Fed Divisions and Rate Cut Speculation:

How Mixed FOMC Signals Are Redefining US Dollar Momentum - Dollar price now a volatile waiting game

Mid-November 2025 (18th-25th November) has seen uncertainty surge to the center of markets as a visibly divided Federal Reserve reshaped the odds for near-term easing. Between November 19th–22nd, competing messages from senior Fed officials : ‘dovish’ comments from several senior members (Governor Christopher Waller and New York Fed President John Williams) advocating for rate cuts in response to labor market risks and slowing growth, versus caution from Chair Jerome Powell and others urging patience amid persistent inflation forced investors into rapid, whipsawing reassessments of policy risk. Williams’ remarked that the Fed “can still cut rates in the near term” and Waller’s public case for a December cut , injected fresh easing bets, even as Collins and others emphasized the need for more evidence that inflation is on a sustainable path.

The duality of this rhetoric, along with recent labor market data showing a healthy pace of job creation (4.4% above forecast) but also a slight uptick in unemployment, adds to the mixed signals complicating the policy outlook. Even though inflation pressures are still above target in certain sectors and some data releases have been delayed, markets are now positioned for a cut, though this remains uncertain as mixed FOMC signals fuel confusion and volatility. We can see that the US dollar’s momentum has become a waiting game, highly sensitive to the everchanging erratic signals from the FOMC.

Rate‑Cut Roulette: Sentiment Volatility as the Daily Trade

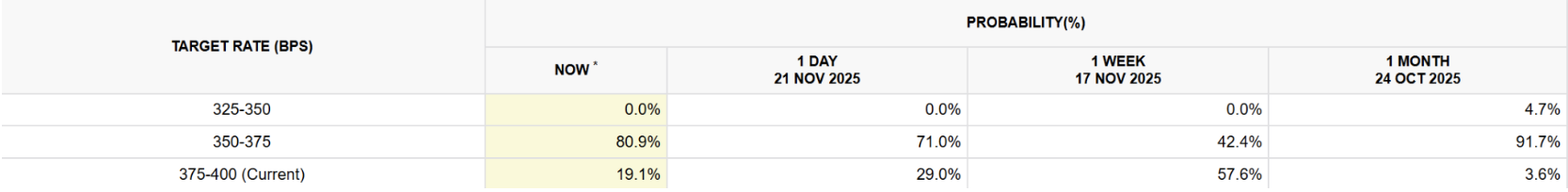

That rhetoric has produced extraordinary volatility in market sentiment over a matter of days. Using the CME FedWatch tool as the market’s thermometer, the probability of a 25-basis-point December 2025 cut swung dramatically: a Reuters summary shows probabilities around 42.4% about a week before November 24, collapsed to roughly 30% on November 20 in some reports, then reversed sharply after renewed dovish comments to near 81% by November 24. In short, what looked like a settled view in mid-November broke apart between the 19th and 22nd as each Fed utterance was re-priced within hours.

This scattered forecasting—magnified by missing economic data from the federal shutdown and contradictory jobs figures—has caused mistrust in the Fed's short term decision and unleashed capital flows and repricing across Asia, Europe, and beyond with reduced equity buying and diversification into other asset classes (E.g FX). The heightened uncertainty and increase in volatility in market sentiment, has also seen volatility price measures spike, with the VIX (V olatility Index) and FX implied volatilities climbing with VIX going from a trough 19.72 on 20th morning to a monthly high 26.81 on 21st noonNotably, market participants have had to increasingly rely on qualitative cues from Fed speeches and regional economic releases based on the lack of comprehensive federal data, emphasizing the critical role of communication in shaping expectations in this data light environment. The tug‑of‑war between hopes for near‑term rate cuts and caution about rates staying higher for longer is intensifying, making FX markets more sensitive to every shift in Fed rhetoric and volatility is becoming a lasting condition, likely to continue until clearer economic data arrives and the Fed’s policy path becomes more certain.

Market Impacts: Fed Messaging Defines Dollar Direction

Markets now enter a pivotal stretch, with investors bracing for fresh catalysts as U.S. retail sales and producer-price data are slated for release later in the week. These upcoming figures take on heightened significance amid the intense volatility triggered by the Fed’s conflicting signals between November 19–22, when rapidly shifting rate-cut expectations repeatedly reshaped dollar momentum.

The combination of missing federal data, contradictory labour‑market readings from local authorities in lieu of timely national releases, and sharply divergent Fed messaging has left investors navigating a landscape defined more by belief‑driven swings than by stable macro trends. With reputable Fed funds rate trackers now assigning nearly an 80% probability to a December rate cut following comments from Governor Waller and New York Fed President Williams — up from roughly 30% before their remarks — traders are acutely aware that this week’s data (release of U.S. retail sales and producer prices data due later in the week) could either validate the dovish turn or reignite the Fed’s hawkish contingent. As a result, markets remain hyper-sensitive, balancing the prospect of near-term easing against the risk that sticky inflation or firm consumer spending push policymakers back toward caution.

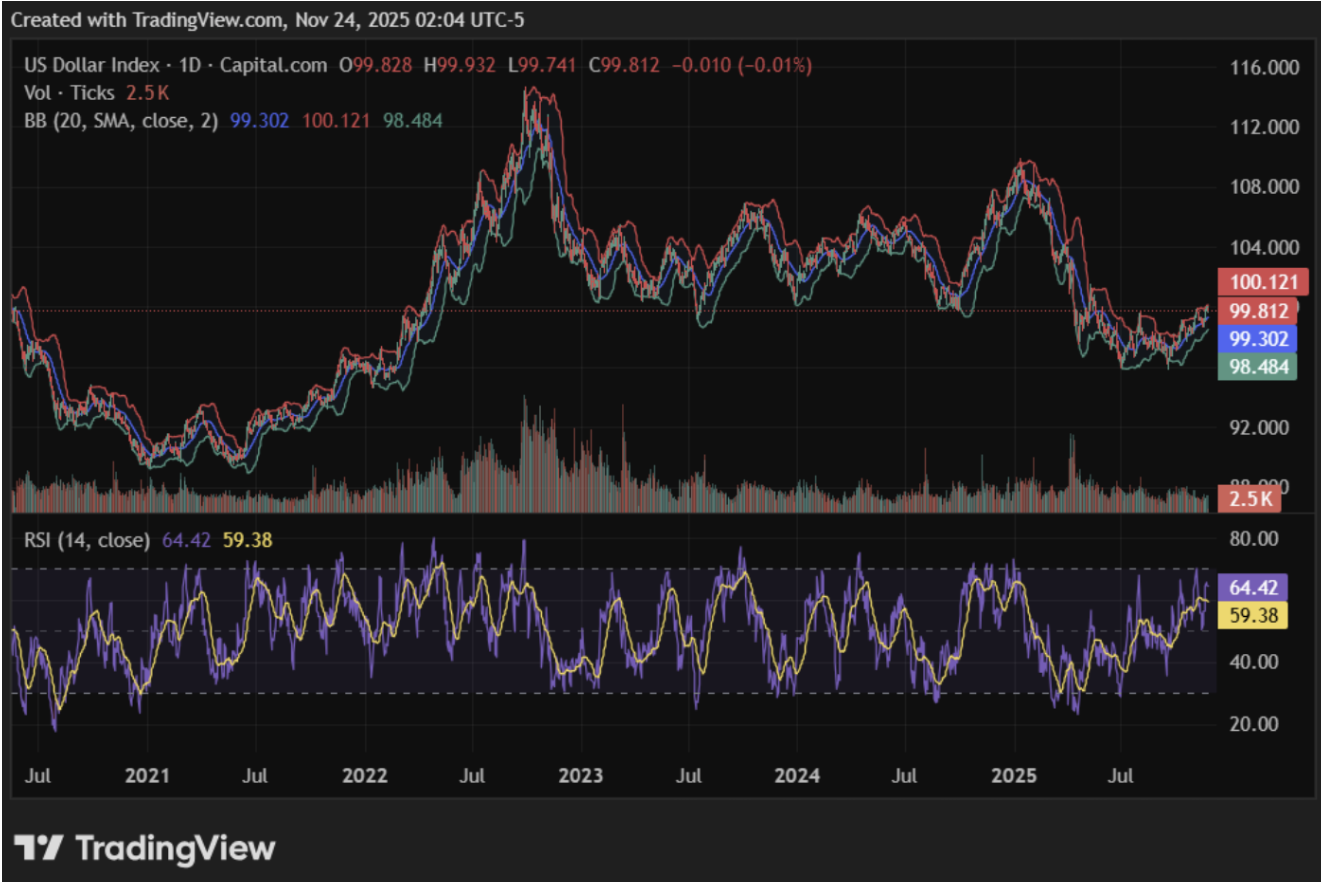

Market sentiment remains cautious, with traders divided between those anticipating Fed rate cuts and those betting on policy resilience, as the U.S. Dollar Index (Basket containing 6 currency pairs including EUR/USD,GBP/USD,USD/JPY ,USD/CAD) hovers near the key 100.00 level since the 19th-25th . This psychological barrier has become the focal point for FX reactions, with the latest surge in cut speculation raising uncertainty over whether the greenback (USD) will be capped or driven into another bout of reversal‑led volatility.

EUR/USD:

EUR/USD held firm above 1.1500, trading near 1.1525 as ‘dovish’ remarks from Fed members lifted the December rate‑cut bets to 70%, pressuring the dollar. Conflicting signals from other Fed officials capped momentum, while the ECB’s (European central bank) steady and vigilant stance provided underlying support to the Euro. The move reflects dollar weakness driven by shifting US policy expectations rather than Eurozone strength, leaving the pair volatile but biased higher as long as Fed easing remains priced in.

GBP/USD:

GBP/USD slipped towards 1.3095 despite renewed Fed rate‑cut bets, as mixed US policy signals and anticipation of the UK budget kept sterling under pressure. The Pound weakened after a string of soft UK data last week—highlighted by a surprise drop in inflation, weaker services PMI, and falling retail sales—which reinforced expectations of a December BoE rate cut. Dovish comments from New York Fed President John Williams lifted hopes for dollar softness, but sterling failed to benefit, held back by caution ahead of the autumn budget, worries over fiscal tightening, and ongoing concerns about UK growth. With markets awaiting Reeves’s fiscal plans and delayed US data, traders fear the UK budget could drive the Pound to new multi‑month lows, especially as speculation builds that the BoE may join the global easing cycle in 2026.

USD/JPY:

USD/JPY surged to nearly 157.00 as initial market skepticism about Federal Reserve rate cuts gave way to renewed optimism following dovish commentary from New York Fed President John Williams. However, the yen's losses were partially offset by increased verbal intervention from Japanese officials and warnings of possible FX market action, helping the currency recover from ten-month lows. The impact is driven largely by wide US-Japan yield differentials, which have renewed the attractiveness of the carry trade—borrowing cheap yen to invest in higher-yielding US dollar assets—drawing investors back into the strategy. Coupled with the Bank of Japan's continued dovish monetary policy, the pair remains highly volatile as traders balance expectations of Fed moves with the risk of Japanese intervention, as highlighted by Japanese Finance Minister Satsuki Katayama.

USD/CAD:

USD/CAD climbed above 1.41 as traders increasingly priced in a December Fed rate cut, supported by dovish signals from several officials citing a slowing labor market and easing inflation risks. Still, caution from other Fed members and the Bank of Canada’s steady stance capped further gains, leaving the pair volatile around the 1.4100 mark. Recent moves are being driven mainly by shifting US monetary policy expectations rather than changes in Canada’s economy, underscoring ongoing uncertainty and heightened sensitivity to Fed rhetoric and upcoming data in November 2025. In a low‑data environment, a firm USD combined with a passive Canadian Dollar has kept USD/CAD near two‑week highs despite rising Fed cut odds.

Implications for K2 Clients

The Fed’s conflicting messages and the dramatic swing in December rate-cut expectations — from 30% to nearly 80% within days — have revived sharp volatility in US Markets- including FX. The hawkish narrative that was believed to be stable in the start of November has been flipped around, and its this volatility that matters directly for client decision-making, as markets are now moving on sentiment and sudden mixed FOMC signals rather than stable data.

For SMEs

Importers face higher cost uncertainty, with USD spikes raising the price of US-sourced goods and squeezing margins.

Exporters may benefit when USD strength boosts the GBP value of US sales, but day-to-day volatility complicates pricing and cash-flow planning.

With the Dollar Index hovering near 100.00, even small data surprises could trigger outsized FX moves, making hedging more important.

For HNIs

Dollar-denominated assets — US equities, bonds, and property — may rise in home-currency terms during periods of renewed USD strength.

Repatriation timing becomes crucial, as rapid shifts in Fed expectations can significantly change the value of USD holdings when converted back into GBP or EUR.

Portfolio positioning requires more caution, with market swings now driven largely by Fed rhetoric rather than fundamentals.

The bottom line: belief-driven volatility is back, caused by mixed FOMC signals. Clients should prepare for a choppy December as incoming US data and shifting Fed signals continue to redefine dollar direction. Upcoming US economic data, ECB speeches, and any new Fed guidance should serve as catalysts and investors should constantly monitor for any changes in rate cut probability from current levels.

Market Outlook: What to Watch Next

The Fed’s mixed messaging has pushed markets into full data-dependence with numbers being released at the end of this week, with the December meeting now a genuinely live event. Investors are looking to incoming US numbers to either reinforce the latest dovish shift or revive the Fed’s more cautious tone.

US Retail Sales & Producer Prices: Strong readings would back the Fed’s hawkish voices, signalling that consumer demand and price pressures remain firm. This would likely strengthen the dollar and curb speculation of a near-term cut.

Soft or Weak Data: Dollar bears now need materially weaker figures to keep December cut expectations alive. Any downside surprise could reignite dovish momentum and weigh on the greenback.

Clients should also keep an eye on the Bank of England and ECB, whose communication will be scrutinised closely as a volatile dollar puts added pressure on both central banks’ forward guidance. Additionally Japanese government intervention should be closely monitored behind the falling yen, with the Finance minister saying FX intervention is a possibility, estimating 160 Yen per USD as the limit.

How K2 FX Can Help

The recent swings in Fed expectations have reinforced that uncertainty and volatility are now the norm. Markets are pricing every speech, data release, and signal, making it challenging for businesses and investors to plan with confidence. At K2 FX, we specialise in helping clients navigate exactly this kind of unpredictable environment. Our tailored FX solutions help clients manage risk and seize opportunity amid fluctuating dollar futures and speculation over whether a December Fed cut will occur:

For Importers: Forward Contracts lock in exchange rates today, protecting profit margins from sudden USD strength driven by market swings.

For Exporters: Structured strategies safeguard USD revenues while providing flexibility if sentiment shifts and the dollar moves abruptly.

For HNW Individuals: Expert guidance on timing the repatriation of US assets ensures that dollarmovements translate into real value in GBP or EUR, even amid unpredictable market sentiment.

Whether you are a business managing FX exposure, an investor adjusting US holdings, or an individual planning a cross-border transaction, K2 FX provides real-time insights and personalised strategies to stay ahead of volatile markets. With our support, you can navigate uncertainty confidently, rather than reacting to it.

Conclusion

The recent Fed messaging has made one thing clear: uncertainty is now the norm. Markets are highly sensitive to incoming data, with sentiment driving FX moves far more than fundamentals or technicals. Every US economic release, from payrolls to inflation, now has the power to swing expectations for a December rate cut, creating heightened volatility across currencies. The key takeaway is that investors and businesses must navigate a landscape where rapid shifts in sentiment, rather than steady trends, dictate market direction, making proactive planning and risk management more critical than ever