Celsius’s $1.8bn acquisition of Alani Nu

Written by: Jonah Yearwood (Chapter President), Drasti Svala, Grace Topping, Hung Nguyen, Alex Green & Jonah Souster Vieira

Deal Overview

Acquirer: Celsius Holdings Inc

Target: Alani Nutrition

Total Transaction Size: $1.8 billion

Announcement date: March 2025

Closing date: April 2025

On April 1st, 2025, Celsius Holdings completed its acquisition of Alani Nu for approximately $1.8 billion, consisting of $375 million in cash, $900 million in debt, and $500 million in restricted equity to the founders and Congo Brands advisors. This represents a 26% premium to Alani Nu’s recent pre-deal valuation and reflects disciplined capital allocation in a rapidly consolidating functional beverage market.

The transaction addresses Celsius’ strategic aim to diversify beyond its male focused, performance-oriented positioning by acquiring a fast growing, culturally resonant brand explicitly targeting Gen Z and millennial women, a demographic driving 72% YoY growth in the wellness beverage space. Alani Nu’s $1 billion+ in annual retail sales, 92% female social media base, and established presence in snacks and supplements complement Celsius’ core energy drink portfolio while enabling expansion into adjacent categories.

Market reaction was mixed, with concerns centred on execution risk in preserving Alani Nu’s brand authenticity amid integration into a larger corporate structure. However, the transaction is expected to be cash EPS accretive in Year 1, supported by $50 million in anticipated cost synergies and enhanced distribution leverage through PepsiCo’s North American infrastructure.

Acquirer Overview: Celsius Holdings Inc

Date Founded: 2004

CEO: John Feedly (2018- Present)

Market Cap: $10.62 Billion

LTM Revenue: $2.13 Billion

LTM EBITDA: $442.31 Million

Celsius evolved from an OTC wellness startup (Vector Ventures, 2004) into a $10B+ premium functional energy leader. After rebranding in 2007 and proving international viability with a Swedish launch in 2009, the company listed on NASDAQ in 2017. Under CEO John Fieldly appointed in 2018, Celsius repositioned from competing in a niche fat burn segment to the mainstream fitness and lifestyle segment. Strategic M&A accelerated this growth with delas such as Func Food Group (2019, €15M, European expansion), and Big Beverages acquisition (2024, supply chain control) boosting operational efficiency. Yet Celsius most significant deal is its partnership with PepsiCo (2022, $550M investment), which helped expand US distribution by 95%. This combination of strategic partnerships and vertical integration has helped established Celsius as a category leader.

Product Lines

Celsius - The flagship Celsius line is a clinically supported drink that accelerates metabolism and helps burn body fat during exercise, making it ideal for users seeking both energy and body composition benefits.

Celsius Essentials - The Celsius Essentials range builds on this positioning by combining the MetaPlus blend with essential amino acids; it is aimed at performance-oriented consumers who want to boost endurance, recovery support, and pre-workout effect.

Hydration - The Hydration range offers a caffeine-free, electrolyte-rich drink with B vitamins and zero sugar, designed for consumers who want to stay hydrated without the added calories.

On the Go - Delivers the same clinically supported benefits in convenient powder stick packets, designed for portability and travel. While also enabling distribution through e-commerce, travel and other channels where ready-to-drink cans are less practical.

Strengths

Innovation - Celsius offers a range of clinically backed drinks that support metabolism, fat burning, and physical performance, without relying on artificial sweeteners. This health first positioning appeals to consumers who want a healthier, more functional energy boost and it underpins Celsius’ ability to sustain premium pricing and strong brand loyalty.

Strategic Partnership with PepsiCo - A 20-year distribution agreement with PepsiCo strengthens Celsius’ market presence by giving it access to one of the most extensive distribution networks in North America. This partnership ensures broad retail placement across grocery, mass, convenience, and foodservice, providing support for rapid scaling both domestically and internationally.

Operational Control and Efficiency - Through the vertical integration benefits from PepsiCo and the acquisition of Big Beverages, Celsius maintains tighter control over its manufacturing processes, capacity planning and quality control. Enabling the company to respond quickly to demand spikes, manage input costs more effectively and maintain consistent product quality.

Challenges

Dependence on PepsiCo - Celsius is heavily reliant on its partnership with PepsiCo, which accounts for 59.4% of its total revenue. Any change or disruptions in the relationship could impact Celsius’ financial stability and operational flexibility.

Intense Competition - The energy drink market is highly competitive, with brands like Ghost and Alani Nu offering similar functional benefits. As consumer tastes rapidly evolve, Celsius must continuously innovate to stay relevant. Lower-priced competitors, like Ghost, could undermine Celsius’ premium pricing if consumers perceive them as offering comparable benefits.

Retail Bargaining Power - Large retailers hold significant influence over shelf space, pricing, and promotional mechanics. This limits Celsius' ability to freely set prices and promotions and could challenge its premium image if competing brands push deep discounts or retailers prioritise margin over brand equity.

Market Positioning

Celsius occupies a strong position in the premium energy drink market, appealing to consumers who value health and functionality. Positioned between wellness and performance, it offers energy-boosting drinks that support metabolism and fat burning, without artificial sweeteners or high sugar content. This allows Celsius to compete not only with traditional energy drinks but also with emerging “better-for-you" beverages, effectively broadening its addressable market.

From a pricing standpoint, Celsius is typically positioned above value-oriented competitors such as Ghost but below some higher priced wellness offerings. This mid-to-upper pricing strategy makes it a relatively accessible option within the premium category, enabling the brand to appeal to a broad base of health-conscious consumers without sacrificing margins. However, the market is competitive, with larger brands like Red Bull and smaller brands like Ghost offering similar benefits, making differentiation crucial for Celsius.

Summary

Celsius evolved from an OTC wellness startup into a $10.6 billion premium functional energy leader through strategic repositioning and operational scale. Since its 2017 NASDAQ listing and 2018 strategic pivot under CEO John Fieldly, the company has shifted from niche fat burn positioning to mainstream fitness lifestyle appeal. The PepsiCo partnership was transformational, expanding US distribution by 95% and underpinning its current market dominance. With $2.13 billion in LTM revenue and $442 million EBITDA, Celsius competes with clinically supported formulations without artificial sweeteners. Overall, Celsius is a well scaled category leader positioned in the high growth functional beverage space, through concentration risk and competitive intensity must be considered.

Target Overview: Alani Nutrition

Date Founded: 2018

Founder: Katy Schenider (Hearn) and Haydn Schenider

LTM Revenue: $595 Million (2024)

LTM EBITDA: $87 million (2024)

History & Background

Founded in 2018 by fitness influencer Katy Hearn and her husband Haydn Schneider, Alani Nu was created to fill a gap in the supplement market by offering clean, women focused products that resonated with a demographic largely overlooked by traditional sports nutrition brands. Initially focused on pre-workouts and protein powders, the company quickly identified an opportunity to extent into ready-to-drink energy beverages. The brand experienced explosive growth between 2020 and 2021, with revenue increasing by approximately 335% from $68 million to $228 million. This acceleration was driven by major retail partnerships with Target, Walmart and GNC, which brought the brand into mainstream brick and mortar channels while it continued to leverage direct-to-consumer and social media-first marketing strategies. By 2023, the company commanded a valuation of over $3 billion in private markets.

Product Lines

Energy Drinks - The energy drinks line consists of sugar-free beverages formulated to provide a smooth, “clean” energy boost suitable for daily use rather than only intense workouts. These drinks are categorised by vibrant, approachable flavours and branding that emphasise fun, positivity, and accessibility

Snacks - The brand has built a meaningful snacks platform offering convenient, better-for-you options such as protein bars and gummies designed to support nutrition and recovery on the go.

Fitness Supplements - Alani Nu provides pre-workouts, BCAAs, creatine, and whey protein products aimed at enhancing workout performance, aiding muscle recovery, and supporting metabolism.

Wellness Essentials - The Wellness Essentials category includes nutritional supplements such as super greens, fat burners, balance capsules, and collagen peptides that promote overall health and wellbeing.

Strengths

Rapid Growth and Financial Strength - Financially the brand has demonstrated exceptional scalability, surpassing $1 billion in retail sales in 2025 and growing approximately 72% YoY, while generating around $115 million in free cash flow. This performance indicates a business model capable of translating top-line momentum into tangible cash generation, an attractive trait in a largely marketing driven category.

Targeted Consumer Appeal - Strategically, Alani Nu has successfully carved out a differentiated position by explicitly targeting Gen Z and millennial women. Approximately 92% of its social media following is female, reflecting a deliberate focus on building a community around relatable wellness messaging, hormone balance, achievable fitness goals and “feel good” lifestyle aspirations.

Diverse Product Range - The product range extends beyond just energy drinks to include energy sticks, protein bars, gummies, and RTD coffee and wellness supplements, appealing to multiple consumption occasions and categories.

Social Media Reach - Social media is another major strength, collaborations with Kim Kardashian, Paris Hilton, and Emily Ratajkowski, along with 2.1 million combined Instagram and TikTok followers, amplify brand awareness and trust.

Challenges

Competition with Industry Giants - Alani Nu operates in a market dominated by Red Bull, Monster, and Celsius, which together account for 70% of global sales volume. These companies increasingly recognise the value of a female focused, wellness centric positioning and have begun to launch competing products. Monster’s launch of FLRT Energy is a clear example of a legacy brand targeting Alani Nu’s core demographic.

Limited Global Reach - Alani Nu’s operations are heavily concentrated in North America, which accounted for 37.8% of global energy drink revenue in 2024. Expansion into international markets is challenging due to stricter regulations on functional ingredients and marketing strategies reliant on US based influencers may not resonate with local consumers.

Market Positioning

In the premium energy drink space, Alani Nu is positioned as a high-end option, priced above mainstream brands like Red Bull, Monster, and Rockstar, but just below other premium competitors such as Ghost and Celsius. This pricing reflects its focus on wellness, appealing to health-conscious consumers who are willing to pay a premium for functional benefits like energy boosts and metabolism support.

While Alani Nu’s premium price supports its wellness-focused appeal, it faces the challenge of convincing consumers that the extra cost is justified, especially when other brands offer similar functional benefits at a lower price point. Maintaining this positioning will therefore depend on Alani Nu’s ability to continually reinforce its unique value proposition through product quality, brand storytelling, and influencer led authenticity, even as the competitive environment becomes more sophisticated and price driven.

Summary

Alani Nu is a fast growing, women focused wellness brand founded in 2018, generating $595 million in revenue and $87 million in EBITDA in 2024. Initially a supplements business, it rapidly expanded into sugar free energy drinks, snacks, fitness supplements, and wellness essentials, surpassing $1 billion in retail sales by 2025 and achieving a private valuation above $3 billion. The brand targets Gen Z and millennial women, with roughly 92% of its 2.1 million social media followers being female, reinforced by high profile collaborations with celebrities such as Kim Kardashian and Paris Hilton. Positioned as a premium option priced above Red Bull and Monster but slightly below Ghost and Celsius, Alani Nu competes in a market dominated by large incumbents and remains heavily concentrated in North America, leaving it exposed to intensifying competition and the challenges of international expansion.

Motivation

For Celsius, the acquisition of Alani Nu is primarily about accelerating strategic growth and reinforcing its position at the centre of the functional lifestyle movement. The deal creates a leading functional lifestyle platform aligned with structural consumer shifts towards premium, health-focused beverage options.

Strategic Growth & Market Positioning

By combining two fast-growing, scaled energy brands, the acquisition enhances Celsius’ strategic positioning as an innovative leader in the global energy category. Celsius historically targeted performance oriented, gym focused consumers, while Alani Nu has built a strong franchise among Gen Z and millennial women who approach energy consumption through a wellness and lifestyle lens. The combined portfolio therefore broadens Celsius’ consumer reach, enabling the company to address a wider spectrum of demographics and usage occasions without damaging its existing base.

Consumer & Category Expansion

From a consumer and category standpoint, Alani Nu brings complementary brand positioning and highly attractive demographics. Celsius gains access to a fast-growing audience that may have been underserved by its legacy core brand, while at the same time diversifying its offering beyond energy drinks into adjacent categories such as snacks and protein bars. This opens a pathway for Celsius to build a multi category functional lifestyle platform, extending its relevance from energy drinks.

The acquisition also substantially depends Celsius’ access to social and influencer driven marketing channels. Combining Celsius’ scale and operational discipline with Alani Nu’s cultural resonance positions the joint company to compete more effectively against digitally adept brands such as PRIME and Ghost, which have used creator budgets and algorithm optimised campaigns to dominate the online conversation.

Financial & Operational Synergies

Celsius expects the transaction to enhance its topline growth algorithm and to be cash EPS accretive in the first full year, supported by $50 million in expected cost synergies. For Alani Nu joining Celsius offers access to PepsiCo’s and Celsius’ integrated supply chains and international distribution infrastructure, enabling its products to reach countries, retailers, and small stores that were previously difficult to serve.

From Alani Nu’s perspective, the deal also reflects an assessment of the competitive landscape. Giants like Monster Energy have recognised the potential of female focused marketing and launched FLRT and similar offerings to directly contest Alanu Nu’s position. By joining Celsius, Alani Nu gains the supply chain robustness, scale and platform support needed to maintain its completive edge. In a market where PRIME, Ghost, and Red Bull increasingly dominate the influencer and creator ecosystem.

Deal Navigation

Regulatory Considerations

Navigating the regulatory and contractual landscape was a key part of completing Celsius Holdings’ acquisition of Alani Nu. The transaction required the creation of a holding company to consolidate the sellers’ interests before the deal could close, along with a detailed Registration Rights Agreement to ensure the stock portion of the consideration could be legally resold under U.S. securities laws. In parallel, the companies executed a transition services agreement to maintain operational continuity, while standard representations, warranties, and covenants protected both sides and ensured compliance with SEC regulations.

Financing Structure

Financed through a combination of debt and newly issued shares, Celsius Holdings’ acquisition of Alani Nu results in a net purchase price of about $1.65 billion. The company has secured $900 million in committed debt financing and is contributing roughly $375 million of existing cash. This funding mix keeps leverage at a relatively restrained level, with net debt expected to settle near 1.0x EBITDA on a pro forma basis. This is generally considered manageable for a consumer business with strong underlying cash generation.

The equity component, amounting to approximately $500 million in restricted shares or about 22.5 million new shares, leaves the founders of Alani Nu and Congo Brands with just under 9% pro forma ownership. While this introduces some dilution for existing shareholders, the two-year staggered release of these shares creates a clear alignment of incentives between new and existing owners. The company expects the transaction to lift cash earnings per share in the first full year, with further benefits anticipated as $50 million of projected cost synergies are realised.

Integration

Key Integration Metrics:

Combined annual revenue of approximately $2.7 billion

$50 Millon in projected cost synergies achievable within 18-24 months

Alani Nu maintains operational autonomy with shared strategic oversight

Congo Brands leadership to remain as strategic advisors

To ensure a smooth integration, preserving Alani Nu’s distinctive brand identity and community whilst leveraging Celsius’ operational scale and PepsiCo’s distribution infrastructure is crucial. Alani Nu’s core value resides in its cultural resonance with Gen Z and millennial women consumers, a demographic representing one of the fastest growing segments in functional beverages. Maintaining this authenticity whilst integrating operational systems requires carful balance.

Operationally, integration focuses on supply chain consolidation, distribution optimisation and cost synergy realisation. PepsiCo’s extensive North American and international distribution network enables Alani Nu to expand significantly into smaller retailers and convenience channels.

Alani Nu’s diverse product portfolio of energy drinks, snacks, protein bars, and wellness supplements, complements Celsius’ energy drinks focus rather than consuming it. Cross leveraging distribution, marketing and supply chain efficiency across both brands unlocks incremental shelf space and extends addressable market reach without product consolidation.

The projected $50 million in cost synergies derives from rationalising overlapping SG&A functions, consolidating supplier contracts for volume discounts and optimising manufacturing across combined facilities. These synergies are expected within 18-24 months, a realistic timeline given Alani Nu’s established operations and Congo Brands continued engagement during transition.

Talent retention, particularly within Alani Nu’s influencer relations and marketing teams, remains critical. Celsius’ commitment to maintain core leadership and advisory structures preserves institutional knowledge and brand authenticity. This approach allows operational integration of back-office functions whilst preserving brand specific marketing autonomy for the first 12 months.

Finally, the acquisition accelerates international expansion. Alani Nu’s North American credibility combined with Celsius’ PepsiCo partnership opens pathways into Europe, Aisa and emerging markets.

Valuation

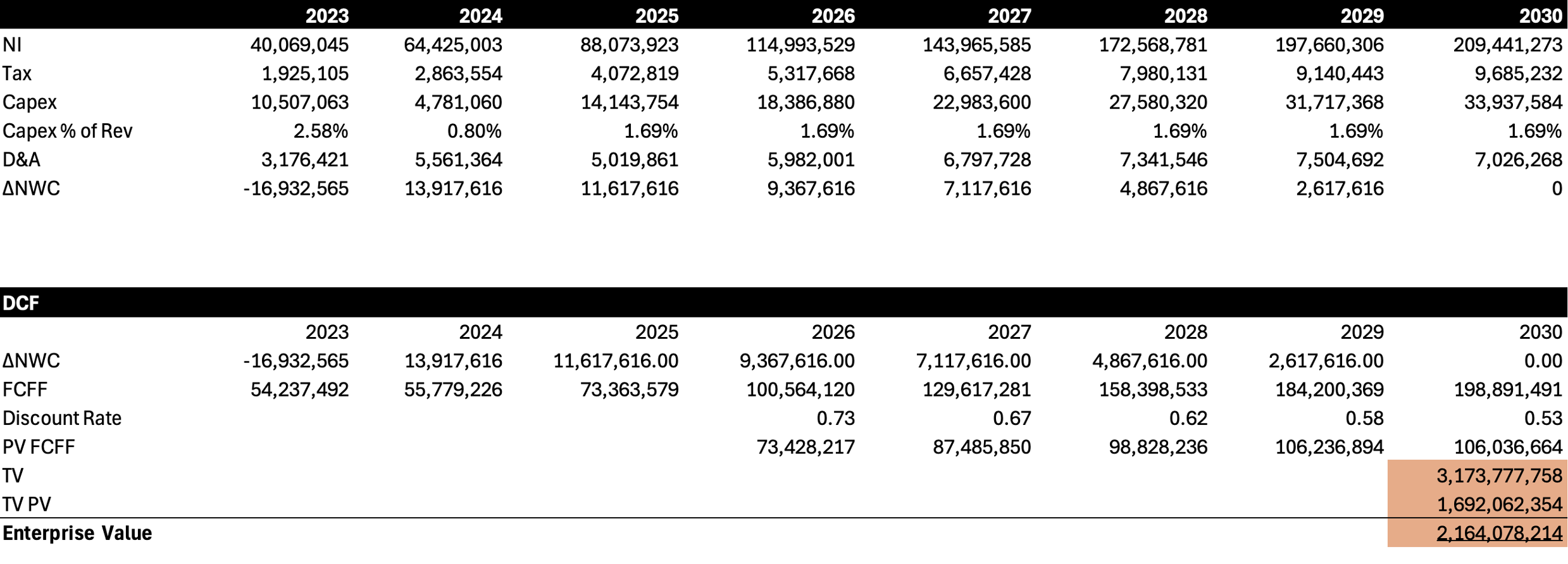

DCF

Our base case indicates an enterprise value of ~$2.2 billion. This valuation was derived using a WACC of 8.18% and a TGR of 1.8%, which are conservative but reasonable assumptions for a high-growth consumer brand. The agreed purchase price of ~$1.8 billion represents a notable discount on the modelled intrinsic value, suggesting Celsius was able to secure the asset at a price that does not fully capitalise its standalone growth potential.

Several factors explain the gap between the DCF derived value and the observed transaction price. First, private markets often exhibit lower pricing efficiency than competitive public auctions, especially when the buyer universe is narrow. In the absence of strong competing bids, sellers may accept a price below theoretical fair value, unlike high-profile situations such as the bidding war between Paramount and Netflix where valuations are driven closer to, or even above, intrinsic estimates.

Negotiating dynamics likely also played a role. Celsius entered the transaction with experienced management, strong backing from PepsiCo and a track record of successful execution, whereas Alani Nu’s leadership, is comparatively less experienced. This imbalance may have afforded Celsius greater leverage in negotiations.

Furthermore, buyers often adopt more cautious assumptions when underwriting acquisitions of private business with limited financial history or comparatively short operating track records. Based on the model’s revenue trajectory, the agreed sale price would be consistent with more pessimistic combinations of WACC and terminal growth than the base case inputs of 8.18% and 1.8%, reflecting a risk premium for uncertainty and the absence of public market transparency.

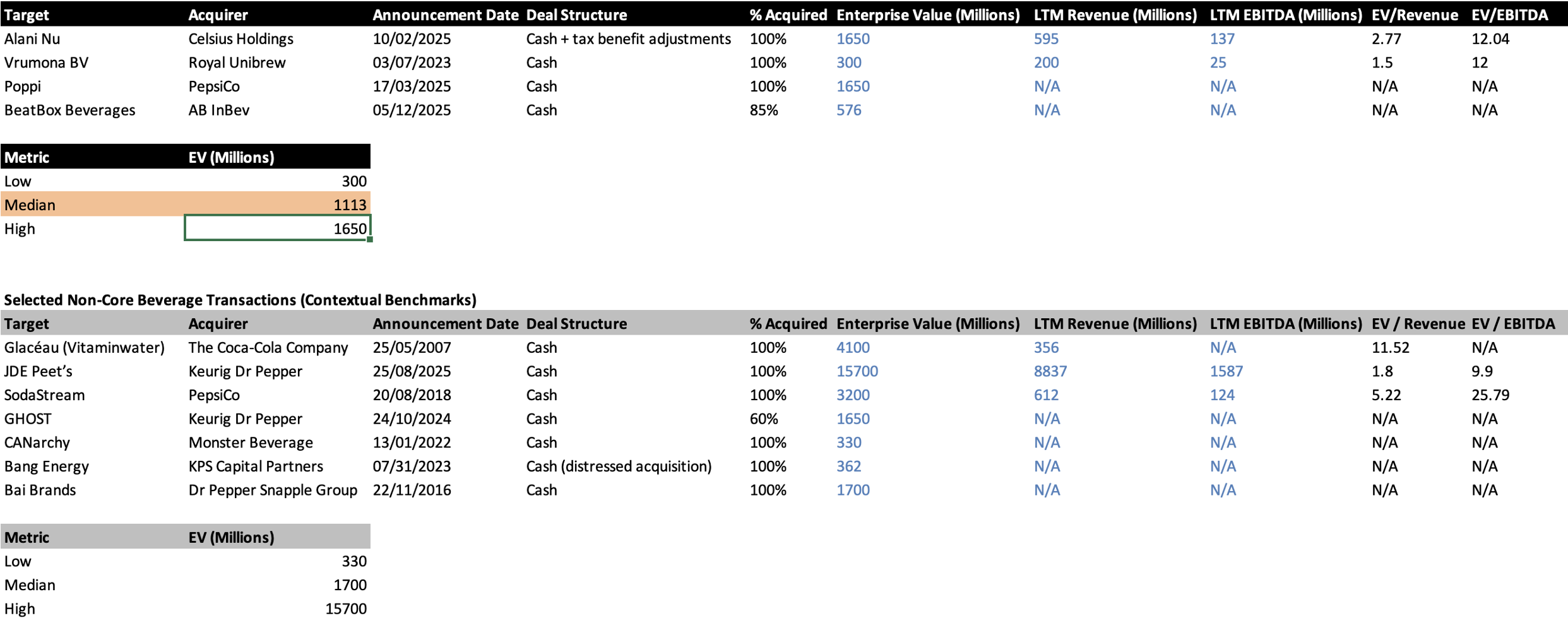

Precedent Transaction

The precedent transaction analysis supports the view that the deal was fairly, if not attractively, valued. Celsius’ acquisition of Alani Nu at 2.8x LTM revenue is consistent with core precedent transactions involving functional, better-for-you beverage brands. Selected non-core beverage acquisitions have historically traded at higher revenue multiples largely reflecting greater scale, broader portfolios and more established distribution. On an earnings basis, Alani Nu’s 12.0x LTM EBITDA multiple sits within the observed range and is consistent with other comparable beverage transactions.

Overall, the $1.65-$1.8 billion transaction value places the acquisition at the upper end of observed core precedent deal values in absolute terms, but not in terms of multiples. This position is consistent with Alani Nu’s strong growth profile and attractive margins while still offering Celsius meaningful upside relative to intrinsic value estimates if it can successfully deliver the anticipated synergies and growth trajectory.

Risks

Team Retention - Alani Nu’s value is deeply tied to its founders’ influence and agile, influencer driven marketing model. Loss of creative autonomy or perceived “corporatisation” could alienate its core Gen Z and millennial female community, whilst any departure of key marketing teams would erode competitive advantage.

Completive Landscape - Competitive retaliation poses a significant external threat. Established companies like Monster and Red Bull have vast resources and have already launched counter products targeting the female wellness demographic. Aggressive pricing strategies or retail exclusivity mandates could impede the combined entities shelf space expansion.

PepsiCo Reliance -Distribution concentration risk is elevated. Celsius already derives 59.4% of revenue through PepsiCo; add Alani Nu into this same network deepens dependence on a single partner. Any distribution to the PepsiCo relationship would now simultaneously impact both major revenue streams.

Shifting Tastes - Consumer preference volatility remains intrinsic to the category. The better-for-you energy drink segment is driven by rapid health trends and ingredient popularity. If consumer tastes shift toward legacy brands or emerging functional ingredients where Alani Nu is less established, growth rates could decelerate significantly.

Integration - Finally, most moderate of the risk factors but still worth highlighting is the integration risk. While proforma leverage of ~1.0x EBITDA is conservative, the deal requires $900 million in new debt. If anticipated $50 million cost synergies are delayed due to supply chain or IT harmonisation complexities, the deal’s accretive profile could be diluted. Managing two high growth brands simultaneously also risks diverting management focus from core Celsius operations.

House View

The deal combines a mature, operationally experienced buyer with a high-growth, culturally resonant brand, creating a platform positioned to compete effectively against legacy brands. The transaction strengthens Celsius’ exposure to the fast-growing, better-for-you wellness space and gives it access to a consumer group it was previously less dominant in. The 18-20% discount reflects private market illiquidity and Celsius’ superior negotiating position, providing meaningful upside if integration is executed successfully.

The acquisition’s success hinges on cultural preservation and execution discipline. Alani Nu’s value resides in brand authenticity, influencer partnerships and community engagement, assets easily eroded by heavy handed integration. Celsius must balance cost synergy realisation with protecting the agile, social first marketing that drove Alani Nu’s growth. Crucially, the deal allows Celsius to build a broader functional lifestyle platform, using PepsiCo’s distribution reach and its own operating scale to accelerate Alani Nu’s expansion both domestically and internationally.