T-Mobile’s $4.4bn acquisition of UScellular

Written by: Roshan Binning (Chapter President), Joven Sekhon, Sean Hobbs, Arjun Javagal & Manikandan Vijay

Deal Overview

Acquirer: T-Mobile US, Inc.

Target: United States Cellular Corporation (UScellular)

Total Transaction Size: $4.4 billion

Announcement Date: May 28, 2024

On May 28, 2024, T-Mobile announced that it would acquire the majority of UScellular’s wireless operations, customers, retail stores and a selection of its spectrum licenses, in a transaction valued at approximately $4.4 billion, comprising $2.6 billion in cash and $1.7 billion of assumed debt. The agreement includes the transfer of around 4 million wireless customers, associated retail locations, networking operating assets, and around 30% of UScellular’s spectrum holdings, while UScellular retains its 4200 towers and the remaining 70% of its spectrum (wireless signal airspace) portfolio.

Following the deal, UScellular will step back from operating as a nationwide mobile carrier, where instead the company will shift toward a tower and spectrum leasing model, generating steadier, recurring revenue while also reducing the capital expenditures required to maintain a fully competitive wireless network.

This transaction comes at a time when the US wireless industry is undergoing a new phase of 5G expansion, where carriers are competing to improve higher-quality coverage depth and extend their services beyond dense metropolitan regions, mainly into suburban, rural and previously underserved regions. Demand for reliable connectivity is growing fastest in rural home broadband and business network services. Yet the investment required to keep pace in these areas have become increasingly difficult for regional operators like UScellular, while national carriers benefit from the nationwide scale.

T-Mobile has stated that the acquisition is intended to improve its presence in underserved markets and improve 5G performance and coverage consistency, whilst also pushing for expansion into fixed wireless home broadband and public sector communications. By incorporating UScellular’s services, T-Mobile expects to fill in coverage gaps enabling more efficient use of spectrum across its platform.

Initial investor reaction was cautious, primarily due to concerns regarding the cost and difficulty of modernising the acquired network infrastructure, particularly in rural areas where service expectations are increasing. Even so, the strategic rationale behind the deal is well understood, T-Mobile will expand its coverage and strengthen its 5G capabilities, while UScellular steps away from the expensive retail wireless market and shifts towards a more stable, infrastructure focused revenue model.

Acquirer Overview: T-Mobile US, Inc

Founded: 1994

CEO: Mike Sievert

Market Cap: $195.07 billion

LTM Revenue: $81.4 billion

LTM EBITDA: $30.9 billion

P/E: 24.1x

Ticker (NASDAQ): TMUS

Deal Advisor: Morgan Stanley & Co. LLC

History & Background

T-Mobile traces its origins to the U.S wireless market in the 1990s, but the company’s contemporary identity was shaped in the 2010s through its ‘Un-Carrier’ strategy, repositioning the firm as an alternative to traditional telecommunications providers. This strategy helped position T-Mobile as a clear alternative to traditional telecommunications providers by removing long-term contracts, simplifying pricing, and promoting greater transparency and customer choice. The approach proved to be highly effective, enabling T-Mobile to expand its subscriber base and become a major competitor alongside AT&T and Verizon.

A defining milestone in the evolution of the firm occurred in April 2020, when T-Mobile completed its merger with Sprint. The merger provided substantially expanded its mid-band spectrum holdings, enabling T-Mobile to accelerate its 5G rollout, beating competitors in terms of both network reach and performance.

Product Lines

T-Mobile provides a wide range of telecommunications and network services:

Wireless Mobility Services: Phone and data plans for consumers, businesses and government customers. This remains the company’s largest business area.

Fixed Wireless Internet: High-speed internet delivered through T-Mobile’s 5G network. This service is designed to provide an alternative to cable and fibre internet, particularly in areas where broadband options are limited.

Enterprise and Public Sector Solutions: Connectivity services for organisations, including Internet-of-Things (IoT) device networks, secure communications and private wireless networks.

Strengths

Financial Strength: T-Mobile US has continued to deliver strong financial results and generate robust cash flow. In fiscal year 2024, the company reported a total service revenue of $66.2 billion, representing a 5% increase from 2023, while net income rose 36% to $11.3 billion. Operating cash flow grew strongly, reaching $22.3 billion, up 20% year-over-year, showing the company has the financial strength to invest in growth and return value to shareholders.

Rural Market Expansion Capability: T-Mobile has expanded steadily and improved its network in rural areas, boosting 5G availability beyond major cities. T-Mobile has the largest share of 5G users spending most of their time on its network in both urban and in rural markets, ahead of competitors such as AT&T and Verizon. The company has continued to invest in low band and mid band spectrum to extend its 5G coverage to smaller towns and communities.

Scale and Cost Efficiency: T-Mobile’s size helps it to get more value from acquisitions than smaller regional operators. Its large customer base allows operating costs to be shared more widely, reducing costs per customer. Its 5G scale also gives it greater buying power with vendors, along with lower unit costs for equipment and stronger cash generation; these factors allow T-Mobile to invest faster and deliver higher returns than smaller competitors.

Challenges

Regulatory Risk: Telecom mergers in the United States face close regulatory and political scrutiny, especially around competition and rural coverage, The deal must be approved by several regulators, and they could slow progress or how T-Mobile operates, potentially delaying expected benefits as well as increasing costs and complexity.

Competitive Response from Incumbents: The deal could lead competitors such as AT&T and Verizon to respond more aggressively, particularly in the same regional markets. This may include stronger promotions, price cuts or increased in investment, which could reduce T-Mobile’s short-term gains and slow how quickly it benefits from the transaction.

Capital Intensity: T-Mobile still faces high investment demands despite benefiting from its size. Upgrading networks to 5G standards and maintaining service quality require significant spending; this puts a lot of pressure on capital allocation, especially as the company continues to invest heavily in expanding its nationwide 5G network.

Summary

T-Mobile is financially strong, with growing revenue, higher profits and solid cash flow enabling future investment and securing strong shareholder returns. The company has expanded its 5G network beyond major cities, building a strong position in both urban and rural markets. Its size helps lowers costs per customer, improves buying power, and helps to create faster network investment than smaller competitors However, close regulatory scrutiny, potential competitive rival responses and high 5G investment are key challenges T-Mobile faces.

Target Overview: United States Cellular Corporation

Founded: 1983

CEO: Laurent C. Therivel

Market Cap: $4.45 billion

LTM Revenue: $3.91 billion

LTM EBITDA: $810 million

EV/LTM EBITDA: 6.47x

Ticker (NASDAQ): USM

Deal Advisor: Centerview Partners LLC, Citigroup Global Markets Inc. PJT Partners LP, TD Securities (USA) LLC, Wells Fargo Securities, LLC.

History & Background

UScellular entered the US wireless market in the 1980s as United States Cellular Corporation, focusing mainly on rural markets rather than major metropolitan areas. The company built its business around ensuring reliable coverage, and strong customer relationships, helping UScellular to develop loyal customers and maintain long-term positions in underserved markets.

The US wireless industry changed significantly as companies consolidated and the cost of investing in new technology (especially 5G) increased. Large national carriers gained advantages from their size and wider coverage, which made it difficult for smaller regional providers to compete.

Product Lines

UScellular provides a range of different wireless communication services, focused mainly on regional markets in the United States:

Consumer Wireless Services: Mobile voice and data services for individual customers.

Home Connectivity Solutions: Offers wireless home internet services to households in areas where fixed broadband is limited or unavailable, helping everyday online activities.

Business and Community Services: Delivers wireless connectivity solutions for local businesses, agricultural users, public sector organisations etc, including services tailored to regional needs.

Strengths

Strong Network and Spectrum Assets for Rural Areas: UScellular has strong low band and mid band spectrum that is well suited for rural (and semi-rural) areas. This spectrum travels further and covers areas more efficiently, making it hard to replace and cheaper to deploy. Through this transaction, the buyer can expand rural coverage faster and meet coverage and regulatory requirements more easily.

Strong Rural Network Footprint and Local Expertise: UScellular has a large network of rural cell sites and supporting infrastructure that would be expensive and time consuming for a national operator to build from scratch. UScellular’s local knowledge and strong community relationships also reduce deployment risk and help improve the network more quickly.

Established Wholesale and Roaming Partnerships: UScellular has long-term wholesale and roaming agreements with national carriers, providing steady, recurring revenue and showing the strength and reliability of UScellular’s network.

Challenges

Rural Network Modernisation Costs: UScellular’s rural focused network requires ongoing investment to upgrade sites and spectrum usage to meet 5G performance expectations.

Integration with National Carrier Networks: Integrating UScellular network and IT system with a larger national carrier is complex. With different network designs and operating models, integration would require careful planning and time to complete, which may slow decision making and increase short term integration costs.

Customer Retention in Transition Markets: UScellular customers place importance on service reliability, local support and consistent branding. During a transaction or changes to network operations, uncertainty may develop increasing the risk of customer churn. Maintaining service continuity and keeping communication clear is important to reduce this risk.

Summary

UScellular has built a strong position in regional and rural US markets, through its high-quality rural spectrum and loyal customers in underserved areas. These assets are difficult to replicate and are clearly valuable in helping expand rural coverage and meeting regulatory requirements. The company also benefits from established wholesale and roaming partnerships providing stable revenue. However, UScellular faces challenges from ongoing rural network upgrade costs, the complexity of integrating with a national carrier and the risk of customer churn during a transition.

Motivation

For T-Mobile

“Bringing together UScellular’s network resources with ours will enable us to fill gaps in connectivity that will create a better experience for all of our customers with more coverage and more capacity” T-Mobile CEO Mike Sievert

Expand rural coverage and close network gaps: UScellular had roughly 4 million customers across 21 states, with customers heavily skewed to rural and small city markets where T-Mobile had typically performed weaker in. Buying UScellular lets T-Mobile fill coverage gaps and extend its 5G network to rural households and businesses. This meant T-Mobile could improve its competitiveness and market share without having to compete with the likes of UScellular who had previously specialised within this niche.

Benefitting from major cost and capital expenditure synergies: Another key motivation for T-Mobile was the significant efficiency gains available from integrating UScellular’s network into its own. UScellular operated thousands of towers that overlapped with T-Mobile’s footprint, creating an opportunity to reduce operating costs by combining and reducing the number of sites.

Revenue growth/ synergy opportunities: The deal also gives T-Mobile significant room to grow revenue, not just cut costs. Many UScellular customers are still on older, lower priced plans, which creates a clear opportunity for T-Mobile to introduce them to its higher value 5G plans, and device upgrade programs. T-Mobile can also bring its fast-growing 5G Home Internet product into rural areas where UScellular has been the dominant provider, opening a completely new source of sales. In addition, converting UScellular stores into T-Mobile locations should boost foot traffic and device sales. With access to a stronger national network and an improved product range, former UScellular customers are also likely to stay longer and spend more, helping T-Mobile lift revenue over time.

For UScellular

“Delivering on our mission requires a level of scale and investment that is best achieved by integrating our wireless operations with those of T-Mobile” UScellular CEO Laurent Therivel

Avoiding massive 5G investment requirements: UScellular faced escalating capital expenditure needs to compete within the 5G-driven telecom market. As a regional carrier operating in rural regions, UScellular lacked the scale to efficiently invest, upgrade and maintain competitive 5G speeds. Rising capital expenditure requirements meant that staying independent would require billions of dollars in future investment. By selling to T-Mobile, UScellular avoided these heavy costs and ensured that customers would still receive modern 5G network upgrades that UScellular could not economically deliver alone.

Strategic pivot into a higher-margin business (Array Digital Infrastructure): The deal also allowed UScellular’s parent company, TDS, to step away from the capital-heavy retail wireless business and redirect its focus toward a more stable, higher margin opportunity. By selling the mobile operations, TDS could concentrate on its fast growing tower leasing business, now rebranded as Array Digital Infrastructure. Instead of pouring money into 5G tower upgrades, the company can now lean into a business model with steadier recurring revenue, all of which offers less operational complexity. The sale of UScellular also provides the liquidity needed to accelerate this strategic pivot and strengthen Array’s position in the digital infrastructure market.

Enhancing service quality for customers: UScellular recognised that partnering with a larger carrier like T-Mobile would ensure its customers gained access to broader coverage, faster 5G speeds, and improved network reliability. Limited by its regional scale and investment capacity, UScellular risked falling behind in service quality compared to national competitors. The acquisition therefore offered a way to secure long-term customer satisfaction and retention by giving subscribers access to a superior network that UScellular could not build alone.

Deal Navigation

Regulatory & Legal

The deal will need approval from the Federal Communications Commission (FCC) and the U.S. Department of Justice (DOJ) Antitrust Division, as it affects competition and spectrum ownership across regional wireless markets. It’s also expected to be reviewed by more regional authorities in areas where UScellular currently operates. Regulators are likely to examine whether the merger could limit consumer choice in rural communities, but T-Mobile has argued that combining the two networks will actually improve rural 5G coverage and speed up network upgrades, supporting the government’s broader goal of expanding nationwide connectivity.

Financing Structure

T-Mobile is funding the acquisition primarily through cash consideration, with no equity issuance expected. The company has a strong balance sheet and consistent free cash flow generation, allowing it to absorb the purchase without the need for external fundraising. The transaction structure enables T-Mobile to maintain financial flexibility while efficiently integrating UScellular’s spectrum, towers and retail assets.

For UScellular’s parent company, Telephone and Data Systems (TDS), the proceeds from the sale will be used to strengthen liquidity and support the expansion of its tower and infrastructure business under the Array Digital Infrastructure brand.

Integration

Early integration in T-Mobile’s acquisition of the majority of UScellular’s assets has been deliberately structured to prioritise operational continuity whilst accelerating delivery against the deal’s core strategic objectives. Given the transaction’s asset-focused structure rather than a full corporate acquisition, integration complexity is marginally lower than traditional mergers, enabling T-Mobile to apply a phased and targeted integration model across a two-year timeline starting August 2025.

Leadership, governance, and operating model alignment appear to be progressing with minimal hindrance. Responsibility for integration has remained embedded within T-Mobile’s existing network, retail and customer operations leadership rather than via the formation of parallel governance structures; this approach is consistent with prior deals involving T-Mobile. The absence of significant leadership reshuffles and public integration challenges suggests an early level of stability.

Network integration, primarily focusing on deploying UScellular’s low-band and mid-band spectrum onto T-Mobile’s existing towers (particularly in rural areas), has resulted in faster speeds, a fall in dropped connections and improved indoor coverage performance. The deal has subsequently expanded T-Mobile’s 5G Home Internet eligibility by over 1 million households. Thus, network integration is progressing credibly.

Retail footprint rationalisation, as a result of T-Mobile inheriting approximately 2300 UScellular retail stores, has seen a focus on selective rebranding (around 280 stores are being rebranded to T-Mobile or Metro by T-Mobile) and the preservation of local market coverage amidst customer transition rather than immediate closures. This has enabled physical retail access in rural locations but has deferred cost synergies.

The inward migration of 4 million UScellular subscribers has been phased, with emphasis on minimising disruptions through staggered customer transitions due to the highly associated risk. To date, T-Mobile has not reported elevated churn or service disruptions. Immediate effective integration was achieved through reciprocal roaming, providing both customer bases expanded national coverage whilst technical migration is ongoing.

Talent retention and cultural integration risks have remained relatively contained. The deal’s focus on UScellular’s assets dismisses any requirement for T-Mobile to keep specific talent to ensure the acquisition’s success. Limited retention bonuses, layoffs and restructuring costs have been announced by T-Mobile, inciting a smooth integration process, although leaving less visibility into potential medium-term workforce optimisation initiatives.

Overall, early integration signals appear consistent with the transaction’s strategic rationale. The scale of assets being absorbed introduces substantial risk, but T-Mobile’s phased approach reflects a conservatively effective approach thus far. The limited timeframe curtails the extent of synergy realisation though initial integration supports the formerly stated motivation of rural coverage expansion.

Performance and Valuation

T-Mobile agreed to acquire substantial portions of UScellular’s wireless operations for approximately $4.4 billion. Rather than a full corporate takeover, the transaction is structured as an asset-led acquisition, allowing T-Mobile to selectively absorb components that directly enhance its network scale and competitive positioning.

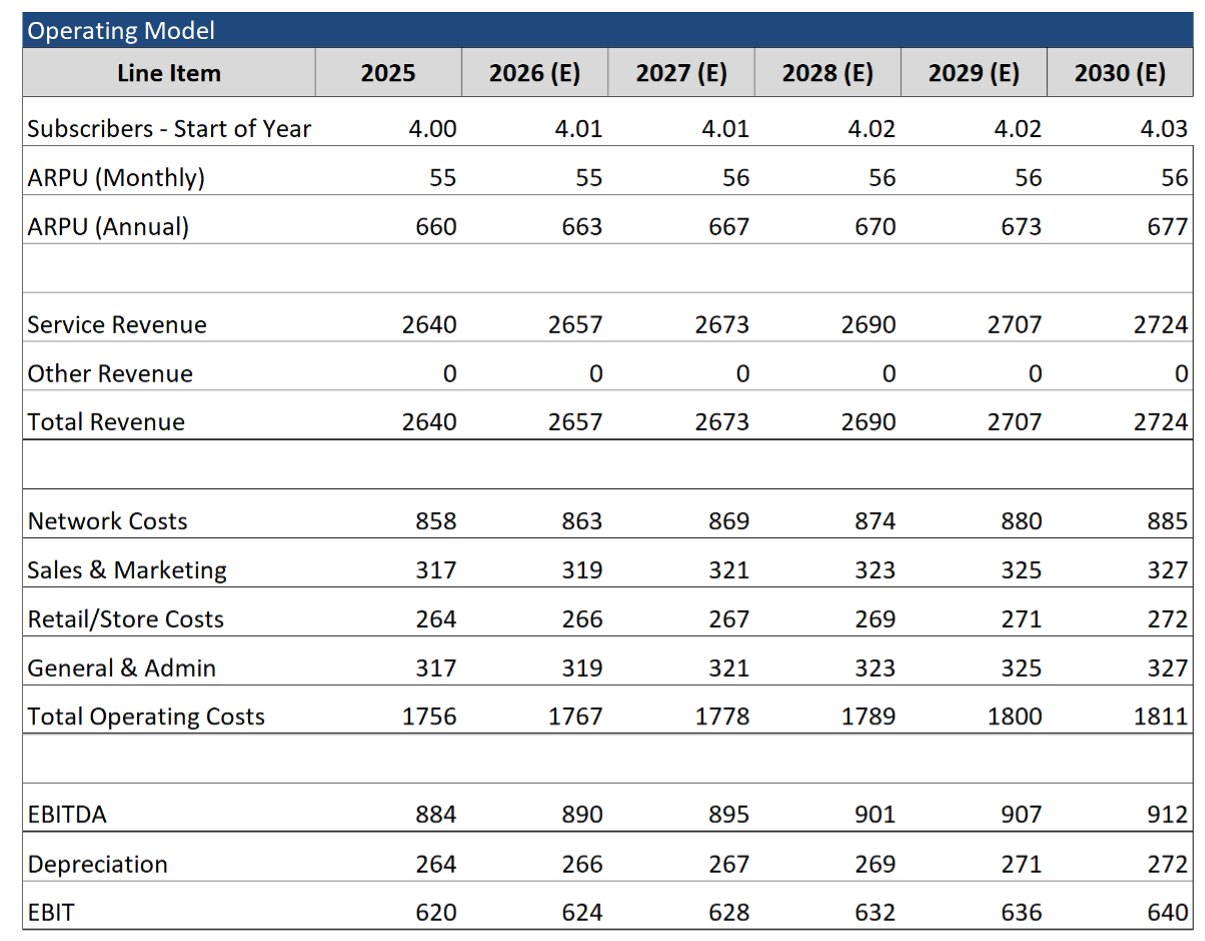

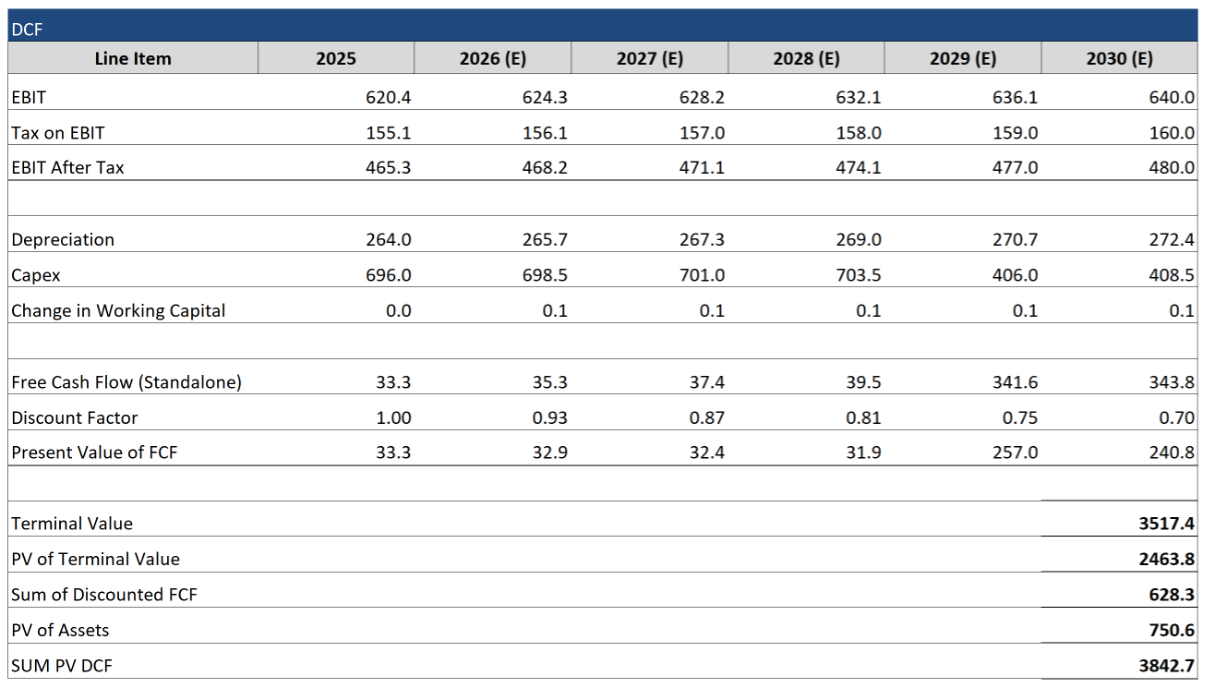

From a valuation perspective, the headline price reflects the economic value of UScellular’s customer base, spectrum portfolio, and supporting infrastructure, rather than legacy liabilities. The acquired wireless customers provide immediate service revenue, while owned spectrum represents a long-duration asset with low marginal operating costs. Network towers and related infrastructure were accounted for through their contribution to operating cash flows and capex avoidance, rather than as standalone real estate assets. In DCF terms, this translates into stable near-term free cash flow with improving conversion over time as duplicative network investment is eliminated.

Strategic Expansion: The c.15% premium paid by T-Mobile relative to our standalone DCF valuation of $3.8bn is primarily justified by strategic considerations rather than intrinsic growth prospects. The transaction accelerates industry consolidation, strengthens T-Mobile’s rural coverage, and deepens spectrum depth without requiring greenfield deployment. By acquiring an existing regional footprint, T-Mobile effectively compresses the timeline required to monetise these markets. Such expected synergies make the implied valuation reasonable when viewed through a strategic lens rather than on traditional telecom multiples alone.

Strong Early Signs: Early indicators suggest the integration has progressed constructively. Service continuity has been maintained, spectrum assets are being integrated into T-Mobile’s network roadmap, and there has been no material negative investor reaction signalling concern over capital discipline. Overall, the deal appears to reflect fair value with strategic upside, supported by predictable cash flows and a coherent long-term infrastructure strategy.

Risks

Strategic Risk: The primary strategic risk lies in under-delivery against the rural expansion motivation. Whilst the acquired UScellular spectrum covers approximately 30 million people from predominantly rural backgrounds, much of the anticipated value depends upon T-Mobile’s ability to translate spectrum ownership into measurable improvements in network quality. If network integration is delayed, the deal may fail to decrease the perceived rural performance gap against competitors such as AT&T and Verizon. Additionally, given that around 40% of the acquired customers are located in low-density markets with a lower ARPU, there is a risk that incremental revenue uplift does not fully offset network investment costs.

Generalised Integration Risk: Inward migration of approximately 4 million UScellular subscribers onto T-Mobile’s pre-existing system introduces churn sensitivity, particularly with the compressed two-year timeline. This remains particular in rural markets where service disruptions are more visible. Frontline employees from UScellular must also be trained as per T-Mobile’s protocols; misalignment could reduce operational efficiency.

Financial Risk: The approximately $4.4 billion transaction represents a significant outlay. With meaningful near-term cost synergies absent, the deal’s financial justification is dependent upon long-term operations. Thus, if anticipated synergies or subscriber growth do not materialise, the deal’s effectiveness could be lower than expected. With the deal financed as a split between a $2.6 billion cash outflow and approximately $1.7 billion of debt, underperforming may limit T-Mobile’s immediate flexibility for other strategic moves due to debt constraints.

Technological Risk: The integration of legacy systems and network configurations across geographically dispersed rural markets introduces operational complexity. Technological differences with incorporating UScellular’s older systems efficiently could delay T-Mobile’s operational efficiency. Interoperability issues and cybersecurity vulnerabilities when integrating could also create security risks. These challenges could negatively impact customer experience and cause outsized revenue losses, especially with T-Mobile incurring $350 million in non-cash charges for modifying and retiring legacy billing systems.

House View

Viewpoint

The UScellular–T-Mobile transaction remains strategically coherent, with early execution broadly aligned with the deal’s stated objectives. Initial integration progress indicates that value creation is promising but not yet realised, with longer-term outcomes dependent on effective rural network monetisation, customer economics, and the evolving competitive and regulatory environment.

Positive Signals

Operational Continuity and Integration Progress: Early integration has prioritised service stability, reducing execution risk during the transition period. Deployment of UScellular’s low- and mid-band spectrum has contributed to improved rural coverage, enhanced indoor performance, and expanded eligibility for T-Mobile’s fixed wireless broadband offering. Customer migration has been phased conservatively, with no evidence of elevated churn to date.

Structural Simplicity of the Transaction and Market Reception: The asset-led structure of the acquisition has reduced integration complexity relative to a full corporate merger. By selectively acquiring spectrum, customers, and retail assets while excluding legacy liabilities, T-Mobile has limited organisational disruption and accelerated progress against strategic priorities. The absence of an adverse market reaction further supports confidence in execution discipline and capital allocation.

Emerging Risks

Reliance on Long-Term Monetisation: Despite encouraging early execution, the transaction’s financial returns remain back-end weighted. A significant proportion of acquired customers are in lower-density, lower-ARPU markets, limiting near-term revenue uplift while still requiring sustained network investment.

Deferred Synergies and Regulatory Considerations: The deferral of cost synergies in favour of service continuity delays margin expansion and increases reliance on revenue-led value creation. Ongoing regulatory oversight and potential competitive responses from national incumbents remain relevant considerations as the integration progresses.

Forward Insight

Overall, early evidence indicates that the transaction is progressing in line with its strategic rationale, with initial integration outcomes supporting the potential for long-term value creation. However, the deal’s ultimate success remains dependent on T-Mobile’s ability to convert expanded rural network scale into sustainable revenue growth and improved returns over time. While near-term execution risks appear contained, value realisation remains back-end weighted, leaving the full impact of the transaction subject to continued operational discipline and effective post-integration monetisation.