Vodafone UK’s £16.5bn Acquisition of Three

Written by: Ryan Regmi (Chapter President), Lukas Cakir, Tresor Nsengiyumva, Cyprian Bekha, Morgan Zocco & Aditya Jayaram

Deal Overview

Acquirer: Vodafone UK

Target: Three

Total Transaction Size: £16.5 bn

Closed Date: May 31, 2025

In May 2025, Vodafone completed the acquisition of Three UK in a transaction valuing the combined business at approximately £16.5 billion. The deal represents a major consolidation within the UK telecommunications market, which has been characterised by intense price competition, high network investment requirements and pressured returns on capital.

The transaction takes place as operators face rising costs associated with nationwide 5G rollout and increasing regulatory scrutiny. Vodafone’s strategic rationale is to achieve greater scale and spectrum depth, enabling more efficient network investment, improved coverage and material cost synergies. Management has guided to significant operating and capital expenditure efficiencies over the medium term, supported by a multi-year investment commitment approved as part of the regulatory clearance process.

Investor reaction has been cautious but pragmatic. While the industrial logic of consolidation is widely recognised, concerns remain around integration complexity, near-term cash flow pressure and the timing of synergy realisation. For Vodafone, the acquisition strengthens its competitive position in the UK market, but successful value creation will depend on disciplined execution, delivery of the announced synergies and effective management of the enlarged balance sheet.

Company Overview: Acquirer - Vodafone

Founded: 1982

CEO: Ahmed Essam

Market Cap: £22.46 bn

LTM Revenue: £39.8 bn

LTM EBITDA: £2.1 bn

P/E: -6.48

History

As one of Europe’s largest telecommunications providers, the firm has entered the UK market as its original home base. Historically, the business grew through aggressive investment, organic expansion and multiple cross-border M&A deals which have created a pan-European and African footprint. Over the past decade, Vodafone UK has faced intensifying price competition and regulatory pressure in the UK mobile market. Prior transactions, including the sale of Vodafone New Zealand and the carve-out of Vantage Towers, reflect a broader group strategy to simplify operations and refocus on core markets.

Product Lines

The company offers mobile connectivity including voice, data and 5G broadband; IoT solutions and enterprise communication services. With a share of mobile subscribers in 2023 of circa 20%, Vodafone’s positioning as the third-largest mobile operator in the UK by customer base prior to the merger. Its customer mix is balanced across consumer and enterprise segments.

Strengths

Strong brand equity: One of the UK’s most prominent telecommunications operators.

Advanced network assets: Including nationwide 5G deployment and a strong mid-band spectrum position.

Enterprise relationships Built through IoT, cloud and managed communication services.

Economies of scale: From global procurement and shared group platforms.

Challenges

Margin pressure: Due to intense competition among the four-player UK market (EE, O2, Three, Vodafone).

Slow top-line growth: Average revenue per user under long-term pressure

Regulatory scrutiny: Around consolidation and pricing

Competitive threats: E.g. Giffgaff and Tesco Mobile increasing downward pricing pressure.

Market Positioning

Through the lens of Porter’s Five Forces, the mobile market in the UK features high competitive rivalry, moderate supplier power and high buyer power. Vodafone is positioned as a strong mid-tier operator (not the market leader), but can, with enough scale, compete effectively in network quality and brand perception. However, its relative scale disadvantage versus O2 and EE limited its ability to fully monetise 5G investments.

Summary

Vodafone enters the transaction from a position of operational strength, but strategic constraint. The merger enables Vodafone to overcome structural challenges, particularly scale limitations and margin pressure, while accelerating 5G development and cost synergies. The company profile aligns with a consolidation-driven rationale: unlocking scale, improving returns on capital and enhancing network competitiveness.

Company Overview: Target - Three

Founded: 2003

CEO: Robert Finnegan

Market Cap: £22.46 bn

LTM Revenue: £2.59 bn

LTM EBITDA: £541 m

P/E: 6.1-6.72

History

The firm entered the UK market as the first 3G-only mobile operator. Since then, it has built a reputation as a disruptive challenger focused on aggressive data pricing. Over time, Thee gained a loyal high-data-usage customer base., but remained structurally sub-scale relative to the UK's three larger operators - O2, EE, and Vodafone. The company has consistently argued that insufficient scale constrained returns on required network investments, especially transitioning to 5G. The 2025 merger approval represents the first successful consolidation attempt following the blocked O2-Three transaction in 2016.

Product Lines

Three’s main business is mobile connectivity (SIM-only), handset contracts, mobile broadband and 5G home internet. It is positioned as a value driven operator, with competitively priced unlimited data plans and strong penetration among younger, tech-savvy customers. Before the merger, Three held roughly 10-11 million subscribers, making it the smallest of the four mobile network operators.

Strengths

High-quality 5G spectrum portfolio: Particularly strong holdings in the 3.4-3.8GHz mid-band range.

Data-heavy, growth-oriented subscriber base: Supporting future 5G monetisation.

Lean operating structure: This enables cost synergies when combined with a larger network.

Brand position: A price-competitive challenger, complementing Vodafone’s mid-market positioning.

Challenges

Sub-scale network economics: Leading to lower operating margins compared to peers.

High capex requirements: A must to remain competitive in 5G development without scale benefits.

Margin pressure and churn: Driven by aggressive pricing and competition from MVNOs.

Regulatory risk: Due to historical scrutiny over reducing the number of UK mobile operators from four to three.

Market Positioning

Three occupies a “challenger” position, with price and unlimited data proposition being the main unique selling points. Relative to EE and O2, its network breadth is more limited. Also, relative to Vodafone, its financial constraints reduce long-term investment capacity. In a Porter’s Five Forces framing, Three faces: high buyer power (Price sensitive UK consumers and MVNO competition). High rivalry among the four MNOs. Significant barriers to achieving scale, limiting its competitive impact as a standalone operator.

Summary

Three brings the assets Vodafone lacks: scale-enhancing spectrum, customer volume and cost synergy potential. When merged, the operators form a UK market leader which has the ability to accelerate 5G rollout, lower unit network costs and improve ROIC. Three’s standalone challenges (limited scale, low margins, heavy capex needs) translate into strong strategic complementarity within a merged entity.

Motivation

A fragmented market under intense pricing pressure

The UK telecommunications market is characterised by high fragmentation and intense competition, with no mechanisms for price coordination, which has led to sustained pressure on revenues and margins. In this challenging environment, the merger aims to stabilise competitive dynamics and generate revenue synergies.

Enhanced market power against leading competitors

The transaction enables Vodafone to reposition itself against dominant players such as EE (BT Group) and O2, with the ambition of becoming the leader in terms of number of users. Expanding the customer base enhances the group’s market power, improves customer retention, and supports revenue stability in a context of persistent price competition.

A transaction enabled by strengthened regulatory safeguards

Previous consolidation attempts in the sector had failed due to concerns around the creation of an excessive oligopoly. This transaction was made possible through the integration of strong consumerprotection commitments, particularly regarding pricing, ensuring compliance with competition authorities’ requirements. This explains why such a rationale had neither been fully considered nor practically achievable at an earlier stage.

Industrial value creation: 5G deployment, economies of scale and purchasing power

Accelerated rollout of 5G

The merger represents a key lever to accelerate the transition to 5G, through the pooling of financial, technological and operational resources. Vodafone has announced a £11 billion investment over ten years to build the UK’s best network, targeting 99% population coverage by 2030, followed by nationwide coverage by 2034.

This technological scale-up is expected to drive higher usage, attract new customers, and increase market share, thereby enabling faster market access and a quicker, less expensive nationwide coverage overall.

Economies of scale and cost optimisation

Achieving critical scale enables the realisation of significant economies of scale, notably through: network and infrastructure sharing, elimination of redundant investments and rationalisation of support functions and headcount. These levers result in a structural reduction in OPEX and CAPEX per subscriber, improving both capital and labour productivity.

Enhanced purchasing power

The increased scale of the combined entity significantly strengthens its purchasing power vis-à-vis suppliers of network equipment, IT services, energy and maintenance. This enables: lower unit procurement costs, improved contractual terms and enhanced investment returns. The combination of economies of scale and purchasing power represents a core driver in restoring returns on capital, which have historically been under pressure in the sector.

Financial discipline, group simplification and sustainable growth

Strategic refocus and capital allocation

The merger forms part of a broader strategy of geographical refocus, following the divestment of several international subsidiaries, notably in Spain. These disposals allow capital to be reallocated to key strategic markets, particularly the UK and South Africa, where Vodafone benefits from strong value creation potential.

Deleveraging and profitability improvement

The transaction addresses a strategic need for deleveraging, while correcting the limitations of a partially unsuccessful organic expansion strategy. The merger enables: sustainable cost reductions, improved operating profitability and enhanced cash flow generation. In this context, the transaction is presented as accretive, both in terms of cash flow and return on capital employed.

Simplified governance and long-term growth

Finally, the transaction is accompanied by a governance transformation, aimed at simplifying the group’s organisational structure, improving strategic decision-making and fostering more disciplined, sustainable and value-accretive growth over the long term.

Deal Navigation

Regulatory and Legal Considerations

In December 2024, the UK’s Competition and Markets Authority approved the proposed merger between Vodafone and CK Hutchinson, subject to specific legally binding commitments from the newly merged company: VodafoneThree. The transaction was formally completed in May 2025, governed by English law.

In order to obtain regulatory approval, the CMA conducted a full Phase 2 Merger Investigation, which comprises an in-depth inquiry to assess whether a merger is expected to result in a substantial lessening of competition With the merger only cleared conditionally, VodafoneThree is expected to fulfill the following imposed conditions, overseen jointly by Ofcom and the CMA: the establishment of a joint network plan over 8 years to upgrade and integrate their combined mobile network across the UK. The introduction of a cap on selected mobile tariffs and data plans for 3 years to protect customers from short-term price increases. Pre-set wholesale contract terms for mobile virtual network providers to ensure competitive market access.

The combined business is expected to deliver cost and capital expenditure synergies of ~£700 million per annum by the fifth year post-completion, providing positive outcomes in the consumer interest once reflected in pricing.

As both firms operate in telecommunications, which is deemed a “sensitive” industry under the National Security & Investment Act 2021, the merger requires the UK national security clearance. Consequently, the parties must establish a ‘national security committee’ to monitor all work with potential implications for British national security.

Furthermore, the transaction required shareholder approval from Three, which was granted following an irrevocable vote in favor. No shareholder lawsuits or wider litigation have been publicly reported.

Financing Structure

The Vodafone-Three deal is partly financed by ~£6 billion in debt, covering the vast majority of the deal value. This debt will consist of £4.3 billion of debt from Vodafone and £1.7 billion from Three. Existing debt attributable to the latter will be refinanced in the medium term to improve compatibility with the joint firm’s new operational profile. Vodafone’s public statements suggest that the merger has had a broadly neutral effect on its Net Debt to Adjusted EBITDAal ratio in the short term, in line with its target for a disciplined leverage ceiling from the outset. Following merger completion, Vodafone’s credit ratings have been affirmed as ‘BBB’ by Fitch Ratings and ‘BBB’ with a stable outlook by S&P Global, reflecting its low leverage profile.

In addition, the total equity contribution of £800 million is shared to reflect VodafoneThree’s 51:49 ownership split of Vodafone UK - £408 million; Three - £392 million.

On establishment of the deal, the following exit mechanisms were established should one or both parties wish: Vodafone Call Option - Vodafone can call (buy) Three’s 49% stake 3 years after completion. Three Put Option - Three can put (sell) its stake to Vodafone 3 years after completion.

If triggered, the call/put option would be based on ‘fair market value’, which is determined through an independent third-party valuation process. If the option occurs as a non-cash transaction, Vodafone can pay with new shares and/or loan notes subject to conditions. Given that the future option exercise could involve Vodafone issuing new shares, there is potential for limited dilution to earnings per share.

No activist or proxy-vote pressure was publicly flagged, as the deal was negotiated as a joint venture rather than a hostile takeover.

Shareholder Return Targets

Vodafone Group has guided that the merger is expected to be accretive to adjusted Free Cash Flow from FY2029, reflecting the time required to integrate networks with Three and fully realise operational synergies. Until then, VodafoneThree can expect a £165 million drag on adjusted FCF, driven by elevated CapEx and one-off integration costs in the short term, as well as incremental interest expenses beyond. Despite these initial outflows, the underlying operating performance of the merged entity is expected to improve, with a £330 million uplift in adjusted EBITDA on a pro forma basis.

A clear deleveraging framework has been embedded within the joint venture’s financial structure, with targets set on a net financial debt to EBITDAaL ratio of 2.5× on a 12-month rolling basis. Over time, following initial CapEx, VodafoneThree intends to scale and generate sufficient free cash flow to reduce its leverage, consistent with the target.

Vodafone and Three have committed to £11 billion of network CapEx over the next 10 years, prioritising quality investment and long-term growth. Vodafone describes the deal as “value-creating”, given the vast potential to unlock material synergies and “significant shareholder value”. On completion, Vodafone signalled a £1.3 billion net cash return to the Group.

Integration

The integration of Vodafone UK and Three UK remains early, and the public record provides only high-level signals rather than detailed execution evidence. The merged entity has communicated a strong strategic ambition centred on network scale, accelerated 5G deployment and operating cost efficiencies, but disclosure on the practical mechanics of integration is limited. As a result, the integration story currently relies more on the declared thesis and regulatory commitments than on observable delivery.

Leadership and governance alignment

Governance clarity is essential given the 51 percent Vodafone and 49 percent CK Hutchison ownership structure. The completion announcement identifies senior leadership roles, confirming that a unified leadership team has been appointed, but it provides no detail on functional decision rights or escalation structures. This limits the ability to assess whether governance alignment is robust enough to support rapid integration. The CMA’s binding commitments also introduce additional supervisory layers, increasing the need for clear internal authority lines.

Cultural fit and communication of change

Culture integration has not been a visible priority in public communications. Messaging from Vodafone and Three has focused almost entirely on customer continuity and long term investment rather than cultural alignment between the merging organisations. Given the companies’ different strategic histories and leadership traditions, cultural integration will require deliberate management. The absence of any disclosed cultural programmes, employee communication plans or engagement signals indicates that this dimension remains opaque.

Operating model and systems compatibility

This is the most demanding area and the one with the least public clarity. The merger requires consolidation of network assets, spectrum optimisation, harmonisation of IT and billing systems and redesign of operating models. Industry analysis consistently highlights the scale of the technical challenge and the multi-year sequencing required to migrate systems safely. Vodafone’s investor materials outline the strategic benefits of scale but do not set out the systems migration roadmap. Until the company provides milestone detail, external observers cannot validate the operational strength of integration execution.

Early synergy execution and milestone tracking

Vodafone and Three have communicated synergy expectations and long term investment plans, including the intention to invest £11 billion in 5G over the coming decade. However, there is no disclosure of concrete integration milestones or synergy realisation tracking. Regulatory conditions set by the CMA shape how certain efficiencies can be achieved, which increases the need for transparent milestone reporting. Until the merged entity publishes integration indicators, synergy execution cannot be independently assessed.

Flexibility to adapt plans

The merged entity faces substantial long term capex commitments and operates under binding regulatory conditions. This creates a rigid operating envelope, although leadership messaging emphasises the ability to invest more aggressively than either standalone company could. Flexibility will become observable only when integration sequencing interacts with financial and regulatory constraints.

Overall judgement

Early integration signals for VodafoneThree are directionally aligned with the merger’s strategic ambitions, but lack depth. Leadership roles are confirmed and the strategic thesis is consistent. However, there is minimal transparency into the operating model build out, systems migration, talent retention or synergy tracking. Using the integration framework, the merger presents a clear strategic rationale with limited evidence of execution discipline to date. Further disclosures on milestones, governance mechanics and technical integration progress would significantly strengthen the integration narrative.

Performance & Valuation

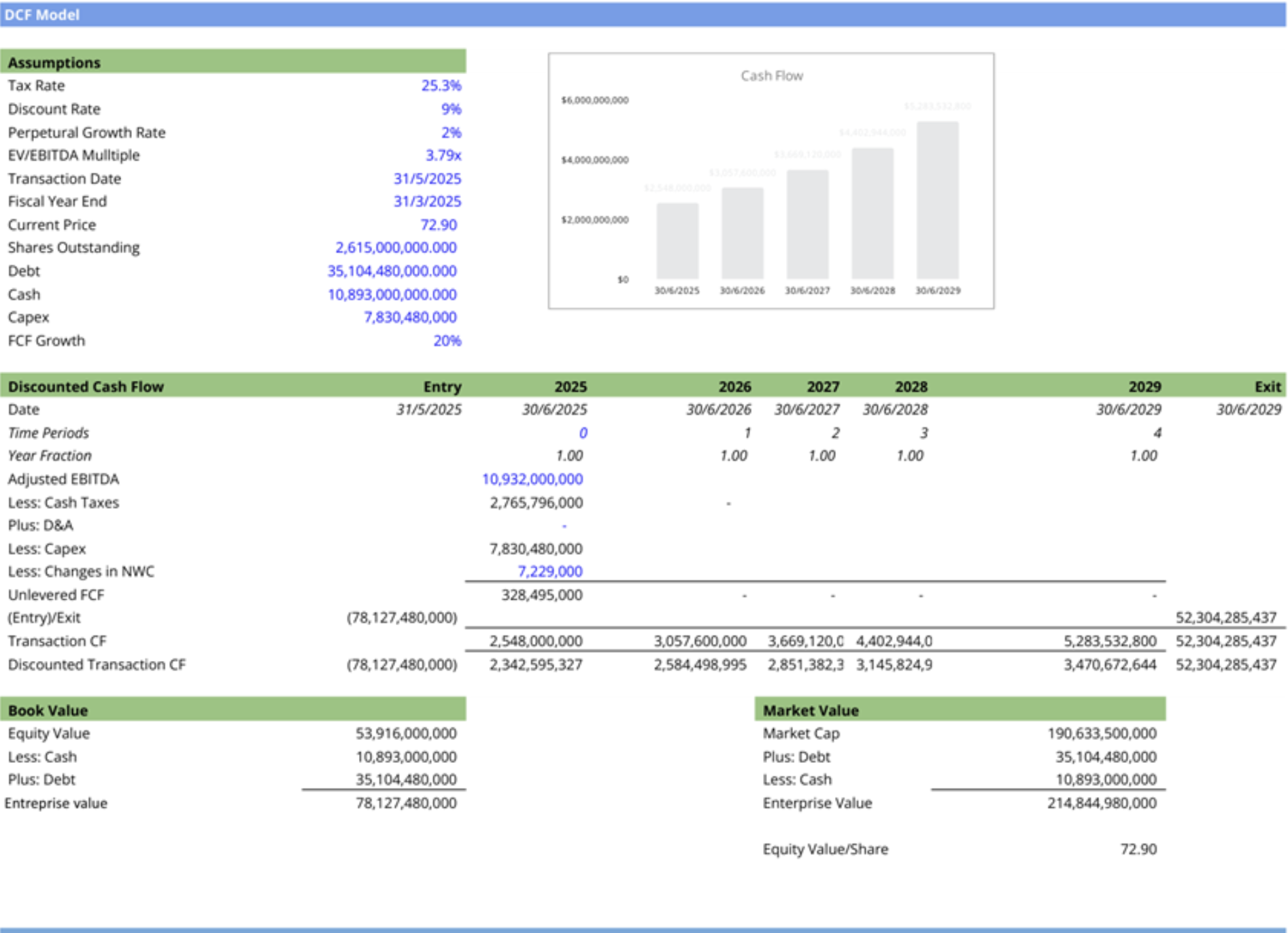

The valuation of VodafoneThree is assessed using a Discounted Cash Flow (DCF) model that explicitly captures the transaction’s multi-year capex profile, expected cost synergies and timing of free-cash-flow recovery. Given the strategic nature of the merger and the large near-term investment programme, intrinsic valuation is the most informative method for judging long-run value (rather than short-term trading multiples). The DCF applies a 9% discount rate, a 2% terminal growth rate and a 25.3% tax rate, and incorporates the modelled net debt position (Debt £35.104bn less Cash £10.893bn → net debt ≈ £24.2bn).

Under these assumptions the model produces an enterprise value ≈ £78.13bn, an implied EV/EBITDA ≈ 3.8x, and an equity value per share ≈ £72.90, while reporting a negative near-term IRR (~-4%) driven by upfront capex and integration cash drag. Applying the DCF as the anchor implies the transaction price is broadly consistent with intrinsic value today, meaning any meaningful upside for shareholders depends on faster or larger synergy capture, superior 5G monetisation, or a reduction in execution and financing risk.

Risks

Regulatory & legal

The CMA’s Phase 2 report concluded that the transaction would likely raise consumer prices in the absence of regulatory intervention, its modelling estimated increases of ~5.5% for Three customers and ~2.6% for Vodafone customers, which formed the basis for imposing a strict behavioural-remedy package.

The legally binding undertakings include an 8-year network-investment plan, monitored annually by Ofcom and the CMA, alongside 3-year retail-tariff caps and 3-year guaranteed MVNO wholesale terms, designed to prevent the merged operator from exercising short-run market power. Parallel to competition approval, the UK government issued a Final Order under the NSIA, requiring the creation of a National Security Committee within the JV to oversee sensitive infrastructure and cybersecurity governance. Operator disclosures confirm that the combined entity intends to invest £11 billion in UK network upgrades over the next decade, but this also creates a multi-year execution and cost-management challenge.

Integration

A major risk could be represented by the hard task of creating a unique network for mobile integration and the migration of all clients toward it, although it has not been disclosed yet whether they will create a unique platform integrating both business or they will operate as a separate companies but under the same management, it still represents a risk that could lead to mass migration toward other platforms due to core/billing migrations and customer experience during cutovers.

Financial

The financial risk is moderate, the merger did not create a balance sheet crisis, but the risk is driven by near term cash-flow pressure and execution discipline. VodafoneThree begins with around £6.0bn net debt, and Vodafone’s group net debt rises by about £1.7bn due to full consolidation The merger is committed to deliver a £11bn, 10-year UK investment plan with roughly £1.3bn planned in year one. While Vodafone expects a rise in EBITDA the dilutive merger will lead to a lower adjusted free cash flow in FY26 (-€0.2bn). This implies value creation depends on sustaining funding through the investment phase and converting network upgrades into durable operating gains.

Technology & data

The company’s ability to execute is limited by both policy rules and the systems it already uses. The required 8-year network plan has to fit with its current technology partners and meet strict security standards. Because the merged business will operate a larger and more complex network, the risk of cyber or operational failures increases. This makes it essential to manage system transitions carefully and tightly control who has access to sensitive systems, as required under the government’s national-security conditions and the ongoing oversight from Ofcom and the CMA.

Overall the risk profile is heightened but manageable. The risk skew is dominated by regulatory-compliance delivery and integration execution under a three-year monetisation fence. If milestones are hit and early quality gains persist, the thesis of quality-led rivalry is intact; if not, FCF timing slips and renewed regulatory heat on “over-earning” post-cap becomes probable.

The House View

The deal looks promising for value creation in the UK telecommunications sector, primarily because it combines scale with a credible plan to upgrade network quality and accelerate 5G investment, conditions that can unlock better service performance and enable new use cases across the communications ecosystem.

However, the merger also raises concentration risk: a larger combined player can reduce competitive pressure, which could translate into higher prices or weaker consumer outcomes over time. That risk is not theoretical, and it is exactly why the transaction was cleared only with binding CMA remedies, including an 8-year network investment commitment, 3-year price caps on selected tariffs, and 3-year preset MVNO wholesale terms, with ongoing oversight and reporting. These constraints materially limit the scope for near-term price increases and make pricing power a difficult lever to pull without scrutiny.

Overall, the deal remains attractive, but in a very specific way: its success will depend less on market power and more on execution, delivering measurable network improvements efficiently, retaining customers through the integration period, and converting investment into sustainable cash generation over the medium term.