SILVER LAKE, AFFINITY PARTNERS AND SAUDI ARABIA PIF’S $55BN ACQUISITION OF EA

Written by: Ben Clarke (Chapter President), Amelia Jolly, Lucas Samson, Nazifa Tasneem, Gianna Kwok Wing Tung & Siru Huang

Deal overview

Acquirer: Public Investment Fund of Saudi Arabia (PIF), Silver Lake, and Affinity Partners

Target: Electronic Arts Inc.

Total Transaction Size: $55 bn

Announcement Date: September 25, 2025

On September 25, 2025, a consortium led by PIF, alongside Silver Lake and Affinity Partners, agreed to acquire Electronic Arts in an all-cash deal valuing the company at approximately $55bn. EA shareholders will receive $210 per share, a 25% premium to the unaffected price, taking the company private while retaining its existing management team and U.S. operating base.

The deal reflects the growing appeal of scaled gaming assets with durable IP and recurring live-service revenues in an otherwise maturing industry. For the acquirers, EA offers a rare combination of global sports franchises, predictable cash flows, and long-term monetisation potential. Strategically, the transaction advances PIF’s Vision 2030 diversification agenda, leverages Silver Lake’s track record in technology buyouts, and benefits from Affinity Partners’ cross-border access.

Ultimately, it is a deal which is strategically sound but tightly priced, leaving limited downside protection if execution underperforms

Acquirer Overview

Silver Lake

Founded: 1999

CEO: Egon Durban and Greg Mondre

AUM: $110 billion

Deal Advisor: J.P. Morgan Securities LLC

History

Silver Lake is an American PE firm, established in 1999 with a dedication to technology investments and now with an AUM of $110bn. The firm built its reputation through landmark tech deals, including Dell Technologies, Skype and X. It now has a portfolio which generates $260 billion of revenue annually. In June 2024 Silver Lake was ranked the 12th largest private equity firm by Private Equity International, cementing its reputation as a global investment firm.

Prior investments

Technology and software: Silver Lake has a long history of high-profile investments in global technology firms. In 2013, Silver Lake led the $24.4 billion leveraged buyout of Dell Technologies, marking one of the largest private equity deals in the technology sector.

Experience management: In 2023, Silver Lake, alongside co-investors, acquired Qualtrics, a leading experience management software provider in a transaction valued at $12.5 billion.

Fintech and digital ecosystems: In 2018, Silver Lake made a $500 million investment into Ant Group, owner of Alipay, one of the largest digital payment platforms.

Strengths

Deep technological expertise across subsector verticals: Positioned as a global technology investment firm, Silver Lake’s investment focus spans the broad tech value chain, involving sectors such as software, cloud computing, IT infrastructure, semiconductors etc. This domain focus has led to a build-up of institutional knowledge and network in the tech sector, providing them with an edge in deal sourcing, structuring and value creation.

Strategic partnerships and global alliances: By forming long-term partnerships with major global investors such as the Mubadala Investment Company, Silver Lake extends its reach into new markets, geographies and industry verticals. They also partner with leading firms and management teams to co-create growth strategies, with WME and Integrity Marketing. This strengthens their capital base, industry reach and operational leverage.

Weaknesses

Disproportionate concentration in tech: By placing emphasis on the tech sector, this creates excessive dependency on cyclical and volatile technology markets. This means Silver Lake’s risk exposure increases and headwinds such as regulatory shifts and valuation bubbles can heavily impact Silver Lake’s profits. By being less generalist, its portfolio may experience sharper valuation declines than diversified peers in downturns.

Large deal size limits flexibility: Silver Lake typically executes large-scale transactions, This limits early-seed opportunities where the greatest alpha often lies; it also results in fewer deals overall due to capital concentration.

Market positioning

Leading global PE firm in tech: Key differentiators that separate Silver Lake include their specialization in technology and focus on mature, scaled companies as opposed to early-stage venture capital.

Affinity Partners

Founded: 2021

CEO: Jared Kushner

AUM: $5.4 billion

Deal Advisor: J.P. Morgan Securities LLC

History

Affinity Partners is an American investment firm founded in 2021 by Jared Kushner, a former senior advisor to the US administration from 2017 to 2021. A large investor into Affinity Partners in their search for funds was PIF, which invested $2 billion into the firm helping it to establish cross-border networks with the Middle East. The firm operates as a relatively small but high-profile player in the private equity landscape, with notable deals including an 8% stake in UK-based digital bank OakNorth.

Strengths

Strong political network: Affinity Partners has previously secured funding commitments from other sovereign-wealth and investment funds such as PIF and the Qatar Investment Authority. This further strengthens their political access and influence. The result is an enhanced ability to navigate complex regulatory environments, secure strategic opportunities, as well as improve their credibility and access.

Cross-regional investment focus: The firm positioned itself as a conduit of Middle East capital into Western innovation and financial services, aligning with the trend where Gulf investors seek diversification out of oil. By diversifying their investments geographically and through industries, Affinity Partners has been able to substantially mitigate risk across markets and gain access to high-growth sectors globally.

Weaknesses

Limited expertise and track record: A key weakness lies in its limited institutional investment expertise and track record. As a relatively new firm founded in 2021, it lacks the long-standing experience, sector specialization, and performance history that more established private equity and investment firms possess. This can raise questions among institutional investors about the firm’s capacity to manage large, diversified portfolios and execute complex cross-border deals. It doesn’t help that this comes at a time where demand for LP capital is 3x oversubscribed, meaning emerging funds with a less clear track record of DPI are struggling to raise capital more than ever. Additionally, with a lean operational team and limited in-house domain specialists, Affinity Partners may face challenges in conducting deep due diligence, managing sector-specific risks, and competing with veteran asset managers who possess decades of global market experience. As a result, its success depends heavily on external advisors and partnerships, which can dilute control and slow strategic decision-making.

Dependence on political authorities: A significant weakness of Affinity Partners is its heavy dependence on political authorities and networks for access, funding, and influence. Much of the firm’s capital and strategic positioning stem from relationships with Middle Eastern sovereign wealth funds and high-level government connections, particularly those cultivated through its founder, Jared Kushner. While this provides strong short-term leverage, it also creates long-term vulnerability: any shift in political alliances, leadership changes, or policy priorities could directly impact the firm’s funding streams and operational stability.

Market positioning

Niche of cross-border private equity: The firm’s niche in cross-border private equity lies in its ability to connect Middle Eastern capital with high-growth investment opportunities in Western markets, particularly in sectors like technology, fintech, and infrastructure. Unlike traditional private equity firms that focus primarily on financial performance and sector expertise, Affinity positions itself as a geopolitical and financial bridge, leveraging its founder Jared Kushner’s deep diplomatic and political ties to facilitate trust, access, and deal flow across regions that historically operated in separate financial ecosystems. This cross-border niche is especially significant because it aligns with Gulf states’ strategic diversification agendas (such as Saudi Vision 2030 and the UAE’s innovation economy), providing them with vetted access to Western innovation and assets. At the same time, it offers Western firms a gateway to Middle Eastern sovereign wealth funding and emerging markets.

Saudi Arabia PIF

Founded: 1971

Chairman: Prince Mohammed bin Salman

AUM: $913 billion

Deal Advisor: J.P. Morgan Securities LLC

History

The Public Investment Fund (PIF) was established as part of the Ministry of Finance in 1971 and initially helped establish companies of critical importance to Saudi Arabia’s economy. In 2015, the fund was placed under the Council of Economic and Development Affairs, granting it greater independence, and positioning PIF as a key driver for the Kingdom’s Vision 2030 strategy. Since then, PIF has evolved into one of the largest sovereign wealth funds, managing a diversified portfolio across sectors including technology, infrastructure and energy. Its investment framework is organised into six investment pools, four of which are domestic and two international, to stimulate Saudi Arabia’s private sector growth.

Prior investments

Gaming: Since 2015, PIF has built a significant presence in the global gaming and interactive entertainment sector. In 2020, the fund purchased $3.3 billion worth of stock in Activision Blizzard (later acquired by Microsoft) and in 2022, a 5% stake in Japanese Games developer Capcom and $1 billion stake in South Korean games publisher Nexon. Prior to PIF’s leveraged buyout of EA, the fund held $3 billion of stock in the firm.

Energy and infrastructure: PIF has played a leading role in advancing Saudi Arabia’s renewable energy and infrastructure transformation. PIF is a major shareholder in the Saud Electricity Company with a 74.3% stake, as well as a stake owner in major national projects such as NEOM, a megaproject in Saudi Arabia designed to be a new urban region powered by 100% renewable energy.

Transportation: PIF has made substantial investments in technology and mobility companies. The fund holds a $8.9 billion stake in Lucid Motors and has invested $2.3 billion in Uber, supporting the company’s expansion into new mobility and delivery services. They are also the sole owners of Riyadh Air, an airline operating domestic and international flights to over 100 destinations.

Strengths

Diversification into tech and AI: PIF has been strategically diversifying into technology and AI as part of its broader Vision 2030 initiative to reduce dependence on oil revenues. By investing heavily in emerging technologies, digital infrastructure, and AI-driven ventures, PIF aims to foster sustainable economic growth and attract global talent. Its portfolio now includes major stakes in leading tech companies, AI research partnerships, and domestic initiatives such as the establishment of data centers and smart city projects like NEOM, accelerating Saudi Arabia’s digital transformation.

Financial scale and long-term investment capacity: With assets exceeding billions of dollars, PIF has the financial power to pursue large-scale projects across multiple sectors, including renewable energy and entertainment. This deep capital base allows PIF to focus on sustainable value creation as opposed to short-term gains.

Weaknesses

Centralized control: Given that PIF is controlled by Crown Prince Mohammed bin Salman, there is a strong concentration of power and decision-making in one person. This indicates there is potential strong political influence in the decisions that PIF makes which can consequentially result in contravening established governmental practices and establishing uncertainty and risk for investors.

Operational costs and risks: PIF faces execution risks tied to large, long-term projects like NEOM, which involve complex coordination and uncertain returns. In particular, Neom has faced delays and challenges due to the scale and ambition of development.

Market positioning

Long term strategy: PIF likes to position itself as an investor uniquely focused on long-term strategic impact. The fact it is a sovereign, state-backed investor with global-scale capital allows it to be uniquely positioned in this sense. It is thus distinct from the traditional PE houses discussed above, positioning itself between a sovereign wealth fund and a national development platform.

Target Overview

EA

CEO: Andrew Wilson

Market Cap: $50 billion

LTM Revenue: $7.8 billion

LTM EBITDA: $1.8 billion

P/E: 52.74x

Ticker (NASDAQ): EA

Deal Advisor: Goldman Sachs & Co LLC

History

EA is a California based video games maker company founded in 1982 by Trip Hawkins. Throughout the 1990s, EA expanded rapidly through acquisitions – purchasing Maxis (SimCity, The Sims), Westwood Studios (Command & Conquer), and Origin Systems (Ultima) – while diversifying into simulation, strategy, and role-playing games. Franchises in the 2000s such as The Sims, Battlefield, and Need for Speed led to accelerated growth and brand name for EA; the introduction of FIFA Ultimate Team in 2009 marked the start of EA’s live-service model, reshaping its revenue structure. Today, EA stands as one of the world’s leading interactive entertainment companies, built on a mix of owned IP, strategic licenses, and service-based engagement across console, PC, and mobile ecosystems.

Product Lines

Sports: Sports is EA’s most profitable segment, driven by global franchises such as EA SPORTS FC (formerly FIFA), Madden NFL, NHL, UFC, F1 (via Codemasters), and Need for Speed. The segment benefits from deep partnerships with major sports leagues such as the NFL, Premier League, LaLiga and Bundesliga.

Adventure & RPG: This category spans narrative and role-playing franchises such as Star Wars Jedi series, Dragon Age and Immortals of Aveum.

Simulation: The Sims franchise remains one of EA’s longest standing and most community-driven ecosystems. Centred on creator-driven, community-powered ecosystems, the genre prioritises player expression and social connection.

Platform / Services / Tech: EA Play subscription service; Frostbite engine; live-service infrastructure for matchmaking, in-game economies, and analytics.

Strengths

Franchise Strength: Franchises such as EA SPORTS FC, Madden NFL, F1, The Sims, and Battlefield have built loyal player bases and continue to perform strongly across release cycles. The scale and popularity of its franchises provide a durable competitive advantage across both sports and broader entertainment segments.

Cash Generation: In FY25, the company reported $7.5 billion in revenue and $2.1 billion in operating cash flow, maintaining a 79% gross margin. Consistent profitability and free cash flow have enabled substantial shareholder returns, including $2.5 billion in share buybacks before the take-private announcement. EA’s liquidity and stable cash flow provides the flexibility to invest in new IP, technology, and studio expansion while absorbing the leverage from the $55 billion acquisition.

Recurring Revenue through Live Services: EA’s transition from single-purchase titles to ongoing live-service models has stabilised its revenue base. In FY24 - FY25, 73% of total revenue came from live services and extra content, including Ultimate Team in EA SPORTS FC and Madden NFL, and Apex Legends. This model provides predictable cash flows and high engagement, reducing exposure to the volatility of individual game releases.

Weaknesses

Mature Industry and Slowing Growth: EA operates in a mature segment of the gaming industry where organic expansion opportunities are limited. Revenue has remained broadly stable since FY23, and the company’s share price has stagnated over the past five years. Without the development of new intellectual property or stronger performance in emerging segments such as new digital formats or mobile gaming - currently only 16% of EA total revenue, EA risks being perceived as a stable but low-growth business.

License Dependence: EA’s dominance in sports gaming is secured through expensive and time-limited licences such as the NFL and FIA F1. Renegotiations of these agreements, particularly in a competitive content environment, could increase royalty expenses and put pressure on margins.

Revenue Concentration and Regulatory Scrutiny: A large share of revenue comes from Ultimate Team and Apex Legends, exposing EA to engagement fluctuations and ongoing scrutiny over loot-box-style monetisation. Changes in regulation regarding this could materially affect revenue predictability.

Dependence on Core Franchises: A significant portion of EA’s revenue comes from a few key titles with recent launches outside of its core franchises significantly underperforming. EA SPORTS FC, Madden NFL, and Apex Legends remain strong, but a decline in player engagement or competitive pressure could materially affect results. This reliance makes diversification through new IP or acquisitions a strategic priority.

Market positioning

Global Leader in Interactive Entertainment: With over $7.5 billion in annual revenue and a diverse portfolio, EA ranks among the world’s top publishers. Its sports-licensing moat and strong live-service ecosystem differentiate it from competitors such as Take-Two Interactive and Ubisoft, which lack comparable recurring-revenue scale.

Motivation

Acquirers

Diversification from oil for Saudi Arabia

PIF’s acquisition of EA aligns with Saudi Arabia’s long-term strategy to diversify the Kingdom’s economy away from oil exports, as set out in Vision 2030. Crown Prince Mohammed bin Salman has prioritised entertainment and technology as new pillars of growth and has committed $38 billion to develop the nation into a global hub for gaming through PIF’s Savvy Games unit focused on video game investments. This investment follows similar stakes in Nintendo and Take-Two Interactive, reinforcing PIF’s ambition to transform Saudi Arabia into a global centre for digital entertainment.Bets on cost-cutting AI

Both PIF and Silver Lake view artificial intelligence as a catalyst for a new era of entertainment and productivity. The investors bet that AI will significantly reduce game production costs by replacing software engineers and automating design and development processes which would potentially cut EA’s $2 billion annual R&D costs. This underpins the consortium’s willingness to pay a premium $55 billion valuation, equivalent to roughly 20x forecast EBITDA. The investors believe AI will not only enhance EA’s operating efficiency but also expand its creative and commercial potential across sports and entertainment ecosystems.Strategic fit with existing portfolios

This transaction complements both PIF’s and Silver Lake’s existing exposure to the sports and entertainment industries. PIF already owns stakes in LIV Golf and football clubs in Saudi Arabia and the UK, and is set to host the 2034 World Cup. Meanwhile Silver Lake is a major shareholder in Endeavor, the controlling owner of UFC, and a minority investor in Manchester City FC. By acquiring EA - the publisher of sports franchises such as EA Sports FC and Madden NFL - the investors gain a digital platform that deepens fan engagement and extends their influence across global sports and entertainment, enhancing the strategic value of both firms’ physical sports assets. These IPs behave like long-term digital monopolies, producing high margins, low churn and strong annual monetization. Thus, acquiring this global IP strongly aligns with PIF’s strategy to own long-lived assets that compound value for decades.Optimal LBO growth levers (e.g. operational efficiencies to be had, expanding APAC games market)

Revenue growth levers include IP expansion and franchise monetization, mobile gaming scale-up and integration of Esports into Saudi Arabia. Margin & cost efficiency levers involve consolidating underperforming studios and investing in high-ROI ones and using cloud-native pipelines. Capital structure and financial engineering levers include asset carve-outs and recurring revenue scaling to support higher leverage. Lastly, synergy levers include emerging market penetration, which PIF’s geopolitical relationships to push EA distribution deeper into MENA, India and Africa.

EA

Limited growth horizon

EA’s flagship franchises (including EA Sports FC, Madden Battlefield, the Sims) are largely annualised or iterative releases that have been driving steady cashflow but little growth. Annual revenue has been broadly constant in recent years. EA is dependent on licensed sport for Madden, and lost the FIFA license in 2022 under which EA Sports FC was previously branded. Additionally, EA is facing regulatory scrutiny for a main revenue source, microtransactions, which are built into some of its games (notably Ultimate Team). This highlights the fragility of EA’s established revenue base.Competitive pressure

EA’s business model is looking increasingly outdated in face of competitors. The gaming market has consolidated around platform ecosystems such as those offered by Tencent, Sony and Microsoft, which leaves publishers (such as EA) at a disadvantage. Player migration towards cheaper content (including free-to-play and mobile games) has decreased demand for EA’s releases which are typically on the pricier side. EA also faces much higher production costs than rivals (such as Epic Games, with Fortnite as their main product).Strategic alignment with the consortium

The investor partnership combines significant capital with deep experience across sports, technology, and entertainment, and the deal “positions EA to accelerate innovation and growth to build the future of entertainment”. PIF’s global sports and esports portfolio includes stakes in LIV Golf, Newcastle United FC and ESL FACEIT Group. These provide a platform that EA can harness in delivering its ambition to deepen the connection between gaming, live sport, and fan engagement. Silver Lake brings expertise in scaling digital and entertainment assets. Affinity Partners’ reach in emerging markets and ties across MENA and Asia offers EA access to fast-growing gaming markets. Altogether, the group gives EA the resources and relationships to expand internationally, advance major long-term growth projects, and pursue acquisitions or partnerships that would have been difficult under public-market constraints.Private Ownership

Freed from quarterly earnings scrutiny, EA can pursue longer-horizon projects. Industry analysts point out that as a private company EA could “retool operations without worrying about shareholder interest or other market scrutiny”. Another firm noted the consortium’s backing should allow EA to focus on long-term bets that were previously “too risky or expensive as a public company”. In short, management gains the luxury of time to develop new franchises or technologies without worrying about next‑quarter stock reactions.Return to the Shareholders and Board

EA stockholders will receive $210 per share in cash (25% above the unaffected price). The board expressly cited this immediate cash payout as a key reason, noting the deal “delivers immediate and certain cash value to our stockholders.”. Shareholders get guaranteed liquidity at a high price, addressing any concerns that EA’s stock was undervalued.

Deal Navigation

Legal

The legal structure under which the deal will occur are as follows:

Parent: Oak-Eagle AcquireCo, Inc., a Delaware corporation

Merger Sub: Oak-Eagle MergerCo, Inc., a Delaware corporation and a wholly owned subsidiary of the parent.

Target: Electronic Arts Inc., a Delaware corporation

The Parent corporation is a new holding entity owned by the consortium. PIF’s EA shares are contributed into the holdco under a PIF Voting, Support and Rollover Agreement meaning that the consortium owns the Parent indirectly.

This is a reverse triangular merger under Delaware General Corporation Law. When the merger occurs, the Merger Sub merges into EA, and EA survives as the Surviving Corporation whilst the Merger Sub ceases to exist. EA’s corporate existence, rights, and obligations continue. As typical for a reverse triangular structure, assets, contracts, and liabilities stay with now privately held EA. The directors of the Merger Sub become directors of EA, and EA’s bylaws are replaced with the Merger Sub’s bylaws. EA survives as a wholly owned subsidiary of the parent.

Capital Structure

The capital structure will be reshuffled, with each share of EA common stock converted into the right to receive $210.

Regulatory

The transaction is subject to regulatory approval from U.S. and non-U.S. antitrust authorities, as well as review by the Committee on Foreign Investment in the United States (CFIUS). Commentary suggests there is significant political pressure for CFIUS to adopt a strict approach given concerns around foreign influence stemming from PIF’s involvement, meaning the review process is likely to be lengthy. These concerns are heightened by the nature of EA’s assets: the company controls sensitive player behavioural data, hosts online communities comprising hundreds of millions of users, operates monetisation systems with regulatory implications, and owns game engines with potential defence-adjacent applications such as simulation technologies. EA also holds detailed behavioural analytics, limited geolocation data, transaction histories, and user communications, which raises data-security and national-interest issues. As a result, CFIUS may require remedies such as U.S. data localisation, restrictions on data transfers to foreign-controlled entities, independent third-party security audits, and the establishment of a U.S.-controlled data governance board. These measures are consistent with those imposed in prior cases involving Chinese or Gulf-backed investments in digital companies.

Furthermore, in the US, this deal will be scrutinised under the Hart-Scott-Rodino Act by federal antitrust agencies who will evaluate whether the merger will influence consumer welfare. That being said, it is unlikely that these investigations will discover a decrease in consumer welfare. This is because there is limited horizontal overlap and vertical integration. PIF, Silver Lake, and Affinity Partners have no direct operating businesses in game publishing. Their exposure to the gaming ecosystem – stakes in Capcom, Nexon, Niantic, Savvy Games, and ESL – does not constitute controlling ownership in competing U.S. publishers. The FTC typically focuses on: 1) market concentration, 2) pricing / output effects, and 3) consumer harm. Because none of the consortium members own a competing U.S. game developer with overlapping AAA franchises, horizontal consolidation concerns are limited. Thus, DOJ is unlikely to view the deal as enabling anti-competitive foreclosure.

Financing Structure

The acquisition of EA is partly funded by $36 billion in equity from PIF, Silver Lake and Affinity Partners, with PIF’s equity portion including the rollover of their existing 9.9% stake in EA. The remaining $20 billion is to be funded by debt financing from JP Morgan, $18 billion of which is expected to be funded at close. There are some concerns that this high level of debt will need to be serviced by the revenue generated by big games such as EA’s new Battlefield 6, and that excess spending might be cut and the company’s workforce may be rationalised to deliver more free cash flow. Upon completion, EA will no longer be a publicly traded company but will remain headquartered in Redwood City, California, with Andrew Wilson continuing as CEO.

The deal will take EA private, meaning all of its public shares will be purchased. Stakeholders are to receive $210 per share, giving them a 25% premium to the unaffected share price of $168.32 on September 25th 2025. This gives EA an estimated equity value of around $55 billion.

Performance & Valuation

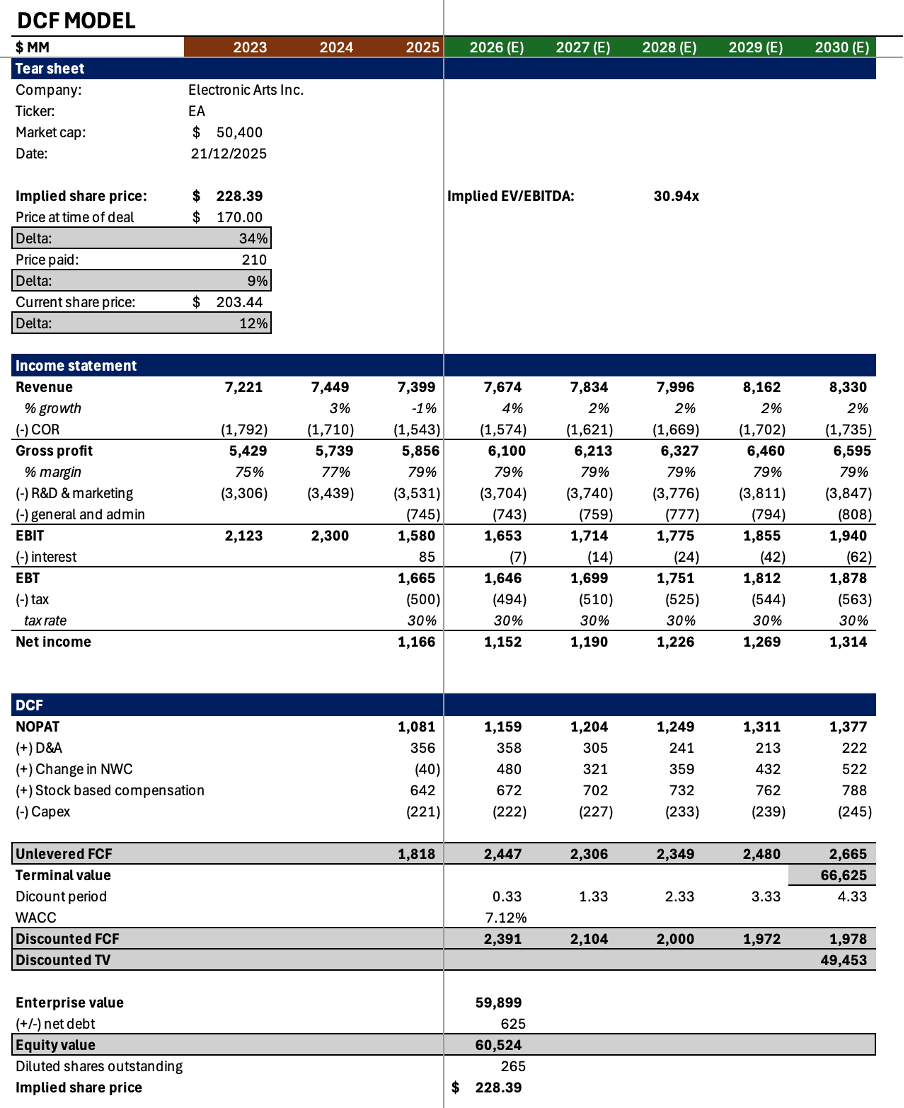

Our intrinsic DCF analysis implies an equity value of $228.39 per share, representing a ~34% uplift to the undisturbed share price at announcement and a ~12% premium to current trading levels. This corresponds to an implied EV/EBITDA multiple of 30.9×, reflecting EA’s high-margin, IP-driven earnings profile, durable live-services cash flows, and long-term growth optionality.

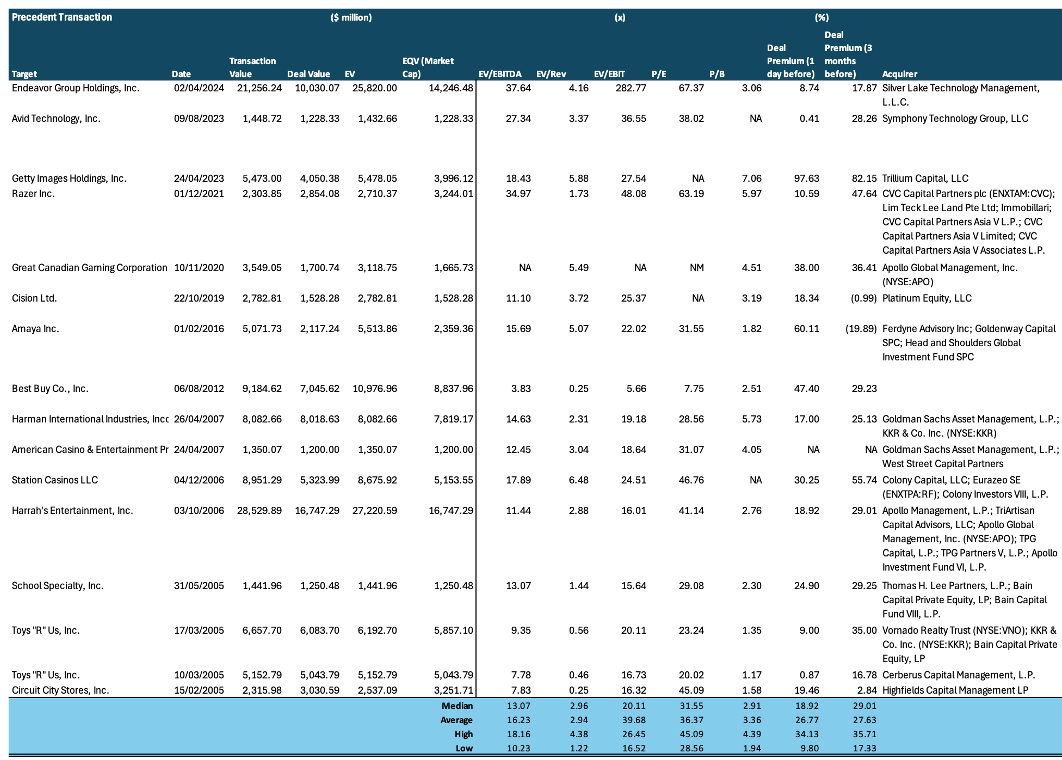

This valuation is further corroborated by precedent transaction analysis. Strategic and sponsor-led acquisitions of scaled digital content, interactive media, and platform assets have cleared at elevated EV/EBITDA with median multiples in the high-teens to low-20s. Premiums expand meaningfully for assets with defensible IP, strong community engagement, and long-duration cash flow, characteristics squarely aligned with EA’s operating profile.

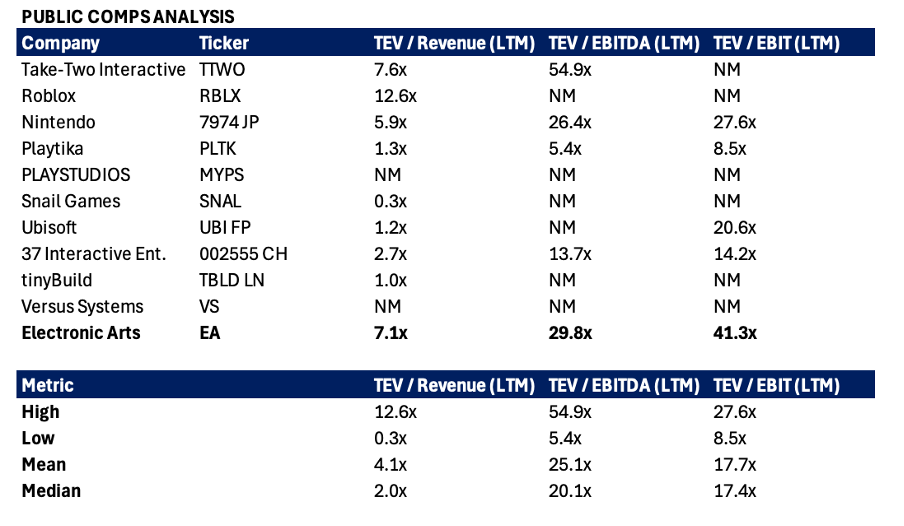

The public comps analysis shows a wide dispersion of trading multiples across the interactive entertainment sector, reflecting differences in scale, profitability, and business models. EA trades at 7.1× LTM revenue and 29.8× LTM EBITDA, placing it well above the peer median on revenue multiples (2.0×) and modestly above the median EBITDA multiple (20.1×), but below the upper end set by premium content and platform peers such as Take-Two and Roblox. Overall, the comps support a valuation at the higher end of the sector range for scaled, high-quality interactive entertainment assets.

Taken together, the DCF, precedent transactions, and public comps indicate that PIF’s proposed purchase price of $210 per share represents an attractive entry point, offering meaningful upside to intrinsic value while securing a high quality asset at a valuation that is well supported by both strategic and market benchmarks.

Integration

EA is not being “merged into” PIF, Silver Lake, or Affinity in any operational sense. There will be no combining of teams or centralised product decisions. Leadership integration is thus intentionally light, with day-to-day authority retained by EA management. The new owners will focus on rules and boundaries rather than operational intervention. The principal integration risks are therefore concentrated in governance execution and talent and cultural fragility as EA’s creative studios and live-ops teams are highly sensitive to perceived political influence, cost cutting, or erosion of creative independence. If handled well, EA operates largely as before, but with tighter financial discipline and stronger regulatory oversight in the background.

Risks

| Risk | Mechanism | Mitigation | Likelihood |

|---|---|---|---|

| Cultural misalignment leading to Human Capital exiting. | EA maintaining its top-tier talent with individual creativity and specialised skills is crucial to it remaining a relevant force in a competitive industry. EA owns studios with progressive cultures such as Bioware and Maxis, which place a strong emphasis on diversity and inclusion in the narratives produced in games. New ownership by a state-owned entity of a country with a low emphasis on diverse values and human rights might make individuals uncomfortable. Additionally, the threat of creative censorship may further incentivise human capital drain. | Operational autonomy could be granted for EA, similar to that of Scopely acting as an autonomous entity under the Savvy umbrella. | 4/10 |

| Reputational risk for EA leading to boycotting of brand by western consumers and consequent revenue drop. | EA’s brand being connected to a state with a low emphasis on diverse values and human rights may lead to negative sentiment towards EA’s brand by connection. This may both decrease the general player base in western countries who will consume entertainment produced by other companies, and could also fracture the ecosystems of certain games if some esports teams boycott certain games. The latter would decrease EA’s sponsorship and broadcasting revenue. | Operational autonomy would preserve EA’s separate brand image. Increased funding on Diversity & Inclusion projects to improve EA’s image. | 3/10 |

| Leverage and credit-rating concerns | The injection of substantial debt ($20 billion) has raised immediate concerns regarding EA’s credit profile. Fitch Ratings placed EA’s A- Long-Term issuer default rating on Rating Watch Negative on October 2, 2025. Fitch also projected that pro forma EBITDA leverage will remain above 6.0x at close and stay above 5.0x for several years post-transaction, a material increase from EA’s historical sub-1x levels. This weakened rating can cause a multitude of consequences namely higher borrowing costs, limited access to capital markets and onerous financing terms. | EA has had robust cash flow generation, generating approximately $1.5 billion in average FCF. This strong cash conversion capability supports debt servicing. | 7/10 |

| Softening fundamentals | Recent financial performance has shown softening fundamentals, which could further exacerbate risks associated with high leverage. According to the Q2 FY26 report, net revenue decreased 9% YoY, operating income fell 48% YoY, and net income fell from $294 million to $137 million. This can cause a cascade of ripple effects, from key debt health metrics such as interest coverage ratio weakening, to creditors increasing scrutiny and triggering covenants that accelerate repayment, to ultimately a downward spiral of asset fire sales, severe cost cutting and liquidity crises. | A franchise turnaround is to be expected, evidenced by EA reporting a return to net bookings growth for key titles including Apex Legends and Madden NFL 26, showing stabilizing headwinds. | 5/10 |

House View

“a deal which is strategically sound but tightly priced, leaving limited downside protection if execution underperforms.”

Overall, we believe the deal is a strategically coherent but weighty bet on scalability and IP longevity in the maturing gaming industry. The logic is clear: EA offers scarce, globally embedded franchises with resilient live-services cash flows that align with PIF’s Vision 2030 diversification agenda, Silver Lake’s suite of operationally-driven tech buyouts, and Affinity Partners’ role as a cross-border access facilitator.

However, the deal is tightly priced and leverage heavy. This leaves limited margin for error. While intrinsic valuation and precedent benchmarks support the $210 per-share consideration, value creation is highly execution-dependent, skewed toward deleveraging, governance discipline, and incremental operational efficiencies rather than transformative synergies. In short, this is a high-conviction, long-duration strategic acquisition, and one where outcomes will be shaped less by vision and more by disciplined delivery.