Stryker’s $4.9 Bn Acquisition of Inari Medical

‘Riding the silver tsunami’

Deal Overview

Acquirer: Stryker

Target: Inari Medical Ltd

Total Transaction Size: $4.9 billion

Consideration Mix: All-cash transaction at $80.00 per share

Closing date: 19 February 2025 (Q1)

On February 19, 2025, Stryker closed a deal to acquire Inari Medical, a provider of VTE clot removal solutions without the use of thrombolytic drugs, for a final transaction fee of $4.9 billion. The deal is positioned to be one of the most important breakthroughs in vascular health this decade, helping to improve surgical outcomes globally.

$80 a share is a standard premium, 30%, across similar Medtech M&A deals. Stryker’s rationale behind the acquisition is crystal clear: they are buying a company that has both proven financial success and a differentiated product portfolio that is becoming increasingly demanded by healthcare providers – safer treatments for blood clots. All in all, this positions Stryker to dominate, not just participate in the peripheral vascular market, leveraging their commercial synergies to sell Inari’s devices worldwide and more importantly, diversify their own revenue streams.

Company Details: Acquirer – Stryker

Founded: 1941

CEO: Kevin Lobo (since 2012)

Market Cap: ~ $140-145bn

LTM Revenue: ~ $21-22bn (FY2023: $20.5bn)

LTM EBITDA: ~ $5.5-6bn

P/E Ratio: ~ 35-40X

History

Stryker Corporation was founded in 1941 by Dr. Homer Stryker, an orthopaedic surgeon from Kalamazoo, Michigan who is also credited for medical inventions such as the mobile hospital bed (the Circ-O-Lectric bed) and the oscillating saw for removing plaster cuts. The company went public in 1979 and began to build a reputation within MedTech, particularly specialised in orthopaedic implants and surgical equipment.

In the last half-decade, Stryker, under the leadership of John Brown (1977-2003) helped diversify the company’s MedTech portfolio. Stryker expanded beyond orthopaedics into neurotechnology, spine and minimally invasive solutions, including robotic and assisted surgeries through aggressive organic growth and strategic M&A deals.

The past 18 years saw Stryker close a number of tuck-in acquisitions; they entered the neurotechnology segment through the purchase of Howmedica (1997), bought MAKO Surgical for their expertise in robotic-arm assisted surgery (2013), Sage Products for $2.78bn for their infection protection solutions (2016), K2M Group for $1.4bn for their complex spine and minimally invasive treatments (2019) and Wright Medical Group for $5.4bn. The INARI deal represents one of the larger strategic moves Stryker has made to date, signalling their ambition to expand into vascular treatments.

Product Lines

As of 2025, Stryker’s operations consisted of two core product segments:

MedSurg and Neurotechnology: This segment accounts for 55% of Stryker’s revenue on average, delivering about $13.5 billion in FY2024; MedSurg sale of surgical equipment, endoscopy, navigation and communications systems; their neurotech capabilities have soared in the past 20 years, selling products like ENT and neurosurgical products. While simultaneously improving their neurovascular offering by developing products to treat Ischemic and haemorrhagic strokes, this segment remains as their Achilles heel. This highlights their rationale for acquiring Inari as the latter ‘s niche expertise in VTE treatments can fill this void in Stryker’s portfolio.

Orthopaedics and Spine: This segment accounts for 45% of Stryker’s revenue on average. Part of the company’s offering is that they provide joint replacements for hips, knees, shoulders and more as well as access to the MAKO robotics system, Stryker’s market-leading robotic-assisted surgery platform. Orthopaedic robotics is a segment that the company dominate, and they produce similar results in both complex spine and minimally invasive solutions. Albeit Stryker are trailing in the joints segment to Zimmer Biomet.

Strengths

Very large scale and financial strength: In 2024, Stryker generated USD22.6 billion in net sales; annual revenue jumped by 10.23% in 2024 (Stryker Corporation, 2025b); The company employs around 53,000 people in 75+ countries – their financial and operational scale enable Stryker to benefit from huge economies of scale and access international markets with ease, developing more tailored and resilient medical solutions.

Stryker’s diversified product portfolio reduces their reliance on a single segment or product line, helping to mitigate risk from regulatory and demand fluctuations – which is paramount in the Medtech space.

Strong innovation and technology-driven solutions: Stryker invests heavily into R&D; technological expertise has enabled them to produce complex implants like porous metal spine implants more efficiently, improving profit margins while offering differentiated solutions.

Geographical Reach: while 70% of Stryker’s annual revenue comes from the USA, the company has an established presence in Europe and is strengthening its operations in the Asia-Pacific and other emerging markets in LEDCs as part of its long-term growth strategy.

Challenges

High acquisition dependence to sustain growth: Shown by their previous ventures in neurotechnology and other product segments, Stryker’s growth engine has been propelled mainly by tuck-ins and other strategic M&A deals rather than sustainable, product-led growth. All of this is enough to raise the eyebrows of strategic on-lookers – there is a clear execution risk associated with integration, the product overlap or lack thereof and coordination of Stryker’s various product lines.

Regulatory concerns across portfolio: Stryker faces potentially serious regulatory challenges across its diversified product portfolio, with compliance requirements differing by geography. All in all, Stryker operates in an industry with arguably the most stringent regulations, necessitating a watertight and tailored approach to maximise both theirs and Inari’s global revenue potential.

Structural changes: There has been a growth decline in Stryker’s largest revenue segment – orthopaedics – to an annual rate of 3-4% in developed countries, creating a growth ceiling. Factors such as fading demographic tailwinds, commoditisation pressures and more long-lasting implants thanks to modern surgical techniques have reduced the global demand for revision surgeries, contributing to the segment’s decline in recent decades.

Heated competitive landscape: Stryker’s competitors like Johnson & Johnson and Boston Scientific are showing a willingness to expand in the cardiovascular market by bidding aggressively for high-growth MedTechs through the acquisitions of Shockwave (2024, $13.1bn) and Bolt Medical (2025, $0.7bn) respectively. Stryker’s current buy-to-grow model is not a sustainable strategy – a long-term trajectory should rest on Stryker’s ability to develop growth solutions organically through product innovation and hospital deals. Pre-Inari, Stryker was weak in venous thrombectomy and PE, the fastest growing segment in vascular treatment (SPINEMarketGroup, 2025). Unlike some of their fiercest competitors, despite having peripheral vascular capabilities, Stryker lacked a flagship VTE product, meaning that they were missing out on a potentially lucrative revenue stream.

Strategy

This is a Porter’s Five Forces Analysis on Stryker.

Rivalry amongst existing competitors (Very High): Stryker operates in an ultra-competitive industry with a strong regulatory climate. One of Stryker’s key rivals, MedTronic, recorded a 2024 revenue of $32 billion, signalling a large market presence. Many of their other MedTech competitors, like J&J and Zimmer Biomet, are also making significant headway into robotics, artificial intelligence and machine learning in their product offerings complemented by their extensive marketing campaigns, while also conducting strategic M&A deals to strengthen their portfolios. 2024 saw over $70bn worth of acquisitions in the medical device industry. In order to maintain pace with the rapidly expanding sector, Stryker has ramped up R&D investment in recent years to $1.1 billion in 2024. One of Stryker’s most important revenue drivers is innovation, in which new products are developed as well as improving existing surgical treatments, such as their aesthetic look, functionality and effectiveness.

Threat of new entrants (Low): The expanding MedTech industry has made regulatory approval for medical devices more complex, requiring significant upfront R&D investment to build effective treatments that are FDA-compliant. In a 2024 earnings call for example, management noted adjusted R&D spending of roughly 6.6% of sales for the third quarter (Investing.com, 2024). Paired with the fact that incumbents like Stryker already have an established set of distribution channels with medical professionals, experts and surgeons make it incredibly difficult for new entrants to replicate, meaning that the barriers to entry into the MedTech market are high. Therefore, niche start-ups amplify their threat level when Stryker’s competitors absorb them into their portfolio.

Bargaining power of suppliers (Moderate): Stryker relies on niche components to build many of their sophisticated products (robotics etc.). Advanced suppliers have specific certification requirements that are regulatory-compliant that smaller firms may not have, which they can use potentially as leverage against MedTechs like Stryker. However, Stryker’s strength in the industry largely negates this, owing to the fact that their global distribution channels are relatively secure compared to smaller competitors.

Bargaining power of buyers (High): Hospitals and other healthcare institutions prefer low-cost, safe surgical treatments that maintain an adequate level of quality as well as an integrated array of clinical offerings (Gulati et.al, 2019). Therefore, Stryker is inclined to widen its clinical pathways in line with hospital preferences, strengthening loyalty with large clients who prefer fewer vendors across multiple therapy areas.

Threat of Substitutes (Moderate): Advanced analytics and non-device-intervention are growing trends in the digitalisation of health, but MedSurg markets still predominantly favour devices, shown by Stryker’s sustained revenue growth by ~10% annually. Globally, robotic surgical tools have become a multi-billion-dollar market (~8.1 billion USD in 2024) and is projected to exceed USD 21 billion by 2031, fuelled by the rapid integration of machine learning and automation capabilities into surgery. However, Stryker has already captured value on both sides of the transition, with its flagship robotics system, ‘MAKO’, being offered as a solution in its orthopaedics arm, and is competing against rival robotics systems like MedTronic’s ‘Hugo’. Therefore, the genuine threat of substitutes is moderate.

Summary

In 2025, Stryker has positioned itself as an authoritative power in the MedTech, MedSurg and robotics sectors owing to its diversified product offering, its strong relationships with suppliers and medical professionals and its proven ability to adapt to an evolving regulatory climate. Stryker’s financials appear to be very promising both in the short and long term, as its augmenting revenue and sales is paired with positive R&D investment.

However, the company’s dependence on its buy-to-grow model is an unsustainable growth strategy, especially as many of Stryker’s rivals are pursuing product-led innovation, and integrating emerging technologies like AI, robotics and machine learning into their product offerings. Genuine growth requires an expansion of Stryker’s product portfolio, which should be achieved by a mixture of product innovation and strategic M&A.

Company Details: Target – Inari Medical

Founded: 2011

CEO: Andrew J. Drew Hykes

Market Cap: ~$4.7 billion

LTM Revenue: ~$574 million

LTM EBITDA: ~$(26) million

P/E: N/A

History

Inari Medical was founded in 2011 as a Delaware corporation, with the name change coming into force in 2013. Headquartered in Irvine, California, Inari set out its mission to develop minimally invasive catheter-based medical devices to treat a range of vascular issues. The most predominant of these issues is venous thromboembolism or VTE, a disease caused by blood clot formation in bodily veins and is a leading cause of death and disability globally (Lutsey and Zakai, 2022). Notable examples of VTE include deep-vein thrombosis (DVT), which causes pain and tenderness usually on the calf or thigh, and pulmonary embolism (PE). Symptoms of PE are not restricted to shortness of breath, chest pain that gets worse with deep breaths, rapid heart rate, coughing or fainting.

Inari went public on the NASDAQ in May 2020, granting it access to broader capital markets, with evidence suggesting that it triggered the company’s revenue expansion in the past 5 years.

In November 2023, Inari completed the acquisition of LimFlow S.A. for up to $415 million, a French medical device company focused on treatments for chronic limb-threatening ischemia (CLTI), in which you have significant blockages in the blood flow to your arms, legs or feet. CLTI is the most advanced stage of peripheral artery disease that is associated with increased mortality, risk of amputation and significantly impaired quality of life (Cleveland Clinic, 2022). The deal added LimFlow’s unique, FDA-approved system that restores blood-flow in deep veins for patients facing amputation to Inari’s already extensive vascular capacities.

Product Lines

Inari Medical specialises in catheter-based mechanical thrombectomy devices designed to treat venous and arterial thromboembolic diseases (VTE) without the use of thrombolytic drugs.

PE Stream – Inari’s main offer for PE is their award-winning Flowtriever® system, paired with its dependent adjunct, the FlowSaver® Blood Return System. The FlowTriever is a mechanical thrombectomy system designed to physically remove clots from the pulmonary arteries without thrombolytic drugs. In conjunction, these integrated systems, which are 510(k) cleared by the FDA, avoiding the dangers associated with thrombolytic medication. Various clinical data including from the PEERLESS trial consistently show fewer ICU admissions, shorter hospital stays and less frequent post-surgical complications like infections when using FlowTriever compared to using thrombolytic drugs. While Inari does not provide a reliable revenue split between FlowTriever and ClotTriever, their main two product lines, market data and financial reports suggest that FlowTriever is generally their main revenue driver, accounting for approximately 65% of their total revenues.

DVT Stream – The ClotTriever system is Inari’s main treatment for DVT and peripheral thrombosis. Unlike FlowTriever which treats clots in the lungs, ClotTriever is used to remove blood clots in the legs in one session, including older clots that drug treatments fail to clear. The medical impact of Inari’s flagship DVT product is like its PE counterpart: patients are less likely to suffer long-term leg pain and thus require less repeat procedures, lowering lifetime treatment costs for hospitals.

Together, the ClotTriever and FlowTriever are Inari’s answer to VTE complications both pre- and post-surgery. Clinical data cited by Inari indicate that across the pair, they offer faster patient stabilisation relative to drug-related therapies, with measures of heart strain improving by almost 30% within 48 hours while maintaining major bleeding risk to around 1% (Tu et al.).

Strengths

First-mover advantage: Inari have positioned themselves at the right time to address the inadequacy of current VTE treatments: aging populations increasing VTE incidence, growing obesity rates globally, increased diagnosis due to more powerful imaging and a post-Covid realisation of the risk of heightened vascular risk in hospitalised patients. The VTE Treatment market is projected to reach $4.40 billion by 2030 at a CAGR of 7.2% from 2023 to 2030 (meticulousresearch.com, 2023).

Expanding clinical applications – Through its 2023 acquisition of LimFlow, Inari has moved into treating severe peripheral arterial disease, expanding its product offering beyond PE and DVT as well as their total addressable market.

Strong revenue trajectory: Inari’s revenue numbers are very promising, which is typical for a high-growth MedTech company. The company grew from approximately $48M in 2019 to over $500M by 2023, almost an 80% CAGR during that period.

Challenges

Increasing competitive pressure in mechanical thrombectomy: The mechanical thrombectomy market is becoming increasingly saturated, with major players like Penumbra and Boston Scientific developing newer generation devices like Lightning Flash 2.0 and AngioJet respectively, improving their thrombectomy performance relative to Inari. A STRIKE-PE trial analysed 150 PE patients treated with Penumbra’s flagship VTE treatment using computer-assisted vacuum thrombectomy (CAVT) software observed significant clinical and functional improvements such as a major adverse event rate of 2.7% (Endovascular Today, 2023). Inari – while a leader in the VTE space, faces competition from larger peers that are producing larger revenues (Penumbra made over $1 billion in revenue in 2023), while companies in the wider MedTech industry like MedTronic and J&J can enter the mechanical thrombectomy market organically or via acquisition.

Structural margin pressure despite scale: Despite a strong gross profit margin of ~88% paired with the fact that revenue is projected to grow at ~19.5% CAGR from 2023 to 2028E, operating losses widen from $14M to $27.7M over the same period, highlighting how Inari’s OpEx is scaling faster than its revenues. This can potentially explained by increasing Medtech competition mentioned earlier, and thus SG&A expenses accounting for around 73% of revenue and a sustained R&D spend of ~17% is realistic for Inari given the significant costs of clinical trials, equipment procurement, hospital supply deals and regulatory compliance.

Motivation

For Stryker

Acquisition of clinically approved VTE treatments: The acquisition of Inari enables Stryker to absorb a high-growth player in the peripheral vascular market with a regulator-approved and award-winning portfolio of VTE treatments. While its target’s gross margins look promising at 88%, Inari has felt a profitability downturn as its SG&A and R&D expenses ramp up (natural for a growing MedTech). Under Stryker however, these costs can be diluted by the global scale of their research, medical infrastructure and supply contracts with healthcare institutions across continents.

Accelerate time-to-market through Inari’s platform: Developing a mechanical thrombectomy device organically would take years, requiring significant R&D, clinical trials, due diligences from medical professionals and regulators alike before it hits market, meaning that developing an effective product is insufficient. The acquisition of Inari enables Stryker to bypass these risks by internalising Inari’s ClotTriever and Flowtriever systems, recognised by medical research companies like EvaluateMedTech and EvaluatePharma as a ‘category leader in U.S. mechanical thrombectomy for VTE’.

For Inari Medical

Better patient outcomes: As a high-growth MedTech, Inari’s company profile is very much research-driven in a niche market like mechanical thrombectomy. In terms of product delivery, Inari can suffer from longer development timelines and larger capital requirement which fuel execution risk, with the reason being that they lack established relationships with medical regulators. Stryker acquiring Inari offers the latter access to broader regulatory expertise, manufacturing scale and already-developed links with healthcare providers, aligning with Inari’s objectives to deliver expert ‘solutions to both unmet and undeserved health needs’ wherever they are needed (Stryker, 2025).

Global expansion at lower cost: The deal positions Inari as an important cog in Stryker’s growth strategy and grants the VTE experts with immediate access to Stryker’s global hospital networks, distribution channels and established relationships with regulators in overseas markets like the EU, China, Japan and the United Kingdom. For Inari, the huge benefit is that they can scale their flagship VTE and emerging therapies like InThrill, LimFlow and VenaCore internationally without the need to duplicate Stryker’s infrastructural investments.

Realising value for Inari’s shareholders: For Inari’s shareholders, the transaction reflects immediate liquidity and valuation certainty, easing the metaphorical pain they’ll be suffering on the company’s long road to profitability. In the backdrop of strong revenue growth via a 20% CAGR from 2023 to 2028E (model), Inari’s operating expenses widen as cash burn ramps up from R&D with their cash flow forecasted to exceed $200 million by 2030E. Given Inari’s risky cash profile, the sale enables shareholders to lock in value at a strategic premium while scaling Inari’s vascular platform.

Deal Navigation

Regulatory and Legal

The deal’s first legal hurdle was U.S Antitrust clearance under the Hart-Scott-Rodino Act filed on Jan 17th 2025, but quickly passed in a month due to the minimal horizontal overlap between Inari and Stryker’s portfolios, implying that the acquisition represented a market-entry for the latter rather than consolidating monopoly power.

In August 2024, Inari’s ClotTriever was handed a FDA Class I recall, the most serious recall classification a medical product can receive in the US, amid reports of serious adverse events when the catheter became entrapped and caused a blockage of lung arteries, including 4 injuries and 6 deaths. Having inherited Inari 6 months later, Stryker is now responsible for managing potential product liability claims related to the 4 casualties and 6 deaths linked to the Class I recall as well as updating the IFU in line with specific FDA instructions in order to prevent future complications resulting from misuse of their products.

Financing Structure

Stryker agreed to acquire all of the issued and outstanding shares of common stock of Inari Medical, Inc. for $80 per share, with a fully diluted equity value of $4.9bn. The funding mix included $3 billion of new debt issuance, consisting of four series of notes with maturities ranging from 2027 to 2035 bearing interest rates from 4.550% to 5.200% (Investing.com, 2025). The remaining $1.9 billion is to be financed by cash on hand.

Moody’s upgraded Stryker’s credit rating to A3 in June 2025, 4 months after the deal closed, reflecting credit investors’ expectation that Stryker will ‘continue strong growth across its business segments’ as well as ‘robust free cash flow that will fund research and development’ and their M&A strategy (Investing.com, 2025).

Shareholder Return Targets

Stryker has suggested that the Inari acquisition will be dilutive to adjusted EPS in the near term, estimating $0.20 to $0.30 of dilution to 2025 earnings (GlobalNewsWire, 2025), though the deal is immediately accretive to revenue growth. Management ‘generally targets to get back to WACC’ within five to seven years as synergies from public company cost elimination, SG&A leverage and international expansion materialise (Investing.com, 2025)

.While funding the deal pushed net leverage from 1.2x to 1.9x EBITDA, credit agencies expect Stryker to maintain leverage at around 2.75x or below as they implement ‘margin expansion initiatives’ (Investing.com, 2025).

Investor communications position Inari as the pillar of Stryker’s peripheral vascular strategy, with CEO Kevin Lobo emphasising that the company ‘remains confident in [our] ability to deliver strong financial performance’ (Stryker, 2025).

Stryker’s decision to raise its quarterly dividend by 5% 1 month before the deal’s announcement signals management’s belief that the near-term EPS dilution was temporary and should not alter its commitment to shareholder returns (Stryker, 2025).

Integration

The ‘Silver Tsunami’

The integration of Inari’s vascular expertise into Stryker is critical in order to realise the medical benefits to VTE patients globally, as well as the deal’s financial and strategic value for the latter.

Overall, there has been a growing impetus for safer treatments for VTE concurrent with advancements in artificial intelligence and machine learning - Stryker’s competitors are trying to differentiate their product offering by ramping up investments into these technologies.

A substantial and accelerating surge in the US senior population aged 65 and over by almost 40% between 2010 and 2020 has also increased demand in the USA for medical devices and procedures relating to age-related conditions like blood clots, meaning that Stryker’s recent acquisition positions them to benefit from this silver tsunami (US Census Bureau, 2019).

Conversely, the reliance on aging populations as their target customer base makes them susceptible to changes in healthcare policy and longer-term demographic shifts.

Synergy Alignment

The acquisition has centred both Stryker and Inari Medical to reap immense strategic benefit.

By gaining access to Inari’s innovative vascular treatments like FlowTriever and ClotTriever, Stryker is poised to expand into the vascular intervention market, thereby exploiting surging global demand for safer VTE treatments.

Likewise, Inari’s main synergy is the opportunity to scale up its operations. Stryker’s close relationships with hospitals and medical professionals will boost Inari’s global reach and customer base and will have the license to ramp up R&D investment thanks to Stryker’s superior financial resources, strengthening the target’s clinical innovation pipeline and product quality.

The deal represents something much more than Stryker’s one-sided entry into the vascular intervention market – it marks the strategic convergence of the companies’ commercial strategies and priorities.

Leadership Changes

In February 2025, Stryker announced that Allan Golston would retire from the Board of Directors after 14 years. Golston worked as Lead Director from 2016 to 2022, where he played an important role in setting Stryker’s corporate strategy, leveraging his extensive experience in healthcare and education to provide unique insights to the rest of the Stryker leadership.

The timing of this huge shift in leadership is critical for investors, given that the deal closed in the same month, who will be closely watching the process of finding Golston’s replacement as his successor’s background as well as their plans for Stryker’s long-term future will be factored in their assessment of the impact on Stryker’s financial performance by the end of FY2025.

Overall Integration Outlook

The Stryker-Inari acquisition has the potential to have a measurable impact in the MedTech industry, diverging from the recent industry precedent of bolt-on M&A deals with much smaller firms with less strategic value.

Stryker’s ‘extensive integration experience’ has been echoed according to management, citing their array of recent M&A deals, framing Inari as the next chess piece in their longstanding mission to improve healthcare outcomes rather than a short-term acquisition.

However, the ultimate value creation depends on whether Stryker can innovate newer generations of vascular treatment by actively leveraging Inari’s medical and regulatory expertise in developing catheter devices – the primary mechanism by which they can compete with the significant investments made by Medtronic, J&J and Boston Scientific.

Performance and Valuation

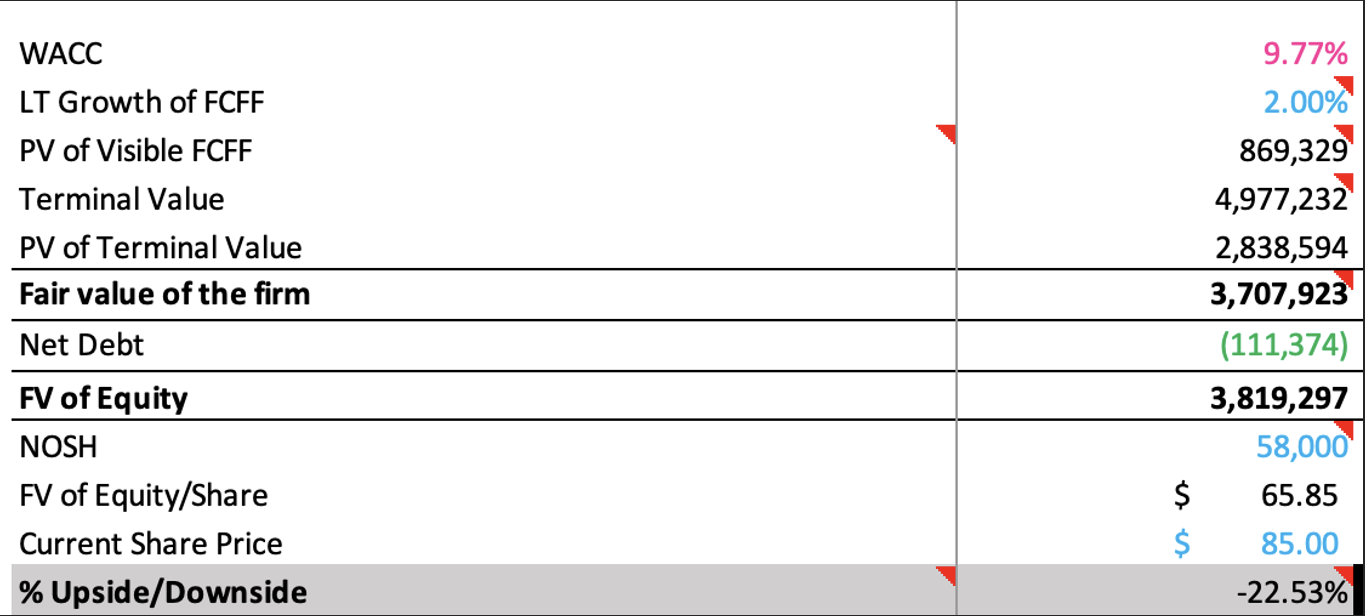

A discounted cash flow model was selected given the absence of direct public comparables with a similar product portfolio and growth profile to Inari. The closest companies, including Penumbra, AngioDynamics and Teleflex, all have more diversified portfolios, meaning a comps analysis would be less reliable.

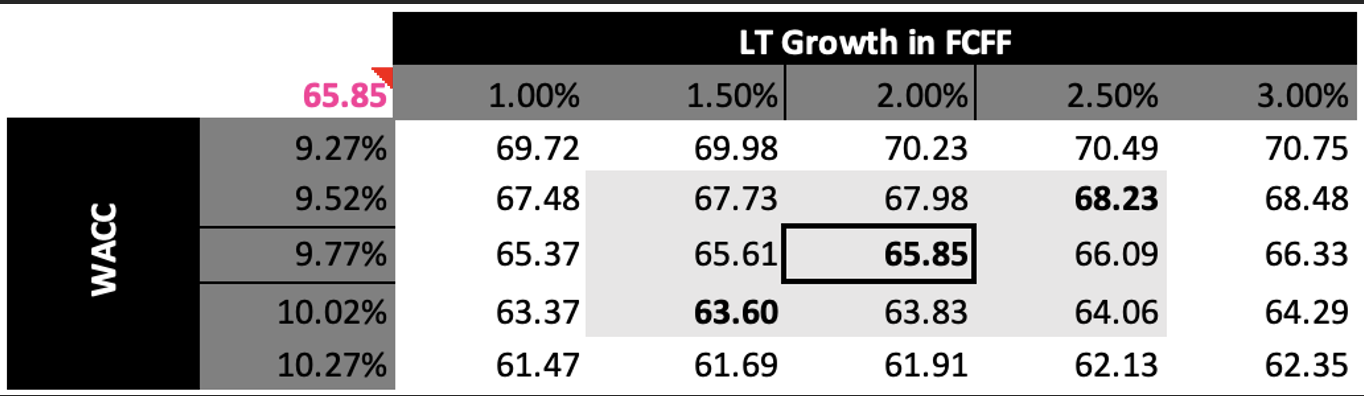

The sensitivity analysis shows fair values ranging from approximately $61 to $71 per share, adjusting for WACC and long-term growth in FCFF assumptions.

I calculated a WACC value of 9.77%, reflecting Inari’s all-equity capital structure at the time of acquisition. The cost of equity included a risk-free rate of 4.17%, a relatively volatile beta of 1.200, typical of growth stage MedTechs, and an equity risk premium of 4.67% found by averaging latest figures from Kroll and Damodaran.

A terminal growth rate of 2.00% was applied, anchored to long-term US nominal GDP growth expectations. This reflects the assumption that Inari’s growth will stabilise in the mid to long term as the peripheral vascular market matures.

Overall, the DCF provides an implied fair equity value of $65.85 per share, approximately 23% below the acquisition price, suggesting that Stryker paid a premium for Inari.

Reasons for this strategic premium lie in the deal’s synergies for the surgical heavyweight: a launchpad for Stryker into the peripheral vascular sector with a range of award-winning, FDA 510(k)-cleared mechanical thrombectomy devices that are already producing over $600 million in annual sales, as well as long-term growth potential.

Risks

Regulatory Risks as Stryker scales Inari Internationally

Stryker’s acquisition positions Inari to scale its devices through its global distribution network into fast growing markets in the EU, Asia-Pacific and South America. However, Inari’s products currently only have regulatory clearance for the US market.

Medical device approvals from the NMPA in China can take 2-3 years, while Rule 11 of the EU MDR was updated in 2021 to move some Class I devices into higher risk Classes II and III, requiring special audit and documentation reviews, known as Conformity Assessments, to be completed by an independent Notified Body before the device can be sold in EU markets. EU MDR regulations have also tightened clinical evidence requirements; it has significantly raised the bar for equivalence data as clinical evidence, meaning manufacturers must now conduct more clinical trials.

While Inari’s ClotTriever and FlowTriever already have strong US clinical data from trials like PEERLESS and DEFIANCE, Stryker may be blocked from using them under the revised EU MDR and instead must comply with EU specific clinical investigation requirements. Expanding into each of these markets requires separate regulatory approval, increasing the time-to-market for Inari’s catheter devices.

Talent Retention Risk

In under a decade, Inari CEO Drew Hykes along with his founding team has built a niche business model that is projected to generate over $600 million – their wealth of experience in vascular technology can be an immense source of input for Stryker.

Inari’s sales model is client-focused and bespoke, fundamentally different from Stryker’s broader hospital sales approach.

Integrating these differing models can create challenges and amplifies the risk of losing key Inari personnel with specialised expertise of the VTE market. McKinsey consultants highlight that it is becoming a trend in MedTech for many founders and senior leaders to depart within a few years as integration and cultural friction build, despite buyers’ attempts to keep them, including earnouts and retention packages (McKinsey, 2025).

Potentially losing members of Inari’s clinical and R&D teams, who have extensive knowledge of catheter designs and regulations, could slow Stryker’s plans to expand Inari’s clinical pipeline at a time when innovation and product differentiation is paramount to keep pace with competitors in the accelerating peripheral vascular market.

Financial Risk

Acquiring Inari for $4.9 billion may increase Stryker’s opportunity cost. If a more attractive M&A option arises in the forthcoming 2-3 years, Stryker’s higher leverage limits their flexibility.

Buying at a 23% premium also represents a significant show of confidence in Inari’s future growth expectations.

Having also modelled Inari’s SG&A margin as elevated over the next 4 to 5 years as the company continues investing in its clinical pipeline, this is relatively expensive to maintain and, for Stryker, to scale internationally. From a management perspective, cost synergies may take longer to materialise, extending the timeline towards profitability.

House View

Viewpoint

Stryker’s acquisition of Inari Medical represents a concrete step into one of the fastest growing segments in MedTech – the peripheral vascular market.

Despite the acquirer paying a substantial 23% premium, it reflects the value of a market-leading company with a specialised VTE treatment portfolio spanning a range of FDA-cleared, award-winning mechanical thrombectomy devices.

Positive Signs

Strategic Fit – Inari’s niche expertise in mechanical thrombectomy solutions for blood clots fits into Stryker’s product portfolio seamlessly, offering a clear gateway into the peripheral vascular market.

Favourable Market conditions – The VTE market is projected to reach $4.4 billion by 2030, driven by aging senior populations, increased diagnosis, soaring obesity levels and the integration of artificial intelligence into treatments.

Emerging Risks

Integration execution – Retaining specialised talent from Inari’s ranks and preserving the culture that drove Inari’s success depends on how well their differing models integrate.

Rising competitive pressure – MedTech rivals like MedTronic, J&J and Boston Scientific are in the process of launching newer-generation mechanical thrombectomy devices with the help of artificial intelligence. The Inari acquisition alone does not guarantee market leadership in the peripheral vascular market – Stryker must accelerate R&D investment immediately in order to fully exploit their first-mover advantage.

International expansion - Expanding into Asia-Pacific, the EU and beyond requires separate regulatory approval, increasing the time-to-market for Inari’s catheter devices.

Forward Insight

The deal positions Stryker to benefit from the ‘silver tsunami’, as shifting demographic tailwinds concur with a growing demand for safer treatments against blood clots.

If Stryker can leverage its scale to expand Inari’s treatments globally, the acquisition can lead to significant long-term value creation, but execution across regulation, integration and competition is key.

References

Bullfincher (2015). Stryker Corporation Revenue. [online] Stryker Corporation Revenue 2015-2024 | Bullfincher. Available at: https://bullfincher.io/companies/stryker-corporation/revenue [Accessed 26 Dec. 2025].

Centers for Disease Control and Prevention (2024). Data and Statistics on Venous Thromboembolism. [online] Venous Thromboembolism (Blood Clots). Available at: https://www.cdc.gov/blood-clots/data-research/facts-stats/index.html.

Cleveland Clinic (2022). Critical Limb Ischemia: Causes, Symptoms and Treatment. [online] Cleveland Clinic. Available at: https://my.clevelandclinic.org/health/diseases/23120-critical-limb-ischemia.

Eakins, C., Samorezov, J. and Pfeiffer, P. (2025). Talent, tech, and team: The formula for medtech R&D success. [online] McKinsey & Company. Available at: https://www.mckinsey.com/industries/life-sciences/our-insights/talent-tech-and-team-the-formula-for-medtech-r-and-d-success.

Endovascular Today (2023). Interim Analysis Presented From STRIKE-PE Study of Penumbra’s Indigo Aspiration System. [online] Endovascular Today. Available at: https://evtoday.com/news/interim-analysis-presented-from-strike-pe-study-of-penumbras-indigo-aspiration-system [Accessed 26 Dec. 2025].

GlobalNewsWire (2025). Stryker reports first quarter 2025 operating results. [online] GlobeNewswire News Room. Available at: https://www.globenewswire.com/news-release/2025/05/01/3072811/0/en/Stryker-reports-first-quarter-2025-operating-results.html [Accessed 25 Dec. 2025].

Gulati, M., Henry, J., Llewellyn, C., Peters, N., Simon, C. and Tolub, G. (2019). Creating ‘beyond the product’ partnerships between providers and medtech players | McKinsey. [online] www.mckinsey.com. Available at: https://www.mckinsey.com/capabilities/operations/our-insights/creating-beyond-the-product-partnerships-between-providers-and-medtech-players.

Investing.com (2024). Earnings call: Stryker reports robust Q3 growth, raises 2024 outlook. [online] Investing.com UK. Available at: https://uk.investing.com/news/stock-market-news/earnings-call-stryker-reports-robust-q3-growth-raises-2024-outlook-93CH-3762835 [Accessed 26 Dec. 2025].

Investing.com (2025a). Earnings call transcript: Stryker Q4 2024 earnings beat forecasts. [online] Investing.com. Available at: https://www.investing.com/news/transcripts/earnings-call-transcript-stryker-q4-2024-earnings-beat-forecasts-93CH-3835717.

Investing.com (2025b). Moody’s upgrades Stryker Corporation to A3, outlook stable. [online] Investing.com UK. Available at: https://uk.investing.com/news/stock-market-news/moodys-upgrades-stryker-corporation-to-a3-outlook-stable-93CH-4138698 [Accessed 26 Dec. 2025].

Investing.com (2025c). Stryker issues $3 billion in new debt for Inari acquisition. [online] Investing.com UK. Available at: https://uk.investing.com/news/sec-filings/stryker-issues-3-billion-in-new-debt-for-inari-acquisition-93CH-3917037 [Accessed 26 Dec. 2025].

Lutsey, P.L. and Zakai, N.A. (2022). Epidemiology and prevention of venous thromboembolism. Nature Reviews Cardiology, [online] 20(4), pp.1–15. doi:https://doi.org/10.1038/s41569-022-00787-6.

Meticulousresearch.com. (2023). Venous Thromboembolism Treatment Market - Global Opportunity Analysis and Industry Forecast (2023-2030). [online] Available at: https://www.meticulousresearch.com/product/venous-thromboembolism-treatment-market-5745.

SPINEMarketGroup (2025). Stryker reports 2024 operating results and 2025 outlook - SPINEMarketGroup. [online] SPINEMarketGroup. Available at: https://thespinemarketgroup.com/stryker-reports-2024-operating-results-and-2025-outlook/ [Accessed 26 Dec. 2025].

Stryker (2025). Stryker announces definitive agreement to acquire Inari Medical, Inc., providing entry into high-growth peripheral vascular segment. [online] Stryker.com. Available at: https://investors.stryker.com/press-releases/news-details/2025/Stryker-announces-definitive-agreement-to-acquire-Inari-Medical-Inc.-providing-entry-into-high-growth-peripheral-vascular-segment/default.aspx.

Stryker Corporation (2025a). Stryker announces definitive agreement to acquire Inari Medical, Inc., providing entry into high-growth peripheral vascular segment. [online] GlobeNewswire News Room. Available at: https://www.globenewswire.com/news-release/2025/01/06/3004972/0/en/Stryker-announces-definitive-agreement-to-acquire-Inari-Medical-Inc-providing-entry-into-high-growth-peripheral-vascular-segment.html.

Stryker Corporation (2025b). Stryker reports 2024 operating results and 2025 outlook. [online] GlobeNewswire News Room. Available at: https://www.globenewswire.com/news-release/2025/01/28/3016762/0/en/Stryker-reports-2024-operating-results-and-2025-outlook.html.

Tu, T. (2019). A Prospective, Single-Arm, Multicenter Trial of Catheter-Directed Mechanical Thrombectomy for Intermediate-Risk Acute Pulmonary Embolism. JACC: Cardiovascular Interventions, 12(9), pp.859–869. doi:https://doi.org/10.1016/j.jcin.2018.12.022.

US Census Bureau (2019). Older Population and Aging. [online] The United States Census Bureau. Available at: https://www.census.gov/topics/population/older-aging.html.