capabilities, enhance developer engagement and help secure the company’s position in an increasingly demanding and rapidly evolving industry.

Written by: Vishisht Bais (Chapter President Technicals), Russel Choy (co-Chapter President Report), Ethan Khoo, Eric Mai, Jessica Williams, Xuan Jia Liu, Rupert Greenwood, Kriszta Jozsa

This report was written as part of M&A Watch’s partnership with the Cambridge Student Investment Fund