UK Autumn Budget: A Key Test for Sterling and Gilts

Rachel Reeves will unveil the government's next budget on 26 November 2025. What will it mean for the growing fiscal hole? What tax measures might emerge? How might markets react, especially in the gilt and currency space?

Broad Overview: What to Expect

The UK finds itself staring at a serious challenge. Public sector borrowing, in the six months to September 2025, was £99.8bn. This high rate of borrowing means that the government must find a fiscal measure to fill this hole. Indeed, think tanks estimate this gap to sit around £20-30bn, which could be worsened by weaker productivity and growth in the next few years.

In order to maintain credibility with investors, especially foreign ones, on borrowing and debt, the budget is likely to combine tax increases, freezing of thresholds (fiscal drag) and some spending control. The IFS (Institute for Fiscal Studies) reports that the UK may undertake a consolidation of approximately 2.2% of GDP between 2025-30, much larger than comparable peers.

Tax-Rises: What's on the table?

While the Labour government entered office pledging that it would not raise basic rates of income tax, VAT or national insurance for working people, this promise is under strain. For example, recent briefing notes state "there is growing speculation about potential tax increases" ahead of the Autumn budget.

Key possible measures include:

Freezing or reducing income tax thresholds so that wage rises push more people into higher tax bands (i.e. fiscal drag)

Extending National Insurance (i.e. employer/employee social security contributions) to new categories such as landlords or small partnerships. ING estimates there is approximately £2bn of potential revenue.

Additional taxes targeted at higher-value property (e.g., council tax on expensive homes), capital gains, or dividend income. ING suggests around £15 bn of “front-loaded tax hikes” are possible.

A possible increase in the tax burden on business profits, though this has to be weighed against the Government’s growth agenda.

An important note is that if these measures are introduced without undermining growth too much, the Government might hit its targets. If not, markets may demand higher yields (i.e., higher interest rates on gilts), and that risk is very much on investors’ minds.

Potential Implications for Currency Markets

When fiscal policy is perceived as credible, a country’s currency tends to perform better because investors believe debt and interest burdens will remain manageable. In the case of the UK, the upcoming budget is shaping up as a currency test for the British pound (GBP).

The sterling's exchange rate reflects both domestic fundamentals (growth, inflation, fiscal stance) and international comparisons (e.g., relative interest rates). If the budget conveys ill-discipline (a larger than expected deficit, weak growth prospects) investors may lose confidence, prompting selling of GBP in favour of other currencies, especially the US dollar. Conversely, if the budget shows credible tightening (or a path to it), the pound could stabilise or even strengthen.

Analysts at ING map out four possible scenarios around the budget: a base outcome (tighter fiscal policy, limited currency reaction), a stronger-tightening outcome (modest GBP weakness), a prudent but inflationary budget (GBP stronger), and a worst-case of insufficient action (sharp sterling weakening). Many commentators argue the pound is already fragile, ahead of the budget. According to StoneX: “The upcoming budget may define how sustainable the UK’s fiscal path appears to global markets.” For example, GBP/EUR recently broke above ~0.880 and GBP/USD slipped ~0.8% over a brief period, driven by a weaker growth/fiscal expectation rather than just interest-rate shifts.

Gilt Yields and the Budget: Why the Bond Market Cares

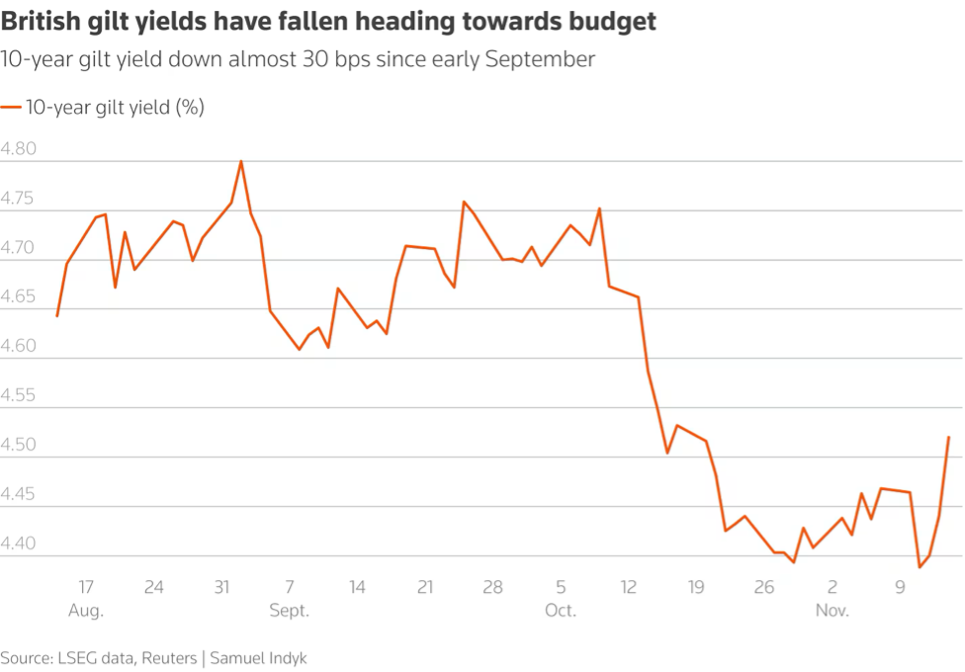

The budget also affects gilts (UK sovereign bonds). Rising gilt yields (i.e., the Government has to pay more to borrow) signal elevated risk, which can weigh on the pound as investors demand higher compensation for holding UK assets.

The yield (interest rate) on UK government bonds, especially long-dated ones, is a key barometer of market confidence in the UK’s fiscal path. If yields spike, it indicates that investors believe the Government will struggle to meet its debt/deficit targets without inflation or growth setbacks.

Recent data show that yields on 30-year UK gilts moved from around 4.5% up to ~5.7%, their highest levels since 1998. A heightened supply of gilts (to finance deficits) and weaker demand from traditional buyers is a structural headwind. Pre-budget, highlighted commentary notes that “bond yields and currency weakness reflect investor doubts over fiscal discipline.” The budget is viewed as a test of such discipline. If the budget under-delivers on tightening, there is a risk of widening yields (i.e., costlier borrowing) and a possible sell-off in sterling, as noted in multiple scenarios.

Conclusion: A Budget With High Stakes

The UK’s forthcoming budget is more than just a set of tax and spending announcements: it is a credibility event for the Government. On one hand, the Government must show it can plug a multi-billion-pound fiscal hole without derailing growth. On the other hand, markets will respond not only to the size of tax and spending moves, but to how clearly and credibly the path is laid out.

For the pound, the upshot is: the more the budget reinforces confidence (i.e., credible fiscal tightening, growth-friendly structure), the better the chances of stabilisation or modest strength. But if the budget leaves uncertainty, or signals a growth-crushing tax burden, the pound is vulnerable.

Similarly, gilt markets are watching. Higher borrowing costs (rising yields) are both a consequence and a cause of weakening confidence, and they feed back into currency markets via risk premia and relative interest expectations.

In short, the UK budget is a wobbly moment for the British economy. For FX traders, bondholders and fiscal watchers alike, the message will be read loud and clear, and the pound will respond accordingly.