Shifting Rate Expectations: How Monetary and Fiscal Policy are Moving Global Markets.

Entering Q4 we have seen significant economic policy being implemented globally – markets entering the typical year-end “silly season” reminding us the year is not over just yet. Over the past 2 weeks market fluctuation has been driven by a reassessment of interest rate expectations in the U.S and across the pond in the U.K - Labour’s second budget delivered a fiscally cautious stance that stabilised gilt markets and hinted future Bank of England monetary policy. Parallel to this in the U.S - Non-Farm Payrolls and softer Purchasing Managers’ Index (PMI) & Producer Price (PPI) Index have reenforced the view that the Federal Reserve may implement rate cuts sooner than expected.

Together, these developments have created a two-sided shift in global rate expectations

U.K fiscal policy shaping domestic bond yields and GBP sentiment.

U.S economic data driving a clear repricing of dollar interest rate risk.

This divergence has impacted major FX pairs – particularly: GBP/USD, EUR/USD and USD/JPY – making it a pivotal week for clients with currency exposure.

Market Impact:

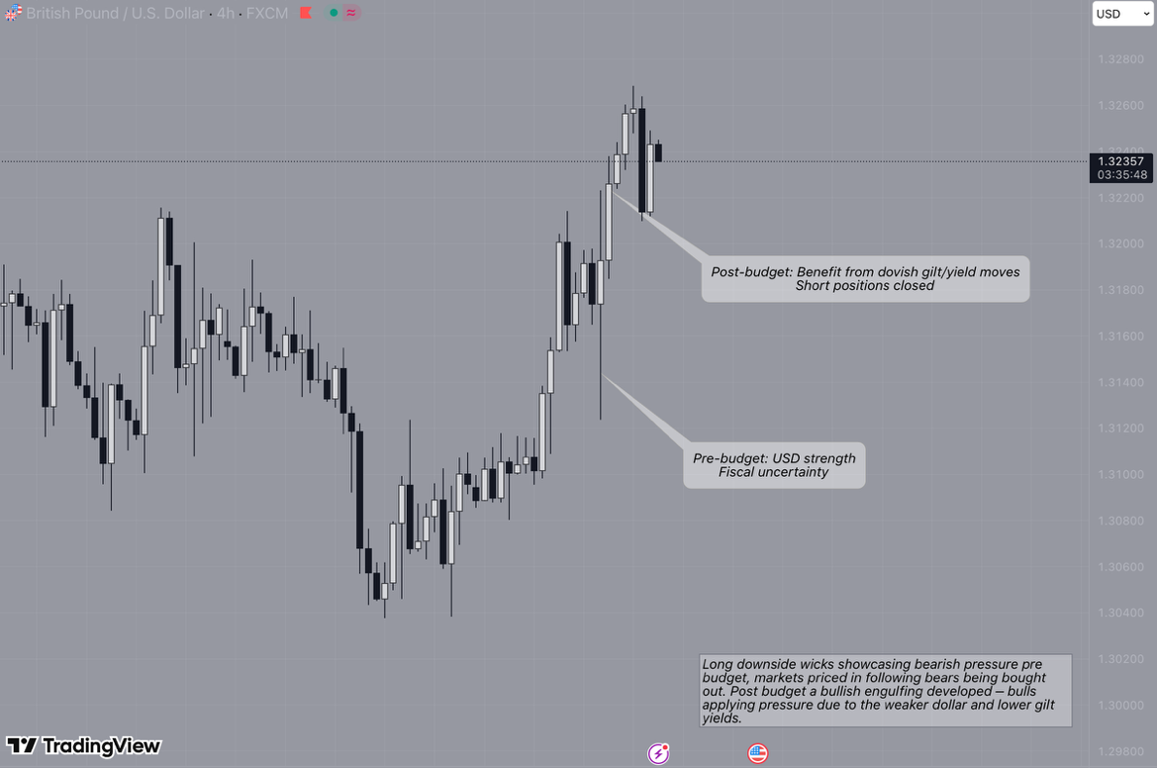

GBP/USD – Volatile but Supported by Fiscal Caution:

Sterling saw two-way fluctuations driven by combined U.K fiscal news and broader USD weakness.

Initial bearish price action came as the OBR downgraded U.K growth forecasts, putting downward pressure on GBP.

Sterling recovered later as markets deemed the Autumn Budget to be fiscally restrained, prompting gilt yields to trade lower from earlier highs.

The pair also benefitted from broad USD weakness following weak U.S data.

Overall: Dollar/Sterling ended the week modestly higher, reflecting a harmony of weak U.K data and a softer dollar environment.

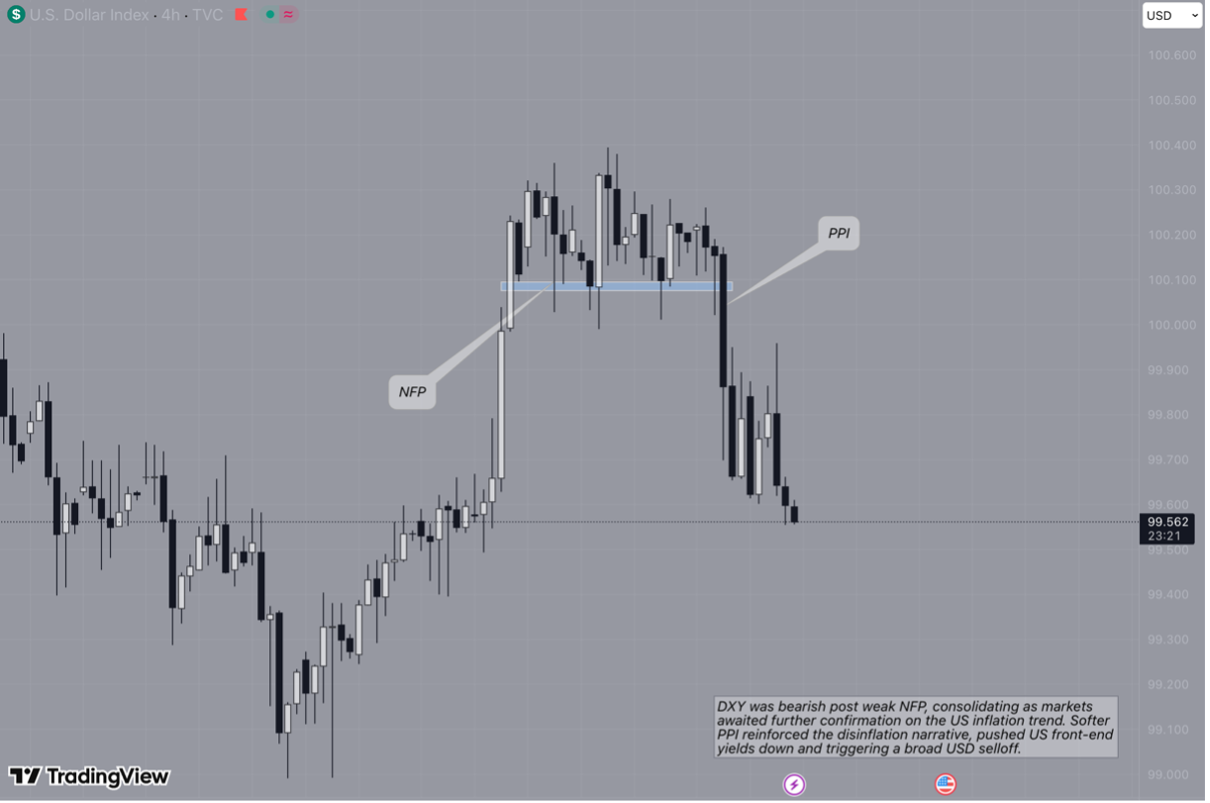

EUR/USD – Higher on Broad Dollar Weakness:

The Euro gained strength as unfavourable U.S data pushed investors out of the dollar.

Bullish moves driven by a weaker dollar, markets repricing the U.S side of the rate differential, not sudden European bullish growth.

Softer U.S PPI reenforced disinflation trends, pulling U.S front-end yields lower, pushing the market further toward early 2025 Fed cuts.

With the Fed now seen as having a more aggressive cutting rate than the ECB, relative policy path has swing in the Euro’s favour.

Overall: With U.S yields continuing to slip and no hawkish pushback from Fed speakers, EUR/USD extended gains into month end.

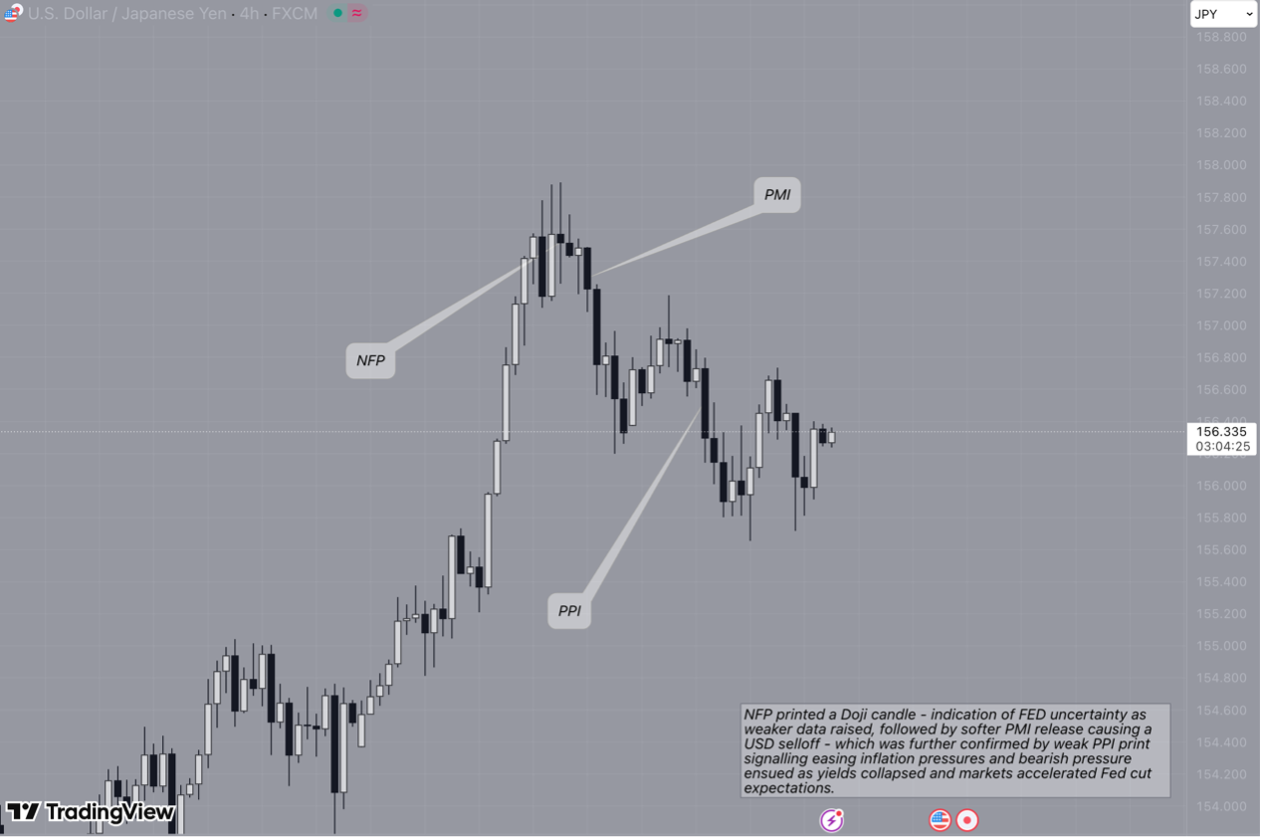

USD/JPY – Lower as Yields Fall and BoJ Outlook Shifts:

Dollar/Yen moved lower as the U.S yield curve shifted downwards.

Shrinking Fed-BoJ rate differentials - maintained pressure on USD/JPY with investors increasingly confident the FED will ease before the BoJ normalises policy in 2025.

Softer U.S PPI data was the key catalyst, further reenforcing the disinflation trend and increasing speculation of earlier FED rate cuts.

Decreasing yields caused dollar to trade lower, with the pair tracking the sharp decline in U.S Treasury yields following weaker inflation data.

Overall: Dovish repricing of U.S rates, triggered by weak PPI and furthered by falling Treasury yields, caused USD/JPY to trade lower as the Yen benefited from tightening Fed-BoJ rate differentials.

Implications for K2 Clients:

SMEs – FX vulnerability shrinking margins:

Due to the current bearish standing of the dollar, imports of raw materials/components will come at lower cost – allowing for improved margins and more competitive pricing strategies. SMEs should consider reviewing of procurement and sales contracts: FX-adjusted pricing or hedging tools. For exporters, a weaker dollar offers a competitive window to expand or renegotiate contracts due to goods becoming more affordable to foreign buyers.

Corporates – FX fluctuations & transaction risks can impact earnings and cash-flows:

Weaker USD may cause improved FX earnings for firms with non-USD operations, when foreign revenues are translated back to home currency. However, firms with global supply-chains may see benefit from a weaker USD, due to lower import costs from USD-priced markets. Overall corporates should reassess FX exposure – both on loans and operational revenues, considering hedging (forwards, options) known for FX-sensitive cash-flows. Also considering diversifying from USD exposure and exploring different sourcing/supply geographies to benefit from FX shifts.

High Net Worth Individuals – Currency shifts enhancing returns on unhedged international assets:

“A weakening dollar may turn currency exposure into a return enhancer for unhedged international investments”, non-USD asset allocation becomes more attractive due to the dollar depreciation – offering diversification and potential alpha beyond domestic markets. However, it is important to note FX fluctuation increases volatility, clients should review currency exposure across portfolios. A weaker USD presents opportunity to increase allocation to international equities, emerging markets or commodities, for FX-dominated liabilities, hedging and restructuring exposure should be considered.

Market Outlook:

Key data releases – Clients should monitor the following to determine whether the FED pivot narrative strengthens or weakens.

US Core PCE: A weaker release would reinforce the current disinflation narrative extending USD bearish trends. A firmer reading would challenge the rate-cut narrative and slow dollar weakness.

US ISM Services PMI & Jobless Claims: Services activity and labour-cooling remain key for FED rate expectations. Weakening demand or rising claims would further cause the dollar to trade lower.

Treasury auctions: Demand for U.S bonds will signal whether yields continue to fall or find a price floor. Strong demand pushing the dollar lower while weakening demand would offer the dollar a short-term lift.

Central Bank Communication & Policy Path

Federal reserve: Further dovish comments will extend the USD weakness; any hawkish sentiment would slow or partially reverse bearish pressure.

Bank of England: Weak U.K growth projections following the Autumn Budget limits the upside for GBP, despite short term fiscal stability post-budget supporting gilt markets. Clients should watch BoE speeches for signals of when easing could commence.

European Central Bank: The ECB remains data dependent. Signals of delayed easing would cause the euro to trade higher against the dollar.

Concluding Statement:

Recent market moves have been centred on clear repricing of interest-rate expectations: Softer U.S labour data, weaker PMI along with a weaker PPI release have reenforced the narrative of disinflation – driving U.S treasury yields lower and consequently driving the dollar into a more bearish stance. In the U.K the Autumn Budget provided short-term fiscal stability but didn’t improve expectations of growth outlooks for the sterling, the euro and yen benefited from the shifting policy differentials against the FED.

Overall, U.S inflation data, yield movements and central bank commentary will be key to managing market exposure as these will dictate future market trends. Making sure FX-strategies are aligned with market fluctuations ensuring the protection of margins and leveraging strategic opportunities.

If you’d like to discuss these moves in more detail, or how they could impact your business or personal FX requirements, please don’t hesitate to get in touch.