Pfizer’s $10bn Acquisition of Metsera

Written by: Salman Haque (Chapter President), Adrien Bourke, Talal Faraz, ZhiJun Gao, Angel Wu, Raphael Del Aguila

Deal Overview

Acquirer: Pfizer

Target: Metsera

Total Transaction Size: $10 billion

Announcement date: September 22, 2025

In September 2025, Pfizer announced its intention to acquire Metsera for an implied transaction value of approximately $4.9 billion, offering $47.50 per share in cash alongside contingent value rights (CVRs) linked to clinical milestones. The process subsequently attracted a competing proposal from Novo Nordisk, reportedly valuing Metsera at up to approximately $9 billion, which triggered a competitive bidding dynamic. Following this escalation, Pfizer revised its offer and ultimately agreed to acquire Metsera for a total value of up to approximately $10 billion, inclusive of CVRs.

The transaction comes at a time when the global obesity therapeutics market is experiencing rapid growth, with forecasts projecting a market size exceeding $100 billion by the early 2030s, driven by rising obesity prevalence and strong demand for GLP-1–based therapies. The competitive landscape is increasingly concentrated, with Novo Nordisk and Eli Lilly dominating current treatments, while large pharmaceutical companies seek to secure differentiated next-generation assets.

Market reaction to the revised offer was mixed, reflecting investor concern over the scale of the premium paid and the long development timelines associated with clinical-stage assets. For Pfizer, the acquisition represents a significant financial commitment but strategically addresses a critical gap in its cardiometabolic pipeline and positions the company for long-term participation in a high-growth therapeutic area.

Acquirer Overview: Pfizer

Founded: 1849

CEO: Albert Bourla

Market Cap: ~$147bn

LTM Revenue: ~$62.7bn

LTM EBITDA: ~$18.5bn

P/E: 15.03

Ticker (NASDAQ): PPE

Deal Advisor: Citi

History & Background

Pfizer was founded in 1849 in New York, by cousins Charles Pfizer and Charles Erhart as a chemical manufacturer, gaining early success with an antiparasitic drug and the large-scale production of citric acid. The company’s breakthrough came during World War II, when it developed fermentation techniques to mass-produce penicillin for Allied troops, marking its transformation into a pharmaceutical firm.

Post-war expansion saw Pfizer establish operations in the UK, notably in Sandwich, which became one of its largest R&D centres. Through the late 20th century, Pfizer diversified and introduced major drugs such as Diflucan and Zithromax, while growth was further driven by significant M&A activity. Its $90bn acquisition of Warner-Lambert in 2000 allowed it to gain control of the cholesterol-lowering drug Lipitor - and the $68bn acquisition of Wyeth in 2009 was just one of the ways Pfizer diversified and expanded its product line and gained leadership in high-growth areas.

In recent years, Pfizer has continued to build on this shift toward biopharma innovation, most notably through its 2020 partnership with BioNTech to develop the first widely approved mRNA COVID-19 vaccine. Since then, the company has focused on rebuilding its pipeline and strengthening its presence in oncology and biologics, supported by targeted acquisitions such as Seagen. These developments reflect Pfizer’s strategy of leveraging its scale, R&D capabilities, and M&A track record to remain a leading global biopharmaceutical company.

Product Lines

Pfizer is a global biopharmaceutical company whose marketed portfolio covers the full spectrum of modern medicine, with numerous established and emerging brands across prevention, treatment, and specialty care. In 2024, Pfizer reported $63.6 billion in revenue and has focused on tighter execution around key products and regions.

Vaccines

Prevnar 20 / Apexxnar (pneumococcal) – prevents pneumonia and invasive disease caused by Streptococcus pneumoniae in adults and children.

Abrysvo (RSV) – protects older adults and newborns from respiratory virus disease.

Comirnaty (COVID-19 mRNA) – Vaccine to prevent COVID-19.

Internal Medicine (cardio-metabolic / neuroscience)

Eliquis (apixaban) – a blood thinner that helps prevent strokes and clots

Vyndaqel / Vyndamax (tafamidis) – stabilises the transthyretin protein to slow heart damage in ATTR-cardiomyopathy.

Nurtec ODT / Vydura (rimegepant) – Medicine to stop a migraine

Oncology (incl. legacy Seagen brands)

Ibrance (palbociclib) – an inhibitor that slows cell division in breast cancer.

Xtandi (enzalutamide) – an androgen-receptor blocker used across multiple stages of prostate cancer.

Padcev (enfortumab vedotin) – an antibody-drug for bladder/urothelial cancer.

Anti-infectives & Hospital

Paxlovid (nirmatrelvir/ritonavir) – Treatment of COVID-19 in high-risk patients.

Zosyn (piperacillin/tazobactam) – an antibiotic for severe hospital infections.

Zyvox (linezolid) – an antibiotic for serious Gram-positive infections, including resistant strains (part of Pfizer’s hospital anti-infectives).

Inflammation & Immunology / Dermatology

Xeljanz (tofacitinib) – an oral inhibitor for rheumatoid arthritis, ulcerative colitis and other immune conditions.

Cibinqo (abrocitinib) – an oral inhibitor for moderate-to-severe eczema

Eucrisa (crisaborole) – a steroid-free ointment for mild-to-moderate eczema.

What’s leading Pfizer’s revenue (FY-2024 reported)

Eliquis: $7.37 B (Pfizer share; alliance revenue with BMS)

Prevnar family (incl. Prevnar 20/Apexxnar): $6.41 B

Paxlovid: $5.72 B

Vyndaqel family (tafamidis): $5.45 B

Comirnaty: $5.35 B

Strengths

Strong product portfolio : Pfizer maintains a broad and diversified portfolio of high-value medicines and vaccines across a wide range of therapeutic areas. This diverse portfolio allows Pfizer to stabilise its financial performance and adapt to fluctuations in individual markets.

Strong financial performance : Pfizer sees a 10% increase in its operating revenue to $14.7 billion in the second quarter of 2025, with a high gross profit margin of 74%. Able to consistently maintain its high dividend yield of 6.55% for 14 years. This demonstrates financial stability, and their ability to fund large scale R&D and acquisitions to ensure their long-term growth.

Strong brand name and long history : Pfizer's strong brand name and long history gives it an advantage in drug commercialisation, as its acquired drugs would be rapidly scaled through Pfizer’s established distribution channel across various markets. Pfizer could also leverage its decades-long relationships with major payors, providers, and regulatory bodies.

Challenges

Patent expiry cliff : Pfizer is facing a significant patent-expiry cliff in 2027 and 2028, putting $17 billion annual revenue on risk, with major products such as Ibrance and Eliquis approaching loss of exclusivity (LOE). This will trigger price erosion and market share losses, which will heavily impact Pfizer’s revenue.

Competitive environment : Pharmaceutical industry remains a competitive landscape, with competitors having accelerated growth in producing drugs in regards to metabolic diseases, obesity, and diabetes, delivering blockbuster therapies. With the high growing peers, Pfizer is under the pressure to innovate and differentiate to maintain their leadership status.

Market positioning

Pfizer positioned itself as a leader in the pharmaceutical industry and is among the largest in the United States by pharmaceutical-sales volumes, but risks losing its positioning due to the upcoming patent-expiry cliff and the post-COVID revenue decline. Pfizer’s main competitors include Johnson & Johnson, Novo Nordisk, and Eli Lilly and Co. As Pfizer’s revenue primarily comes from the development and commercialisation of patented medicines and vaccines, sustaining its leadership means that the timing of patent expiries, the ability to launch next-generation drugs or biologics, and the need to offset losses from LOE events are central to maintaining its market share.

Target Overview: Metsera

Founded: 2022

CEO: Christopher Whitten Bernard

FY24 Revenue: 0

FY24 EBITDA: -$225k

Deal Advisor: Goldman Sachs, Bank of America, Guggenheim Securities, Allen & Company

History & Background

Headquartered in New York, Metsera is a clinical-stage biopharmaceutical company focused on next-generation obesity and cardiometabolic therapies. It was founded in 2022 by Population Health Partners and ARCH Venture Partners and initially operated in stealth mode to advance its science and intellectual property before public disclosure.

Metsera emerged publicly in April 2024 with $290 million in committed capital, one of the largest first-round financings for a biotech that year. The investor base—including SoftBank, Alphabet’s GV, and Mubadala—signalled strong institutional conviction and positioned Metsera among the best-capitalised preclinical obesity biotechs.

In January 2025, Metsera completed a highly oversubscribed IPO on Nasdaq, valuing the company at $2.7 billion despite challenging biotech market conditions. As promising Phase 1b data increased its profile, Metsera attracted significant interest from large pharmaceutical players. By mid-2025, this culminated in a bidding war between Pfizer and Novo Nordisk, with Pfizer ultimately acquiring Metsera in November 2025 for up to $10 billion including milestones, securing a foothold in the rapidly expanding obesity therapeutics market currently dominated by Novo Nordisk and Eli Lilly.

Product Lines

Metsera is a clinical-stage biopharmaceutical company focused on next-generation obesity and cardiometabolic therapies. Its pipeline is designed to address key limitations of current GLP-1–based treatments, particularly dosing frequency, patient adherence, and non-responder populations. By targeting both injectable and oral modalities, Metsera aims to position itself across multiple segments of the rapidly expanding obesity market.

Injectable Incretin & Non-Incretin Therapies (Core Growth Driver)

Metsera’s near- and mid-term value creation is primarily driven by its injectable pipeline, which targets differentiated, ultra-long-acting therapies.

MET-097i – Lead asset; an ultra-long-acting injectable GLP-1 receptor agonist designed for once-monthly dosing. Phase 1b data showed up to ~14% placebo-adjusted weight loss at 28 weeks, positioning it as a differentiated alternative to weekly GLP-1 therapies such as Wegovy and Zepbound. If successful, MET-097i positions Metsera to compete on convenience and adherence, two increasingly important factors in chronic obesity treatment.

MET-233i - An early-stage, ultra-long-acting injectable amylin analogue, targeting a complementary mechanism to GLP-1s. Designed for monthly dosing and being evaluated as both a monotherapy and in combination with MET-097i, particularly for patients who respond poorly to GLP-1 therapies.

Oral GLP-1 Therapies (Long-Term Optionality)

MET-002o - An early-stage oral GLP-1 receptor agonist, part of Metsera’s effort to expand beyond injectables. While still in early development, oral therapies represent a significant long-term opportunity given patient preference and the potential to broaden access to obesity treatment.

Platform Technology (Portfolio-Level Advantage)

Metsera’s pipeline is underpinned by its proprietary HALO™ peptide engineering platform, which enables half-life extension and supports ultra-long-acting dosing profiles. Rather than being limited to a single asset, the platform allows for repeatable development of differentiated peptides across obesity and related cardiometabolic indications, positioning Metsera as a scalable pipeline company rather than a single-product biotech.

Strengths

Differentiated Products: Metsera’s pipeline centres on ultra-long-acting obesity therapies, led by MET-097i, a once-monthly GLP-1 receptor agonist, and MET-233i, a monthly amylin analogue. These assets target key gaps in current weekly GLP-1 treatments by improving dosing convenience (through weekly injections) and addressing non-responders, giving Metsera a differentiated position in the obesity market.

Sustainable Innovation Pipeline: Beyond its lead assets, Metsera is advancing oral GLP-1 candidates and IND-enabling programs, supporting a broader and repeatable innovation engine. This R&D capability is reinforced by experienced leadership, including co-founder Clive Meanwell, underscoring the company’s ability to translate scientific innovation into long-term pipeline value.

Financial Strengths: Post-IPO, Metsera held $588 million in cash and cash equivalents bolstered by the $288.4 million successful IPO, supporting continuous research and development without immediate revenue pressure. High-profile investors like ARCH Venture Partners (25% stake) and Alphabet (5%) underscore confidence.

Challenges

Developmental Uncertainties: Despite high expectations from the market and investors, Metsera’s products remain in the clinical stage, with the earliest delivery timeline estimated at 4–8 years or more, with their market response being unable to validate. The absence of any large-scale international Phase 3 trials also heightens execution risk, where any adverse clinical result could trigger a complete reassessment of the company’s fundamentals and valuation.

Zero Revenue: Despite strong cash reserves, the company reports substantial net losses of $209.1 million for the year 2024, driven by high R&D costs without any revenue due to the absence of approved products. Therefore, Metsera is not a company that will bring in cash flow in hindsight.

Increasing Competition: The obesity market is becoming highly competitive, with major players such as Novo Nordisk and Eli Lilly continuing to expand their pipelines and more players accelerating development. Zealand Pharma’s amylin analogue is in the same clinical phase (Phase 1) as Metsera’s, while Novo’s oral version of its obesity drug is expected to reach the market by year-end. Metsera must sustain differentiation through positive trial outcomes and sustained uniqueness to defend its position in this rapidly evolving market.

Motivation

For Pfizer

Re-entering the obesity and cardiometabolic market: Pfizer’s acquisition of Metsera reflects a strategic push to re-establish a credible position in the rapidly expanding obesity and metabolic disease space. After scaling back earlier internal efforts, Pfizer faced increasing pressure to demonstrate renewed commitment in a market now central to chronic disease management. Acquiring Metsera allows Pfizer to re-enter with differentiated assets rather than incremental follow-on products, positioning it more competitively against entrenched leaders.

Securing long-term growth to offset patent expiries: With several major products approaching loss of exclusivity in the late 2020s, Pfizer needs new, durable growth drivers. Metsera’s pipeline - spanning once-monthly GLP-1 therapies, amylin analogues, and early oral candidates - offers the foundation for a long-term cardiometabolic franchise. Acquiring these assets early reduces Pfizer’s reliance on its post-COVID portfolio and helps address the looming revenue gap.

Acquiring a scalable peptide innovation platform: Beyond individual assets, Metsera brings proprietary peptide engineering capabilities, including HALO™ half-life extension technology that enables ultra-long-acting dosing. In a market where adherence and convenience are increasingly decisive, owning this platform allows Pfizer to generate multiple differentiated candidates internally rather than relying on single-asset licensing.

Defensive move amid intensifying competition: The deal also reflects competitive urgency. With Novo Nordisk and Eli Lilly dominating obesity therapeutics, and Novo pursuing Metsera themselves, Pfizer faced the risk of further concentration of innovation among rivals. Acting decisively prevents a competitor from strengthening its position while accelerating Pfizer’s own entry into a critical therapeutic area.

For Metsera

Accelerating development through scale and resources: As a clinical-stage company, Metsera faced long development timelines, high capital requirements, and execution risk. Becoming part of Pfizer provides immediate access to global R&D infrastructure, regulatory expertise, and manufacturing scale - significantly increasing the probability that its therapies reach patients.

De-risking clinical and commercial execution: Late-stage trials, regulatory approvals, and global launches are capital-intensive and operationally complex. Under Pfizer’s ownership, Metsera’s pipeline can progress without the funding constraints or market volatility that often challenge standalone biotech firms, reducing both clinical and commercial risk.

Realising value at an early stage: The acquisition delivers a compelling outcome for Metsera’s investors by crystallising value well before Phase 3 trials or product approvals. Given the binary risk profile of obesity drug development, the transaction offers certainty and downside protection while validating Metsera’s scientific platform at scale.

Maximising platform potential across indications: Pfizer’s global reach and therapeutic breadth allow Metsera’s peptide technologies to be applied beyond obesity into broader cardiometabolic and chronic disease indications. This significantly expands the long-term impact of Metsera’s innovation compared to what it could likely achieve independently.

Deal Navigation

Regulatory & Legal

With the deal now completed, Pfizer’s acquisition of Metsera had to clear a standard set of approvals. Metsera shareholders voted on 13 November 2025 to approve Pfizer’s revised cash-and-CVR offer, following a unanimous board recommendation, allowing closing shortly afterwards.(Reuters, 2025). U.S. antitrust review was relatively light: the Federal Trade Commission granted early termination of the Hart-Scott-Rodino waiting period for the Pfizer–Metsera transaction, while separately warning that Novo Nordisk’s rival proposal posed “unacceptably high” legal and regulatory risks for the GLP-1 market. (Trading View, 2025). The main legal friction instead came from Pfizer’s own contract and antitrust lawsuits against Metsera and Novo over the competing bid; the Delaware Court of Chancery declined to issue a temporary restraining order, but this litigation did not prevent the shareholder vote or timely closing.

Financing Structure

Pfizer is acquiring Metsera for up to $10 billion, comprising $65.60 per share in upfront cash and up to $20.65 per share in milestone-linked contingent value rights. (Reuters, 2025) The company plans to finance the deal with a mix of cash on hand and new debt, and has tapped the bond market for roughly $5–6 billion of senior unsecured notes to fund the upfront payment, with the balance coming from existing liquidity (Morningstar, 2025). As the management said during the Q3 earning call, before closing, Pfizer’s gross leverage stood at around 2.7x but the Metsera consideration will push leverage modestly above this target in the near term (Pfizer, 2025). Rating agencies have assigned the new notes an A-category rating and kept a stable outlook, indicating limited concern about a temporary increase in net debt-to-EBITDA (S&P Global, 2025)

The consideration is all cash plus CVRs, so Pfizer is not issuing new equity or changing its share count. Even so, added interest expense and higher R&D around Metsera’s assets mean the transaction is expected to be earnings-dilutive for several years despite the absence of share-count dilution (Pfizer, 2025).

Shareholder Return Targets

Pfizer has guided that the Metsera acquisition will be modestly dilutive to adjusted EPS in the near term, estimating approximately $0.16 of dilution to 2026 earnings and indicating that the transaction will remain EPS-dilutive through 2030 as late-stage trials and launches are funded (Reuters, 2025). Management argues this trade-off is justified by the potential for Metsera’s GLP-1 and amylin candidates to generate more than $5 billion in combined peak sales and support a stronger growth trajectory into the 2030s. While funding the deal will temporarily push leverage above Pfizer’s 2.7x target, the company expects to return toward this level over time through operating cash flow, while maintaining its dividend and disciplined capital-allocation framework (Pfizer, 2025). Investor communications position Metsera as a cornerstone of Pfizer’s Internal Medicine and obesity strategy, emphasising that the temporary EPS impact does not alter its commitment to shareholder returns.

Integration

Synergy Potential

The successful integration of Metsera into Pfizer will be critical in realising the strategic and financial value of the acquisition. While the deal provides a clear pathway for Pfizer to enter the obesity market and expand its metabolic portfolio, the extent to which these benefits materialise will depend on how effectively Pfizer integrates Metsera culturally, operationally, and structurally. From an integration standpoint, the deal is expected to generate significant revenue synergies. Pfizer’s CFO has highlighted the intention to “build a global obesity franchise”, with Metsera’s innovative clinical-stage assets serving as the centrepiece. Integrating these candidates into Pfizer’s global development and commercial infrastructure will allow Pfizer to leverage its branding and commercial expertise, and create cross-selling and upselling opportunities across its broader metabolic and primary-care ecosystem. Thisaligns clearly with the deal thesis and early synergy expectations, and supports Pfizer’s efforts to continue growing post-COVID and amid patent cliff risk.

Operational Integration and Execution Risk

However, execution and operational integration remain at a very early and uncertain stage. As a clinical-stage biotech, Metsera brings promising assets but no commercialised products, meaning Pfizer will shoulder most of the manufacturing scale-up, trial acceleration, and global launch execution. This presents both an advantage - fewer legacy systems to integrate - and a challenge, as the real operational burden lies ahead. There is a risk of misalignment between Metsera’s clinical-stage R&D workflows and Pfizer’s more structured pharma operating model. Without careful early planning around decision rights, R&D governance, and manufacturing transfer, Pfizer could unintentionally slow trial timelines or increase development costs.

Cultural Fit and Talent Retention

Cultural integration represents a key risk. Metsera’s lean, research-driven biotech culture contrasts with Pfizer’s more structured, commercial-stage environment, creating potential friction in decision-making. Strong leadership alignment and clear communication around how Metsera will operate within Pfizer — alongside targeted retention of scientific talent — will be essential to preserve innovation momentum and maintain progress on clinical development. While Pfizer has prior acquisition experience with Seagen and Biohaven, the obesity market brings unique scientific and competitive challenges, making synergy realisation uncertain until scale-up plans are more clearly established.

Overall Integration Outlook

Overall, the acquisition is strategically well-aligned, with a clear rationale and strong leadership intent. However, the ultimate value creation will depend on Pfizer’s ability to harmonise culture, preserve R&D velocity, and execute a large-scale operational build-out for a franchise originating from a clinical-stage company.

Performance and Valuation

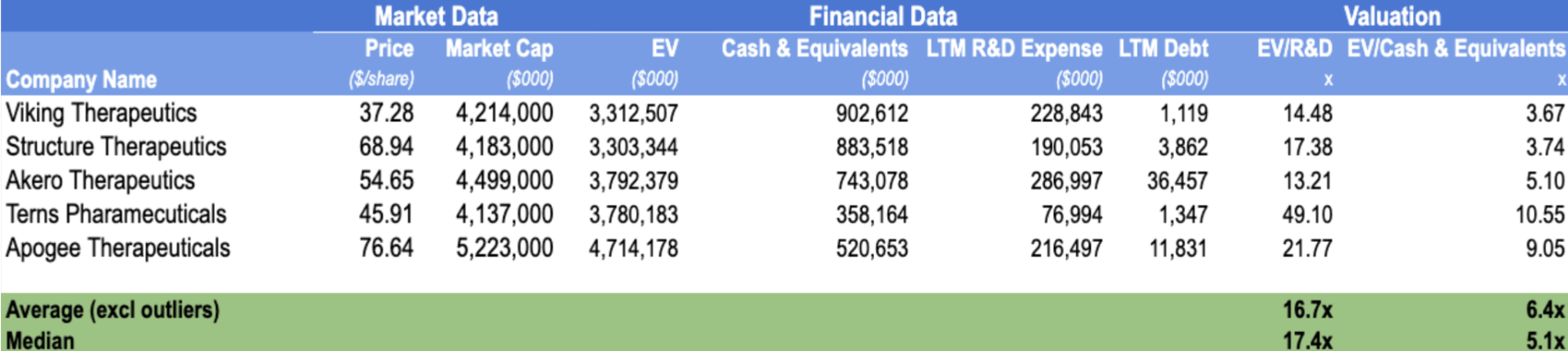

The valuation of Metsera is assessed using a Comparable Company Analysis (CCA), benchmarking the company against a group of pre-revenue, clinical-stage biotechnology peers with similar market capitalisations and R&D-driven business models. Given Metsera’s lack of revenue and profitability, traditional metrics such as EV/Sales or EV/EBITDA are not meaningful, nor is intrinsic valuation. Instead, valuation is assessed using Enterprise Value to R&D (EV/R&D) and Enterprise Value to Cash & Equivalents (EV/Cash), which are commonly applied to early-stage biotechnology companies whose value is primarily driven by pipeline optionality and innovation investment.

Metsera was initially valued at approximately $4.9 billion under Pfizer’s agreed cash offer, before the emergence of a competing proposal from Novo Nordisk materially increased the transaction value. Following this competitive process, Pfizer ultimately agreed to acquire Metsera at a valuation of up to approximately $10 billion, inclusive of contingent value rights (CVRs).

Applying the peer multiples to Metsera’s standalone financials provides useful context for the final transaction value. In FY24, Metsera reported R&D expenditure of $107.5 million and cash and cash equivalents of $352.4 million, Applying the peer-group median valuation multiples implies a standalone enterprise value in the range of approximately $1.8–1.9 billion. Relative to this benchmark, the final transaction value of up to $10 billion represents a substantial strategic premium, underscoring the intensity of competition for differentiated obesity assets and Pfizer’s willingness to pay for long-term optionality. This premium reflects both the scarcity of high-quality early-stage obesity pipelines and the strategic importance of securing future growth drivers in a rapidly expanding therapeutic market.

Risks

Competitive Risk

The obesity market is intensely competitive, with rapid innovation that could erode the strategic differentiation Pfizer seeks through Metsera. Metsera’s lead candidate, MET-097i (a GLP-1 mono-agonist), demonstrated approximately 14.1% weight loss at 28 weeks in mid-stage trials. However, this efficacy may appear less compelling by launch given the emergence of next-generation “super-agonists.” Eli Lilly’s retatrutide (GIP/GLP-1/glucagon triple agonist), currently in Phase III, has shown up to 24.2% weight loss at 48 weeks, while Novo Nordisk’s amycretin (GLP-1/amylin dual agonist), at a similar clinical stage to MET-097i, demonstrated 22.0% weight loss at 36 weeks.

Metsera’s key point of differentiation - once-monthly injectable dosing - also faces pressure from oral therapies that eliminate injections altogether. Eli Lilly’s orforglipron, a once-daily oral GLP-1 pill expected to reach the market earlier, achieved up to 14.7% mean weight loss at 36 weeks in Phase II trials, without fasting or water restrictions. If oral therapies gain strong patient and prescriber adoption, Metsera’s convenience advantage may narrow materially.

In addition, Metsera’s strategy of combining GLP-1 and amylin pathways is not unique. Novo Nordisk is advancing amycretin internally, while Roche has entered the space through licensing petrelintide, a long-acting amylin analogue, from Zealand Pharma. Early data from these programs indicate strong weight-loss potential, placing well-capitalised competitors directly into Metsera’s intended niche.

Clinical Development Risk

Metsera’s assets are largely in Phase II development, a stage where attrition risk remains high before larger, more rigorous Phase III trials. Historical precedent highlights this risk: Novo Nordisk’s CagriSema failed to meet market expectations in its Phase III REDEFINE-1 trial, triggering a sharp market reaction. This underscores that promising mid-stage efficacy does not guarantee superiority in pivotal trials. Any late-stage clinical failure would materially impair the acquisition’s long-term value and eliminate expected revenue synergies.

Pfizer also lacks experience in obesity drug development and commercialization. Pfizer’s previous internal attempts, lotiglipron (liver toxicity) and danuglipron (GI side effects), failed in the clinic. The lack of a successful track record signals the potential mismanagement in complex clinical development.

Financial Risk

The transaction includes a $7 billion upfront cash payment, representing a significant immediate capital outlay. This non-refundable payment may require Pfizer to assume additional debt or draw down cash reserves that could otherwise have been used to reduce leverage. As a result, the deal adds pressure to Pfizer’s balance sheet at a time when the company already faces a high gross leverage target of approximately 2.7x and $37.7 billion of liabilities due within the next 12 months. Furthermore, the deal value relative to Metsera’s fundamentals reflects a significant leap of faith.

House View

Viewpoint

Pfizer’s acquisition of Metsera represents a deliberate and strategically aggressive investment in long-term growth rather than a valuation-driven transaction. While the final consideration implies a significant premium relative to Metsera’s standalone fundamentals, the decision is consistent with Pfizer’s need to rebuild its cardiometabolic pipeline and secure early exposure to the rapidly expanding obesity therapeutics market.

Positive Signals

Strategic Fit: Metsera provides Pfizer with differentiated, next-generation obesity assets, particularly ultra-long-acting injectable therapies that target key limitations of existing GLP-1 treatments such as dosing frequency and patient adherence.

Competitive Validation: The emergence of a competing bid from Novo Nordisk reinforces the strategic value of Metsera’s pipeline and suggests that the final valuation reflects broader industry demand for obesity-focused innovation.

Risk-Sharing Structure: The inclusion of contingent value rights (CVRs) partially mitigates acquisition risk by linking a portion of the consideration to future clinical and regulatory milestones.

Emerging Risks

Valuation Risk: Comparable company analysis implies a standalone valuation materially below the final transaction value, indicating that Pfizer paid a significant strategic premium contingent on successful clinical execution.

Market Competition: Rapid innovation in obesity therapeutics, including next-generation multi-agonist and oral treatments, may reduce Metsera’s differentiation by the time of launch.

Forward Insight

Overall, Pfizer’s acquisition of Metsera reflects a willingness to pay materially above standalone valuation benchmarks in exchange for early access to scarce obesity innovation and long-term optionality. While the premium paid elevates execution risk, it is strategically justified given Pfizer’s patent-expiry pressures, the scale of the obesity opportunity, and the competitive dynamics that continue to reshape the cardiometabolic landscape. The ultimate success of the transaction will depend on Pfizer’s ability to accelerate Metsera’s clinical development while preserving the innovation momentum of a high-science biotech platform.

References

Choudhury, K., & Sunny, M. E. (2025, November 13). Pfizer completes up to $10 billion acquisition of Metsera. Reuters.

https://www.reuters.com/legal/transactional/metsera-shareholders-vote-10-billion-acquisition-by-pfizer-2025-11-13/

Fraçkiewicz, M. (2025, November 21). Pfizer (PFE) on 21 Nov 2025. Techstock2.

https://ts2.tech/en/pfizer-stock-today-pfe-mrna-flu-breakthrough-6b-metsera-bonds-and-a-7-dividend-nov-21-2025/

Gregg Brewer, R. (2025, November 11). Where will Pfizer be in 3 years? Yahoo Finance.

https://finance.yahoo.com/news/where-pfizer-3-years-150700220.html

Guru Focus Research. (2024, February 23). Decoding Pfizer Inc (PPE): A Strategic SWOT Insight. Yahoo Finance.

https://finance.yahoo.com/news/decoding-pfizer-inc-pfe-strategic-050741922.html

Kaczmarek, M. (2025, November 23). Pfizer (PFE) on 23 Nov 2025. Techstock2.

https://ts2.tech/en/pfizer-pfe-on-23-nov-2025-metsera-deal-cancer-win-and-a-7-dividend/

Kellaher, C. (2025, September 22). Pfizer to buy weight-loss drug developer Metsera for up to $7.3 billion—2nd update. Morningstar.

https://www.morningstar.com/news/dow-jones/202509224860/pfizer-to-buy-weight-loss-drug-developer-metsera-for-up-to-73-billion-2nd-update

Kindness, D. (2025, January 15). Who are Pfizer’s (PPE) Main Competitors? Investopedia.

https://www.investopedia.com/ask/answers/052015/who-are-pfizers-pfe-main-competitors.asp

Pfizer. (2022, May 10). Pfizer Press Release.

https://www.pfizer.com/news/press-release/press-release-detail/pfizer-acquire-biohaven-pharmaceuticals

Pfizer. (2023, December 14). Pfizer Press Release.

https://www.pfizer.com/news/press-release/press-release-detail/pfizer-completes-acquisition-seagen

Pfizer. (2025, September 22). Pfizer Press Release.

https://www.pfizer.com/news/press-release/press-release-detail/pfizer-acquire-metsera-and-its-next-generation-obesity

Pfizer. (2025, October 31). Pfizer files lawsuit against Metsera and its directors and Novo Nordisk for breach of merger agreement.

https://www.pfizer.com/news/press-release/press-release-detail/pfizer-files-lawsuit-against-metsera-and-its-directors-and

Pfizer. (2025, November 4). Third-quarter 2025 earnings conference call prepared remarks [PDF].

https://s206.q4cdn.com/795948973/files/doc_financials/2025/q3/Q3-2025-Earnings-Conference-Call-Prepared-Remarks-FINAL.pdf

S&P Global Ratings. (2025, November 18). Pfizer Inc.’s proposed senior unsecured notes rated “A”. S&P Global Ratings.

https://www.spglobal.com/ratings/en/regulatory/article/-/view/type/HTML/id/3480636

Zacks Investment Research. (2025, November 10). Pfizer wins obesity war against NVO, to buy Metsera for around $10B. TradingView.

https://www.tradingview.com/news/zacks%3A6cdc413a3094b%3A0-pfizer-wins-obesity-war-against-nvo-to-buy-metsera-for-around-10b/